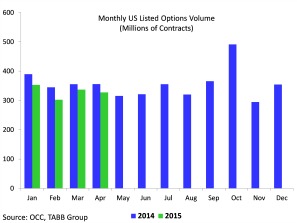

The winter run-up in options volume took a pause in April, as volume dropped for U.S. listed contracts to at 327.6 million contracts for April 2015, 2.8 percent % lower than last month’s 337.0 million contracts, according to Tabb Group.

In its most recent Options LiquidityMatrix (OLM) report, the consultancy also noted that overall option market spreads, adds tightened to 31.6 cents.

Total volume year-to-date measured 1.32 billion contracts, 8.7 percent lower compared to the year-earlier period, accodrding to Luther Zhao, the TABB research analyst who compiles the OLM, reported on a trailing month basis.

Market quality in terms of spread improved to 31.6 cents, down from 34.5 last month and 36.9 at the beginning of the year. However, other metrics such as average bid/offer size and average trade value declined.

The full Options LiquidityMatrix can be accessed now online here.

The OLM is a monthly analysis of options market activity published by TABB Group with analysis and statistics from Hanweck Associates, the OLM includes options trading volumes and statistics on execution metrics for each US listed options exchange and the industry, using data sourced from the OCC and Premium Hosted Database (PhD),a joint offering from Hanweck Associates and the International Securities Exchange (ISE). It also includes data and analysis separately for penny options classes and all options trades.