In the last decade, following the financial crisis and emerging from a period of extreme volatility, the listed options industry has had its share of challenges. Industry volumes have leveled off, some large liquidity providers have left the space, while others have consolidated – resulting in significant concerns about liquidity and market fragmentation.

At the2017 SIFMA Listed Options Symposium, the featured presentation took a deep dive into the recent data, trends and current issues in todays listed options markets. Despite the challenges and continued low market volatility pressuring trading activity, the industry has remained resilient and healthy. Notionally adjusted activity continues to grow, considering the rising market appreciation coupled with little stock split activity; and the largest industry brokerages continue to promote listed options with advanced technology and educational offerings.

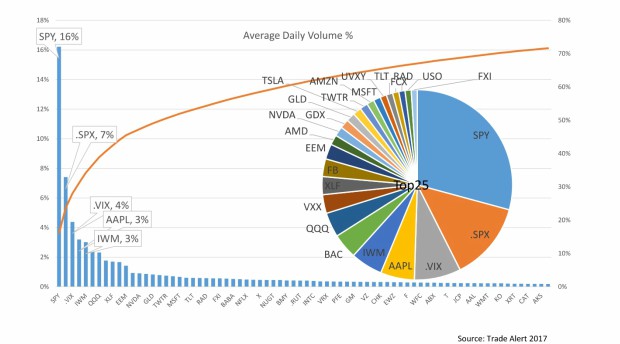

Industry volumes continue to be concentrated at the top, with outsized volume and notional trading in options classes such as SPY, AAPL and a handful of others. Together with index options volume, the level of concentration is even more pronounced with SPX volume accounting for approximately 80% of daily notional traded volume. While there are fewer exchange operators than a decade ago, the number of individual exchange platforms has continued to grow and currently stands at fifteen. At the same time, the number of series has risen to over 900,000, although the explosion of strike listings has subsided in the last two years.

This chart represents the product concentration in the listed options market at the end of November 2017. Source: From the featured presentation delivered by Henry Schwartz at the Listed Options Symposium; used with permission from Trade Alert LLC.

In addition, price improvement auctions continue to be a point of contention. While the effective spread paid by customers has continued to narrow, displayed market liquidity has deteriorated. Some participants argue this is all about fragmentation, the increasing number of strikes and too many exchanges. Others point out that because of the rules that govern auctions, displayed liquidity is poorly incentivized. The debate regarding rulemaking to restrict how auctions are initiated continues – with all participants agreeing that a healthy market driven by narrow spreads and deep, liquid quotes is key to the continued growth and overall health of the industry.

To support a robust market and address some of these issues, SIFMA advocates for a series of changes to enhance liquidity, maintain the flexibility and benefits that listed options provide to all investors, and to protect customer data including:

- A smarter strike listings programto promote tighter and deeper quotes.

- An examination of the universal exchange give-up policythat is in place at several exchanges. This practice, which can add risk to clearing firms, is a critical issue that SIFMA will review in 2018.

- A secure Consolidated Audit Trail (CAT), recommending that personally identifiable information should not be collected and stored in the CAT; instead, less data should be collected upfront, and additional data, including PII, can be requested as needed.

During theRegulation and Risk Panelat the Listed Options Symposium, 63% of attendees indicated that the CAT is one of the recent developments that concerns them the most.

In hisremarksat the symposium, SIFMAs Executive Vice President of Business Policies & Practices, Randy Snook, said, it is vital that we all work together – across firms, exchanges, regulators and all market participants – to address these challenges head on. 2018 is set to be a significant year for these industry efforts.

Mark your calendar for the2018 Listed Options Symposium:

November 15

SIFMA Conference Center, New York, NY

Ellen Greene is Managing Director, Financial Services Operations, at SIFMA.