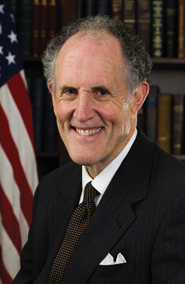

How did a newcomer like Sen. Ted Kaufman, D-Del., get so involved in equities markets issues like short sale and high-frequency trading? After all, he’s a trained engineer with an MBA, who has spent most of his career in and around government–serving current Vice President Joseph Biden for more than two decades when he was in the Senate. And when Biden became part of President Barack Obama’s winning ticket, Kaufman was tapped to fill his old boss’ seat.

The reason behind his activism stems from being a retail investor himself. Kaufman has been an investor for almost 50 years, which includes making some of his own trading decisions. When Kaufman, who is 71 years old, began his two-year Senate term last year, it was just before the Dow Jones Industrial Average plummeted to its lowest point in more than a decade. He learned enough from both to develop strong opinions about the equities markets. In an interview with Traders Magazine in his office on Capitol Hill last week, Kaufman talked about the origins and evolution of his cause for change in equities markets.

He traces his interest in helping to shape the way stocks trade back to the uptick rule, which the Securities and Exchange Commission abolished in 2007. To his thinking, the uptick rule stood as a sturdy barrier against bear raids for decades. And when the stocks of both Lehman Brothers and Bear Stearns plummeted during the crisis of 2008, it was "predatory bears" selling short without securing the shares beforehand that played a significant role in driving them down, Kaufman said. Subsequently, he made the uptick rule’s return his first cause in the equities markets.

The SEC’s solution in February, the alternate uptick rule, with its 10-percent circuit breaker, failed to address the problem adequately, he said. With the alternative uptick rule, after the price of a stock has declined more than 10 percent from its previous close, short sales can only be made at prices higher than the current best bid. But after the circuit breaker kicks in, Kaufman said, it’s a green light for everyone, including long-onlys, to start selling short.

"There are a number of proposals out there that were a lot closer to the uptick rule than the circuit breaker thing that they finally came up with," Kaufman said.

While researching the uptick rule, Kaufman learned from academics, traders and others in the industry about other practices that had grown in prominence over the past few years. Kaufman declined to identify his sources, as they contacted him on condition of anonymity. But they piqued his interest in such topics as dark pools, flash orders, co- location and high-frequency trading.

"There were a lot of people out there who were saying to me, ‘You think that’s bad, wait until you see this,’" Kaufman said. "And so they started contacting my office and saying, ‘Take a look at this’ and ‘Take a look at that.’ And so things started to evolve from there."

High-frequency trading has been a major focus of his. Kaufman likes that the markets are more liquid because of it. But he said too much of that type of trading is opaque. That’s why he supports the SEC’s large-trader rule proposal, which calls for tagging orders. He thinks that is the best way to add transparency to high-frequency trading practices. Doing so would give regulators, market participants, academics and the media a sense of how much the practice affects prices, he added.

"If we don’t have transparency, we don’t really know if [high-frequency trading] is reducing costs," Kaufman said. "People are going to imagine that it’s reducing costs, but no one really knows if it is, because no one knows what the costs would’ve been without it."

Kaufman brushed aside industry studies that purported to show that HFTs have reduced trading costs through narrowed spreads. Narrowing the difference between the bid and ask doesn’t necessarily equate to lower costs for investors if the bid and ask are mispriced, he added.

"Is there a lot more trading going on? Absolutely," Kaufman said. "Is it more liquid and are you getting better prices? You can say that all you want to, but I want someone to go in there and find out what’s going on."

Looking forward, Kaufman has started to attack the topic of "too big to fail." But he’s not through with high-frequency trading, or other issues affecting the equities markets. His time is limited. Kaufman will not run in the election this fall and will step down from the Senate after his term ends this year. But he said he still wants to leave his mark on issues that will have repercussions long after he departs.

Kaufman said his "problem" right now with high-frequency trading is that it represents too much of the market, while at the same time it is not understood or able to be monitored. In the meantime, Kaufman will continue to push for greater understanding of how the business operates and benefits investors.

You can read more about Traders Magazine’s interview with Sen. Kaufman in an upcoming story in the June issue.