Pensions and endowments continue their efforts to become fully funded. If they don’t bridge their gaps, they risk not meeting at least part of their obligations to millions of pension plan participants, including school teachers, police officers and firefighters.

The funding shortfalls aren’t new. But what has changed is the fact that some of these institutions are turning to a variety of alternative investments to increase returns, and in doing so are, at times, potentially magnifying the risk in their portfolios. Yet many are missing an opportunity in one of the more defensible places to search for improved risk-adjusted returns – the exchange-listed options market.

A number of pensions and endowments, which oversee hundreds of billions of dollars, are now attempting to address underfundedness by investing in areas such as illiquid credit instruments, venture capital or private equity. The table below, based on research conducted by Greenwich Associates and commissioned by The Options Industry Council, indicates that 40% of pensions and endowments are currently considering private equity as an investment, while 36% are contemplating illiquid credit investments that do not have an active secondary market where they can be traded – areas like leasing, asset-backed securities and distressed debt. Presumably, these are viewed as offering an acceptable risk profile.

Meanwhile, according to Greenwich, only 16% of pensions and endowments are thinking about exchange-listed options, even though options have far greater real-time price discovery, transparency and reduced counterparty risk. Options also allow institutional investors to design outcomes with readily available loss-mitigation strategies.

What about other asset managers? Almost half of those surveyed by Greenwich are already considering future investments in exchange-listed options, while only 10% are joining their pension and endowment colleagues in considering private equity.

The research suggests that generally, the pension and endowment community has overlooked the exchange-listed options market and strategies that have a demonstrated ability to improve risk-adjusted returns and mitigate risk, even as they actively seek out the parts of the financial markets universe where genuinely complicated instruments dwell.

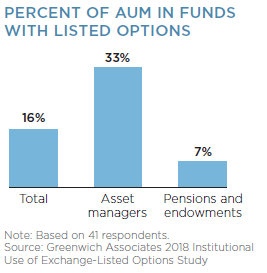

On average, firms investing in options have 16% of their assets under management invested in option strategies. Pensions and endowments, in contrast, average only 7% exposure. To the extent that such strategies improve the risk-return profile of a given fund, the cumulative effect over time could be significant.

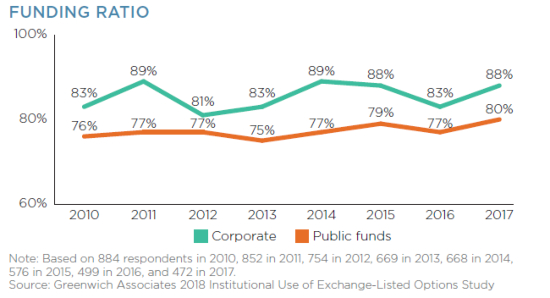

To be clear, options are not without risk. Some strategies require great skill and care. But what’s often ignored is this: When options are properly understood and deployed, they can offer investors what is actually a conservative approach to generating income. For pension funds, they may even provide a way to lessen the 12-percentage-point funding shortfall for corporate funds, as shown in the chart below, or the 20-percentage-point gap for public funds, as of 2017.

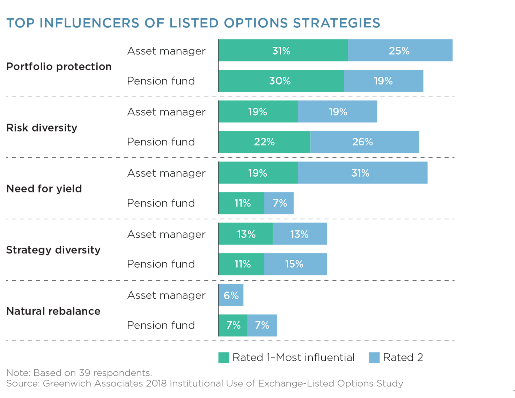

The Greenwich study noted portfolio protection as a top reason for implementing options, but risk diversity is another key driver supporting their utility. As options’ non-linear risk and return characteristics differ from linear assets such as stocks and bonds, the addition of options can expand the efficient frontier of an optimal portfolio.

Also, the ability to improve yield on a portfolio is a powerful incentive for asset managers to explore all available tools. However, the attraction of exchange-listed options appears to be much less pronounced for pensions and endowments than it is for other asset managers. The divergence is somewhat surprising because the potential to generate income with defined risk from a portfolio should be a strong draw, especially for underfunded pension plans.

Data from the Greenwich study also found that when institutional investors decide to implement options strategies, the due diligence process typically takes less than a year for 73% of those surveyed. These findings run counter to popular perceptions that it requires an arduous, drawn-out examination before a suitability determination is made.

Perhaps the most significant barrier to pensions and endowments considering options is found in their investment policy statements. In some cases, these policies, while ostensibly built on managing risk and securing future payment streams, are simply outdated. At times, they may rely on the notion that tools like options carry heightened or unusual risks. In reality, institutions can implement the same strategies, though on a much broader scale, as those employed by individual investors. For instance, writing covered calls or selling cash-secured puts for income can work for investors across the spectrum.

Ultimately, if pension and endowment managers are willing to explore opportunities in new investment areas, they could examine the potential benefits of exchange-listed options in their portfolios. The school teachers, police officers and firefighters who have invested in their funds will be the beneficiaries.

Joseph CusickisDirector, Institutional Education and Business Development, The Options Industry Council