What’s on the mind of buy side senior executives as they work to improve and implement enterprise data management practices and technologies? Their top insights can help drive innovation industry-wide.

By Cubillas Ding, Research Director, Capital Markets, Celent

Capital markets participants, spanning across sell-side and buy-side firms, asset servicers, and market infrastructure providers, are reprioritizing enterprise data management (EDM) as part of strategic technology investments. The transition is aimed to relieve pressure on legacy systems, rationalize costs, respond to evolving customer needs, or address risk and compliance requirements. These EDM practices and technologies are strategically important—yet tactically challenging—as firms embrace modern technology enablers: digitization, artificial intelligence (AI), and automation.

To evaluate current EDM initiatives, Celent turned to the voice of the customer. Six key themes related to EDM were identified through a series of one-on-one interviews, conducted in the fourth quarter of 2021 with senior executives and chief data officers at more than 20 investment management firms (asset management firms, hedge funds, and asset servicers) from across the globe. These interviews yielded insights into contemporary challenges and drivers of EDM initiatives. To achieve the goals of organizational dexterity, strategic differentiation, and improved efficiency for data operations, firms must take action to address each of these themes.

- The need to address pain points: data governance is the most commonly cited pain point, noted by 48%.

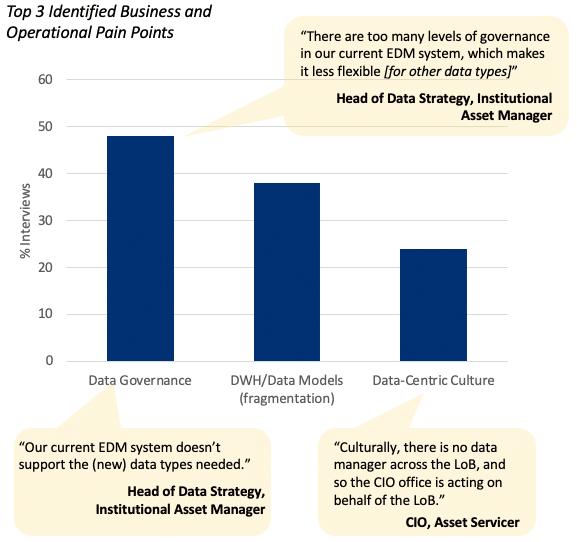

Strategic data enablement requires more than technology. It requires a strong data culture. Employees must understand the importance and benefit of strong data management and must be aware of their roles in helping the organization capture the data opportunity. Many investment firms, however, encounter pain points that can impede these goals.

Nearly half of interviewees identify data governance as a pain point; manual or reactive processes, complicated by a disjointed ecosystem of tools, are often contributing factors. Rigid governance and oversight controls in existing (legacy) EDM systems are also a barrier for employing these data applications more broadly across new data sets.

Culture can often be a pain point, as well. Almost 1 in 4 (24%) of interviewees highlighted that their culture isn’t conducive to data management, due to operations being siloed within the IT function, where staff aren’t best placed to source and provide the right data. Working towards a data-centric organizational culture—where IT and business work side-by side to understand the requirements for data and in which platforms support some self-service data procurement by the business—can help meet strategic data enablement goals.

Top 3 identified business and operational pain points. (Source: Celent.)

2. Data democratization, discoverability, and ease of access: 47% of firms focus on the enterprise data needs of the front office.

As end users of EDM platforms expect more of data and analytical tools, EDM platforms must adapt to provide data sets that can be easily ingested by varied tool sets. Currently EDM platforms struggle to cope with requirements to consume new and emerging data sets, notably environmental, social, and governance (ESG) and alternative asset data, where the data is unstructured or non-uniform.

Addressing these roadblocks can help deliver data in a timely, accurate, and permissioned manner. Doing so helps meet the demands for data that are coming from across the enterprise. Currently the front office is driving the demand for more data to support trade and investment ideas, while priorities are also growing from the middle and back offices. A “front office pull” for data enablement is defining spending priorities and efforts around new data sets and data management initiatives. Focus areas for change around enterprise data are front office only (47%), middle office to back office (33%), front office to back office (13%), and front office to middle office (7%). Better automation and data controls can help accelerate the ability to ingest and provide data to users across the business.

3. A cautious, selective approach toward managed data services and outsourcing: only 9% of firms outsource all data functions.

When evaluating what data functions to potentially outsource, firms carefully evaluate needs and whether keeping functions internal or outsourcing them is most appropriate for the organization and its use cases. Many investment firms take a cautious and selective approach toward managed data services and outsourcing. Among interviewees, 9% outsource all data functions, 20% outsource data functions selectively, 33% outsource minimal data functions, and 38% don’t outsource any data functions.

Concerns about the loss of competitive differentiation—including factors such as the responsiveness of third parties, ceding control, or the possibility of forfeiting longer-term core expertise—are among the reasons many firms have opted not to outsource. Behind this is a perception that, compared to internal operations and proprietary solutions, current outsourced data management offerings don’t address highly firm-specific functional and governance needs.

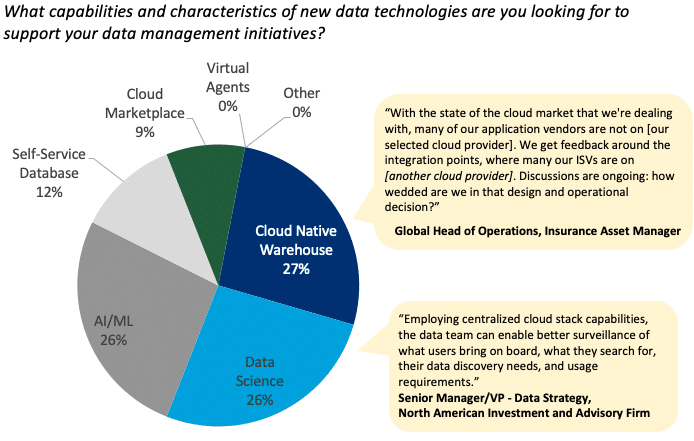

4. Expectations for cloud-enabled EDM: a cloud-first approach is equally important as data science and AI/ML.

Next generation EDM infrastructures are expected to be born in the cloud. This cloud-first approach is table stakes, relying on elements of native cloud, data science, and artificial intelligence/machine learning (AI/ML) to enable stronger data analytics and investment/trading ideas.

The expectation that comes with this innovation is that cloud-enabled EDM technology will translate into clear tactical benefits—not just tech for tech’s sake. Emerging functionalities that can support overall strategies include self-service functionality for data access, business intelligence (BI) design, collaboration features, and metadata tools. Firms that haven’t yet determined their enterprise cloud IT and applications strategy will find it challenging to align their goals with overall EDM.

Capabilities and characteristics of new data technologies desired to support data management initiatives. (Source: Celent.)

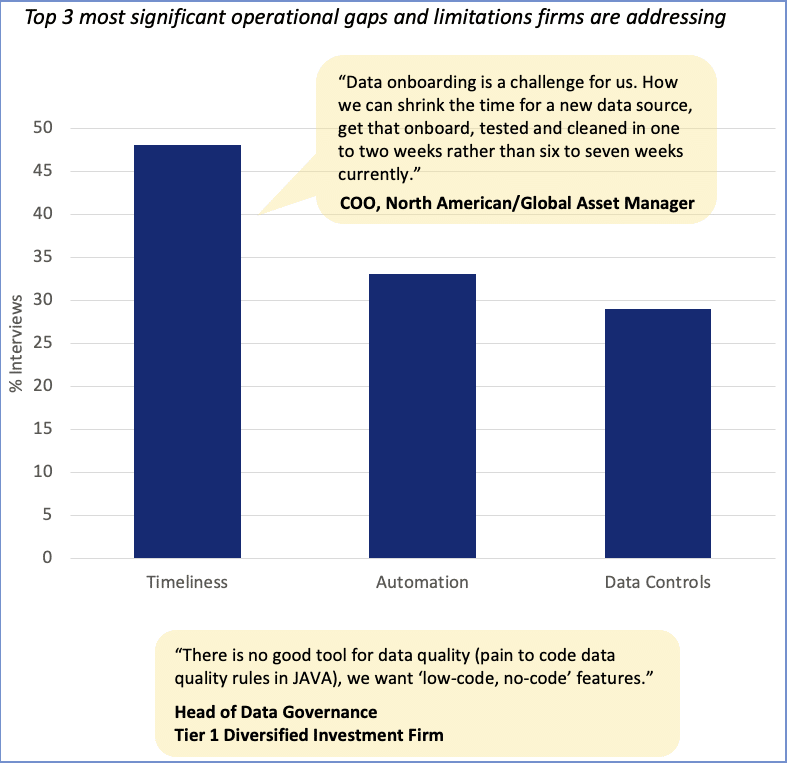

5. A focus on agility and time to market: more than 40% of firms cite timeliness as a significant operational gap.

Many firms are working to address operational gaps that limit important business outcomes, particularly agility and time to market. Top among them: timeliness, automation, and data controls.

For data to be delivered in a timely, curated, and permissioned manner to support business outcomes, address the roadblocks that get in the way. Evaluate underlying factors such as fragmented application/data models, inconsistent information taxonomies, siloed data tools, and ineffective organizational predispositions. When working through these, stay focused on striking the right balance between governance, data risks, innovation, and value.

The 3 most significant operational gaps and limitations firms are addressing. (Source: Celent.)

The evolution of enterprise data operations: 0% of firms have functionally mature, complete EDM operations and platforms.

If your EDM operations aren’t yet fully mature, remember that you’re not alone. Most investment firms (45%) are at a level of adequacy, but none claimed to have a functionally matureand complete EDM operations and platform. Even firms with established data programs continue to work toward the goal of wrapping technology seamlessly to facilitate fluid, flexible, yet controlled and permissioned data.

To make progress with EDM operations, keep in mind the areas where more can be achieved. These include starting data consolidation efforts in earnest; establishing centralized views and data repository infrastructures (e.g., data lakes and data warehouses); appropriate management of manual (and error-prone) data processes; the satisfactory functioning of initiatives across business, IT, and outsourced providers; and having several “live” functional use cases and data sets provisioned.

The business case for rethinking data strategy and data enablement revolves around drivers such as the need to shrink the firm’s cost footprint, reduce the complexity of doing business, simplify interactions with the firm’s ecosystem, enable greater speed of delivery and change, and address commoditization through data and insight. Successful EDM journeys, aimed at meeting these objectives, will focus on both the “how” and the “why” of data enablement.