Small evolutionary changes can lead to significant improvements over time. Last weeks publication of revised market risk rules as part of the Fundamental Review of the Trading Book (FRTB) from the Basel Committee is a good example when it comes to the Risk Factor Eligibility Test (RFET).

As a reminder, the Risk Factor Eligibility Test will create the operational framework through which financial institutions will decide whether it worth them adopting an internal model under FRTB.

While banks risk teams might not be cracking open the champagne over the scale of the changes, there is reason enough to celebrate. The proposals include four fairly minor changes which combine to increase modellability rates, meaning more institutions may ultimately benefit from an internal model and lower capital costs.

Transparency of Real Observations

Banks will be permitted to use either internally executed trade and committed quote data or source this externally. The Basel Committee on Banking Standards (BCBS) has clarified that collateral reconciliation or valuation cannot be considered as a real price observation.

Transparency is critical. Banks will need to own the risk factor to real price observation mapping process, irrespective of where that data has sourced from. This requirement rules out black box pooled data sources – a significant clarification from the previous version of the rules. Banks will be able to complement their observation set with real observation data from third-parties if the following conditions are met:

- Provide the dates on which they observe one or more executed trades or committed quotes

- Provide the instrument T&Cs (i.e. instrument identifier information to enable banks to map real prices observed to risk factors

- Subject to an audit, which is made available on request to the relevant supervisory authority

The onus is on data suppliers to provide sufficient granularity and standardization in their real observation data sets. Banks should not be asked to be data aggregators, and will benefit from being able to leverage normalized trade datasets, enriched with reference data required by the market risk teams, consolidated across multiple asset classes and sources.

Using Fixed Income & OTC observations reported under MiFID II

For banks with European operations, the extensive scope of MiFID II trade data could mean it acts as the pre-eminent source of real observation data and significantly reduces the burden of the RFET compliance obligations.

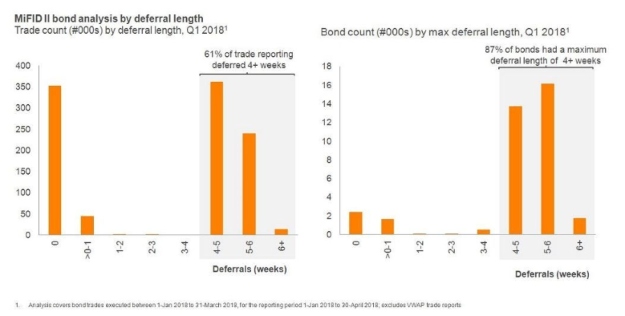

However, one of the challenges of using data which is newly transparent thanks to MiFID II is that many trade reports are deferred for a significant period of time. Research we carried out earlier this year found that 87 percent of the bonds reported on two popular regulated venues were subject to a maximum deferral length of four weeks or longer. The number was even greater for OTC instruments.

For this consultation, we argued regulators should provide banks with sufficient time to collect data thats subject to deferred publication prior to conducting RFET.

Fortunately, the revised regulation does make special allowances for data subject to deferred publication (e.g. illiquid instruments under MiFID II). The RFET period can differ from ES model calibration period by up to 1-month. This will enable banks to integrate far more publically available bond and OTC data in particular.

Impact of Revised Regulatory Bucket Approach

The updated rules clarify the methodologies that can be employed to bucket risk factors, making the Risk Factor Eligibility Test less onerous. Banks are permitted to use their own bucketing approach or the regulatory bucketing approach prescribed by the BCBS. The regulatory bucketing approach is now much simpler than in the March 2018 consultation, especially at the short-end of maturity, with between 5 and 9 maturity buckets depending on the type of risk factor for time-to-maturity (TTM) and time-to-expiry (TTE), and 5 moneyness buckets for volatility-based risk factors.

Analysis of the US Corporate Bond Market [see below] that we carried out previously showed that its almost impossible for U.S. corporate bonds with TTM less than one year to pass the RFET as it was defined previously. By reducing the granularity of the buckets, especially at the short end, banks should be able to achieve higher pass rates.

Our analysis also found that there was also a risk of non-modellability purely from a bond moving from one time-to-maturity bucket to another as it gets closer to maturity. The BCBS have granted banks flexibility to map the real observations from debt instruments to either the maturity bucket associated with the instruments issuance or the maturity bucket linked to remaining maturity at the time of trading, thereby reducing the impact of this roll effect.

Analysis of instruments with optionality, e.g. executed USD-linked vanilla FX options published under the Dodd-Frank Act by major Swap Data Repositories (SDRs) presented concerns around the granularity of TTE and moneyness buckets from the March 2018 proposal. Having fewer mandated TTE buckets will help banks, but the revised granularity for moneyness buckets may still make it challenging for risk factors to pass at the wings given the sharp pass rate drop off away from at-the-money.

Impact of revised RFET test calibration

Under the original Jan 2016 rules, banks were required to show that during the previous 12 months they had at least 24 real observations with no more than one month between any two consecutive observations.

Testing this we found, in line with other analyses carried out by others, that the requirement for no more than a one month gap between two real observations became the binding constraint.

In an important change, the BCBS has revised the test requirements to allow banks to classify a risk factor as modellable if it passes either one of two criteria.

First, if there are 24 real observations per year (over the period used to calibrate the ES model) and in any 90-day period there must in 4+ observations. Our view is that the gap between real observations will still be the binding constraint, but this adjusted should enable more risk factors to pass.

Second, if there are 100 or more real observations during the previous 12 months. This change is valuable, in particular for highly liquid instruments that are deemed non-modellable because they were only observable from a start date within the one-year window (e.g. newly issued debt). The new test criteria will enable such instruments to pass modellability.

Overall, the revisions build on the March 2018 Consultative Document and are largely incremental rather than fundamental rewrites of the FRTB text. Given the amount of time and effort that has gone into compiling these rules since 2008, those in the industry looking for an overhaul were always going to be disappointed.

The revisions to the RFET help increase modellability rates, but the implementation challenges will remain. The need for trade data from non-bank sources is apparent. Banks and vendors will need to work together to develop a standard for real observation data that complements a banks own data, allowing the industry to meet their regulatory challenges in a seamless, efficient manner.

Kaylash Patel is Head of Enterprise Analytics, Refinitiv