Information is the lifeblood of markets. The consolidated market data feed and infrastructure that links U.S. securities exchanges and trading systems enables investors to trade instantaneously and execute every trade at the best price possible. Unique to the United States, this market data backbone known as the SIP (for Securities Information Processors) is operated by a group of exchanges and trading firms overseen by the Securities and Exchange Commission.

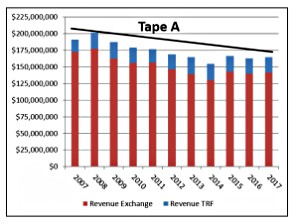

On March 1, the SIP administrators began to publicly share more information about revenues they receive from the consolidated market data feeds. These transparency measures show that the total cost of the SIP to the financial industry has largely remained flat over the last decade and has actually decreased when accounting for inflation. Indeed, fees earned by Nasdaq declined by 28.7% on average, and have trended down for other U.S. exchanges as well. Total SIP data costs have remained flat despite an enormous increase in information flowing through the system -as well as significant technology investments into the SIPs that have increased its speed, resiliency, redundancy and cyber security.

Oliver Albers, Global Head of Strategic Partnerships for Nasdaqs Global Information Services, explained about the SIP, market data in general, and why these matter to large financial firms and the investing public alike.

Q. What exactly is a SIP and what is the benefit for the U.S. securities markets?

Trading in every U.S.-traded equity-from Apple to Zillow-now takes place on 12 different regulated securities exchanges and dozens of alternative trading systems that compete for every order. To protect investors and improve market functioning, the U.S. government sought the development of a data feed that consolidates information on every stock quote and trade together in real time. The SIP is a government-mandated cooperative venture that links protected equity bid/ask quotes and trades from every registered exchange into a single, easily consumable data feed.

The SIP helps brokerage firms meet the SECs requirement that firms execute every trade on every stock at the best price for the investor. There are other benefits: over the past decade the SIP has delivered significant improvements in terms of the amount of volume it can handle and the speed at which information is gathered and distributed. These improvements-including significant cybersecurity and fraud-prevention investments by the exchanges-translate into higher overall market efficiency and resiliency.

Q. Why did the SIP operators decide to publish their revenue?

As the demand and market for trading data grows, so does the scrutiny by market participants. The SIP transparency initiative is responsive to that interest. The transparency initiative shows that even with millions in recent investments and improvements to the SIP, overall costs to the industry have been largely flat for the last decade. As shown in these charts, fee revenue earned by the exchanges such as Nasdaq have actually declined from 2008 to 2017-by 22.6% percent for consolidated tape A (which covers NYSE-Listed securities), by 17.2% percent for consolidated tape B (which covers NYSE-AMEX and other regional listings) and by 3% percent for consolidated tape C (which covers Nasdaq listed securities). The revenues also reflect revenues associated with trade reporting facilities (TRFs), which collect trade reports for dark pools and other off-exchange trading systems. As volumes have increased in these off-exchange venues, the percentage of revenue associated with these venues has also increased. Much of this revenue is in turn shared with dark pools and other off-exchange venues that reported the trades.

We should be very clear — retail investors do not typically pay for the SIP. SIP fees are borne by the financial industry, which trades trillions of dollars worth of shares each year and needs a failsafe market data backbone to best serve the investing public both in and outside of the United States. Retail investors would only pay for the SIP in the very rare instances where they want direct access.

Q. If the SIP consolidates all market data, what is the need for Nasdaqs other market data products?

There are many different types of market participants-from major Wall Street firms to market makers and retail online brokerages-that have different needs for market data. This has resulted in significant innovation and competition in this space as a supplement to the SIP. Some market participants solely rely on SIP data feeds to meet regulatory obligations. But many others want proprietary data products for their trading strategies and data needs.

As a Treasury Report from October 2017 confirms, proprietary data is not required for any market participant. There are a minority of market participants who want data that go deeper than SIP data, such as pending buy and sell interest at different price levels. For these customers of market data, Nasdaq and other firms offer proprietary products that include so-called depth of book and related auction data from our exchanges.

Q. What about more sophisticated industry players needs for market data?

Sophisticated proprietary data products are used primarily by the largest industry players and computerized high-speed traders, who seek total data across all markets in micro-seconds. Nasdaq invests millions to curate and enhance exchange data so customers receive a full order-by-order view of the markets down to a millionth of a second.

For example, during the huge spike in market volatility in February 2018- when the VIX fear index hit levels not experienced since the 2008 financial crisis and the Dow travelled 22,000 points back and forth in one week-Nasdaq was able to flawlessly support the enormous amount of data, giving customers an accurate view of the entire market, in real time, presented in ways that enable smart decisions.

Q. Can customers expect to see other improvements in performance, transparency and governance?

Market data revenue for SIP operators is now being provided on a quarterly basis, with a 60-day lag. The SIP Advisory Committees are focused on improving performance and transparency and are committed to working with the industry to ensure that our markets remain the envy of the world. Both the SIP CTA/CQ Operating Committee and UTP Operating Committee meet quarterly, and post summaries of those meetings as well as other metrics like subscribers and technology statistics atwww.ctaplan.comandwww.utpplan.com.