Nasdaq hopes to up the ante at its trade reporting facility. Nasdaq and FINRA, which jointly own the TRF, have asked the Securities and Exchange Commission for permission to increase the market data rebate they give to their TRF users from 50 to 100 percent.

The increase would put the rebate on par with that of the New York Stock Exchange’s TRF, which is still seeking SEC approval for its pricing proposal.

Broker-dealers that report their trades to Nasdaq’s TRF-mostly market makers and ECNs-would receive up to 100 percent of the revenues Nasdaq now receives for selling its quote and trade data. The brokers now only get half of the revenues.

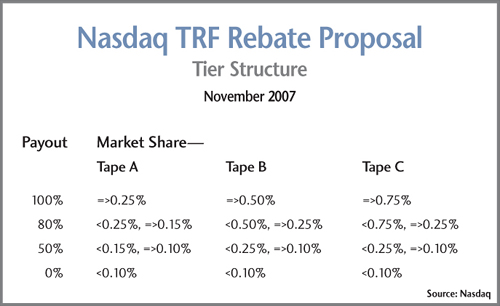

Not all brokers would be entitled to 100 percent. The amount is dependent on how much volume they report to the TRF. Some brokers may receive no rebate at all under Nasdaq’s tiering scheme. Only the largest would receive 100 percent. Tiering levels depend on the type of security-Tape A, Tape B or Tape C (see table).

Nasdaq is not the only TRF operator feeling the heat from the NYSE. The National Stock Exchange, which launched the first TRF in 2006 to accommodate ECNs such as BATS Trading, is proposing to increase its data rebate from 50 to 75 percent.

The move toward higher rebates has drawn some criticism. The Securities Industry & Financial Markets Association told the SEC in a letter that the high rates imply broker-dealers are paying exchanges too much for market data. If exchanges such as the NYSE can give away all of the revenues they receive, they obviously don’t need the monies to cover regulatory costs, their expected use.

SIFMA also holds that the NYSE is engaging in predatory pricing that may squash smaller TRFs, such as the one run by the National.

All three proposals-NYSE’s, NSX’s and Nasdaq’s-require SEC approval.

(c) 2008 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com