Open Trading made up nearly half of emerging market bond trading volumes last year at MarketAxess, the electronic platform for fixed income trading and reporting, and is expected to continue to grow.

Craig McLeod, head of emerging markets at MarketAxess, told Markets Media that Open Trading represented 45% of emerging markets volume last year.

“The network effect has transpired into true stickiness,” he added. “Based on our trajectory so far, I expect Open Trading to continue to grow healthily by the end of 2022.”

Open Trading is MarketAxess’ all-to-all trading mechanism allowing multiple parties in a network to come together to trade, rather than the traditional model of only banks supplying liquidity to the buy side

MarketAxess has spent the last few years building its all-to-all network of clients and dealers across the globe which came its own when volatility increased last year due to the Covid-19 pandemic according to McLeod.

“Open Trading’s unique liquidity continued to be the predominant liquidity pool during the crisis, generating greater cost savings for investors,” he said.

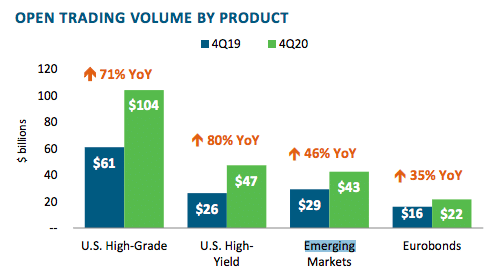

MarketAxess said in its results last month that investors saved an estimated record $1.1bn (€900m) in transaction costs through using Open Trading. In addition the firm stated it achieved record estimated market share in emerging markets, US high-grade, US high-yield and Eurobonds.

McLeod continued that Open Trading addresses the problem of liquidity fragmentation in emerging markets as MarketAxess provides distribution scale to local banks anywhere in the world.

“For example, a local bank in Thailand can trade and face any one of the 2,000 MarketAxess participants across buy side and sell side,” he added.

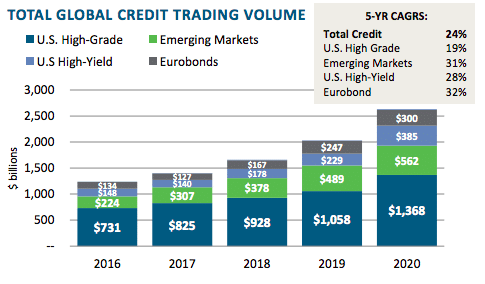

MarketAxess’s emerging markets business has grown at a compound annual rate of 31% over the last five years.

Mcleod said: “I expect that to continue over the next to three years as we continue to solve the problem of liquidity fragmentation.”

One avenue of further growth is increased electronic trading in fixed income. MarketAxess is seeing demand from investors to access electronic trading beyond traditional emerging markets into frontier markets such as Egypt, Croatia and Vietnam with a growing interest beyond core emerging market local debt. In addition, the number of regional onshore participants trading local debt has increased 50% supporting the move to electronic trading domestically.

“There is still huge potential for growth as 70% of emerging market debt is traded onshore,” said McLeod. “In two years, onshore volume grew from 5% to a 35% of volumes.”

ESG in emerging markets

Marcin Adamczyk, head of emerging market debt at NN Investment Partners, said in a media briefing today that governance has traditionally been the main focus of emerging market bond investors. However, since the pandemic environmental and social factors have become more important.

“We expect environmental and social to play an ever increasing role and so we have fully integrated ESG into our investment process,” he said.

Adamczyk continued that investors can benefit from strong returns while contributing to a more sustainable world.

“A growing body of academic research shows that improving ESG scores boosts risk-adjusted returns, yet investors often fail to appreciate how emerging markets are doing this,” he said.

The Dutch asset manager has developed a proprietary ESG Lens which provides a single ESG score for each company or country and includes topics such as corruption, transparency, emissions and standards of public health. NN IP said the sovereign data showed that 56 emerging market countries are improving their ESG scores, while 16 are deteriorating.

Adamczyk said: “On the sovereign level, ESG factors can affect economic growth, public finances, and borrowing costs, for example. Integrating ESG factors can therefore help us proactively manage risk and identify areas of possible concern as well as potential opportunities to secure better investment returns.”

He admitted there are difficulties with the quality and timeliness of data in emerging markets, the ability to analyse it and reach the right conclusions. NN IP conducts a weekly ESG assessment across the countries in its universe, using tools such as big data and social media sentiment analysis. The fund managers also need to be able to assess the experience and quality of management to make a forward looking judgement.

NN IP manages $18bn in assets in emerging market debt strategies, which are all ESG-integrated.