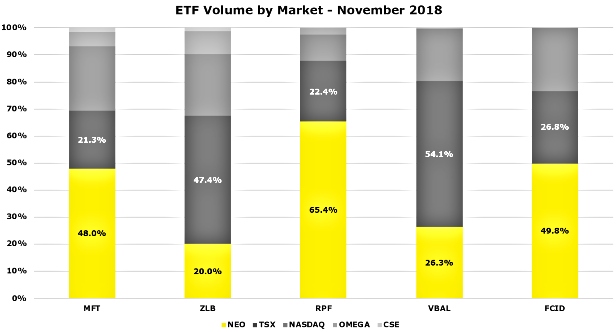

Historical Canadian market structure policy and convention has failed to address todays reality: there are multiple markets in Canada that can and do trade the same public company or fund even when they are listed on the TSX. Each market has a unique focus and creates Canadian capital markets choice for different stakeholders. Consider this sampling of frequently trading funds. The November trading volumes for these products are fragmented across the TSX, NEO, and other markets in Canada.

As trading continues to fragment across multiple markets, a common trend has emerged: significant trading occurs off the home listing exchange. This is particularly common with ETFs and can often lead to the incorrect perception of illiquidity. Why? Investors and advisors have the view that liquidity in ETFs is defined by volume traded when in fact it isnt; the underlying securitys volume is far more important. This is further challenged because the complete, consolidated picture ofalltrading information is not available publicly. A consolidated quote with volume across all markets is not available to investors and investment advisors. Unable to see the full picture, investors jump to the conclusions that certain securities are infrequently traded.

The issue is further compounded as investor portfolios for both do-it-yourself investors using a discount broker channel, as well as those with Financial Advisors are updated based only on trading activity from the listing market. Securities can often appear stale by days or even weeks, while trading continues on other market places. Again, this problem is particularly prevalent in ETFs. The stale closing price results in an inaccurate representation of the value of the underlying holdings.

Without a doubt, the lack of consolidated data causes headaches for investors, advisors, and issuers alike. With no sign of a relatively simple regulatory solution similar to what is available in the US – mandated access to consolidated market data – we need to find other solutions.

At NEO, we have an investor first mandate. It is through this lens that we proposed andimplementeda simple solution that ensures the published closing price of a security will reflect a complete, consolidated price.

We are dedicated to building healthier capital markets for all investors. We identified a problem, consulted with industry stakeholders, proposed and executed upon a solution. This improves the overall investmentexperience for Canadian investors, and we hope other exchanges in the industry will follow. This is how we do things at NEO.

Want to learn more?

For those interested in gaining a thorough understanding of how NEO publishes closing prices for our listed issuers, keep reading:

Whats the problem?

ETFs are a Canadian born phenomenon and theyve grown substantially in popularity. However, the infrastructure and policies that support the industry have not evolved to keep up.

In short: the closing price publication mechanism in Canada does not acknowledge or consider a multiple marketplace environment where trading activity can happen in multiple places.

Eachexchange publishes a closing price for securities listed on their exchange to the investment community. For TSX-listed ETFs, the TSX publishes their closing price; for NEO listed ETFs, we publish our closing price.

There are 10 different markets that also contribute valuable information to the investment community that could be used to create a consolidated closing price suitable for all investors, however this doesnt happen. It needs to.

How are investors currently affected?

The only way a new ETF end-of-day price gets to your portfolio is if that ETF trades on the exchangewhere it is listed– either the TSX or NEO respectively. This is a problem.

NEO represents more than 20% ofall ETF tradingin Canada; and this can be as high as 75% for certain individual ETFs. That means substantial trading activity can happen off the listing exchange, and that trading activity does not contribute to the determination of the closing price.

What are we changing exactly?

For NEO listed ETFs where no trading has occurred within the last 15 minutes of the trading day across any marketplace, we will now set the Closing Price to the time-weighted national best bid and offer midpoint price.

This particular issue should have been fixed a long time ago.

At NEO, we can ensure all NEO-listed ETFs are properly represented. To ensure accuracy, we will show consolidated closing prices from all markets where our listed securities traded. Today, all NEO trading books (NEO-L, NEO-N, and NEO-D) and MatchNow trade NEO-listed securities. Closing prices from all of these markets will be considered when setting the final closing price. As other markets begin to trade our securities, we will consolidate their activity too.

When investors buy NEO-listed ETFs, we will publish a consolidated end-of-day closing price that is available to all investors.