The U.S. options market keeps chugging along at its current breakneck pace despite some potential headwinds facing it.

US options volumes slipped again in May 2018, according to Tabb Group latest Options Liquidity Matrix report. The asset class lost some of the momentum established during a torrid first quarter, but volumes still remain on pace to hit record levels for the year. May 2018 volumes fell to 366 million contracts, from Aprils 398 million contracts.

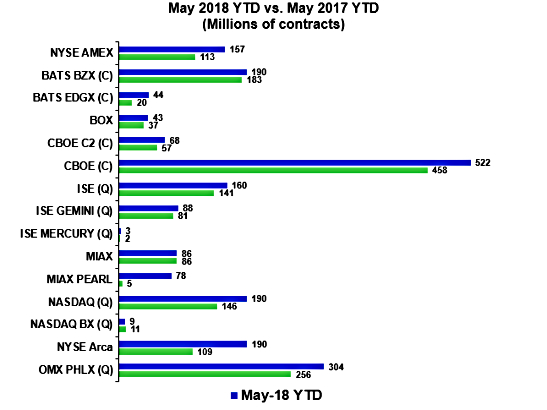

Source: Tabb

However, Tabb noted year-to-date US options volumes represent a healthy 25.2% gain over 2017.

A continued decline in market volatility – the average VIX for May fell to 12.4 from Aprils 14.1 – might be reducing the need for investors to hedge existing positions, suppressing option volumes for the near term, Tabb analysts wrote. Meanwhile, the average bid/offer spread across all exchanges tightened by almost 3 cents in May 2018 month-over-month, to $0.27, indicating an improved trading environment for investors.

The Options LiquidityMatrix is a monthly analysis of options market activity published by TABB Group with analysis and statistics from Hanweck. The report includes options trading volumes and statistics on execution metrics for each US listed options exchange and the industry, using data sourced from the OCC and Hanweck.

The Options LiquidityMatrix includes data and analysis separately for penny options classes and all options trades.

To see the full report, please click here