(Bloomberg) — For more than a decade, John Ramsay had red tape over his mouth. Now that hes left government bureaucracy, he says hes been uncorked.

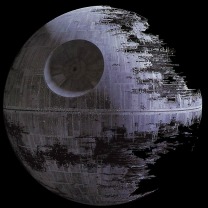

Ramsay, 55, formerly the U.S. Securities and Exchange Commissions director of trading and markets, joined the stock- trading venue founded by Brad Katsuyama, IEX Group Inc., in June and soon began slamming the industry hed overseen for the SEC. He called out the convoluted and illogical pricing rules of major stock exchanges and compared the $25 trillion U.S. stock markets structure to the Death Star of Star Wars.

Ramsays denunciations come during a period of unprecedented scrutiny of equities trading. A chorus of criticism, sparked by the claim in Michael Lewiss book about Katsuyama and IEX, Flash Boys, that the market is rigged against retail investors, has questioned the tactics involved in using algorithms to buy and sell shares in fractions of a second. Ramsays opinions, blunt and impassioned, have extra heft because of his experience as a regulator.

Ive been able to find my voice on these issues in a way I couldnt have done when I was in the government, because youre always limited by internal politics and not wanting to get too far out in front of the agency, he said. I feel like Ive been a little bit uncorked.

Dont expect Ramsay to let up. Last week, IEX hired a chief regulatory officer to assume part of Ramsays responsibilities, freeing him to focus on his role as the New York-based firms chief market policy officer and resident straight talker.

Volcker Rule

Hes a guy who accomplished a lot and doesnt have anything to prove, said James Burns, who worked with Ramsay at the SEC and is now a partner at the law firm Willkie Farr & Gallagher LLP.

Ramsay helped the SEC hammer out the post-crisis Volcker Rule, which bans government-insured banks from gambling with depositors money. The rule has an exemption — it allows banks to continue making markets, or standing ready to buy or sell stocks and bonds from customers. Financial regulators initially clashed over that exemption, with banking agencies fretting that the language would open loopholes for Wall Street to exploit.

Ramsay helped ease the tension with clear language and humor, bank regulators said. Ramsay was the voice at the table making us understand how market making is done, and what kind of parameters are around it, said Scott Alvarez, the Federal Reserves general counsel.

Hes fascinated with how trading actually runs and works, said Richard Ketchum, chief executive officer of the Financial Industry Regulatory Authority who once hired Ramsay to work with him at Citigroup Inc. The bank regulators valued his knowledge and understanding of how fixed-income market trading works and what could be viewed as market making or not.

Populist Mission

Ramsays decision to join IEX, a tiny private market with a populist mission, was an unusual move for a former regulator, Burns said. He couldve used his intimate knowledge of the Volcker Rule to land a job at a law firm or a bank. Instead, he found something thats fun and a little bit edgier, Burns said.

Ramsays positions often put him at odds with his previous employer. The SECs current trading rules, known as Regulation NMS, are partly responsible for the flourishing of high- frequency trading and the dispersion of trading across more than 40 venues, he said. And hes been unafraid about taking his viewpoint to Wall Street.

The current market ecosystem is not sustainable, and significant changes are coming one way or another, Ramsay said in a speech delivered at a New York technology conference in September.

Two Tiers

He outlined how the market lost its way: conflicts of interest among brokers, a two-tier system favoring the speediest and a general sense that todays rules have been crafted to the benefit of insiders.

In an interview, Ramsay said his opinions grew more critical in recent years as he watched the market fragment into 11 public exchanges and more than 40 less-regulated private venues such as dark pools. Trading became more complex and prone to technological malfunctions in the face of rules that were supposed to boost competition and create new choices for investors, he said.

IEX, he said, can be part of the solution.

Thats what Lewis wrote in his best-selling book. IEX doesnt pay firms to buy or sell shares, shirking a practice that many markets use to lure high-speed traders. Amid concern that markets are more vulnerable to mistakes because trading is faster and largely automated, IEX requires a 350-microsecond delay between requests to trade and actual executions. That might not sound like a lot, but its a length of time almost considered old-fashioned buy-and-hold investing in an environment where shares can trade faster than an eye blink.

S&L Crisis

Ramsay, a Houston native, said he first sought a job at the SEC because he was dismayed with what hed seen as a lawyer representing clients in Texas during the savings-and-loan crisis. He wasnt known as a dissenting voice at the SEC, which he joined in 1989. His views on market structure evolved over the past several years, he said.

Ramsay suggested at a conference in Washington in 2013 that some high-frequency traders who had escaped formal SEC oversight should fall under the agencys rules. Three months later, SEC Chair Mary Jo White announced in a speech that the SEC will require those traders to comply with the rules for broker- dealers.

Allowing innovation by firms such as IEX is preferable to making wholesale regulatory changes that could have unintended consequences, Ramsay said. It should be companies, not government, that develop viable alternatives.

This is a space that is ripe for change and some element of disruption, he said.