Thanks to increased market volatility, options trading volume in August reached the highest level seen all year.

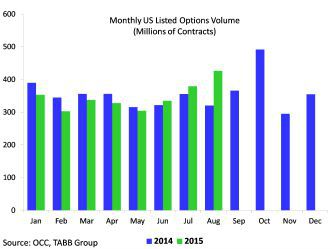

U.S. listed options volumes came in at 426.3 million contracts for August 2015, 12% higher than last month’s 379.2 million contracts and 33% higher than the year-ago August, according to the recent TABB Group Options LiquidityMatrix.

“It represents the highest monthly volume total so far in 2015 and the third highest month for options trading volume on record,” said report author Luther Zhao.

August 21st, 2015 was also the third highest volume day for options trading, printing 39.4 million contracts in a single day. “The volatility in equity markets undoubtedly contributed to volumes.”

Prior to August, U.S. listed options volumes year-to-date were down 4.1% compared to 2014, but thanks to August’s outperformance, 2015 now officially is outpacing 2014 in volume year-to-date.

TABB’s Options LiquidityMatrix includes options trading volumes and statistics on execution metrics for each US listed options exchange as well as the industry as a whole.