The following appeared on the NYSE blog

Since the NYSE Trading Floor partially reopened on May 26, Floor Brokers have quickly restored their key role in the US equity market. Floor Brokers’ return, ahead of a key index event, has highlighted the scalability, liquidity opportunities, and execution quality of the NYSE Closing Auction.

Partial Reopening with High Capacity

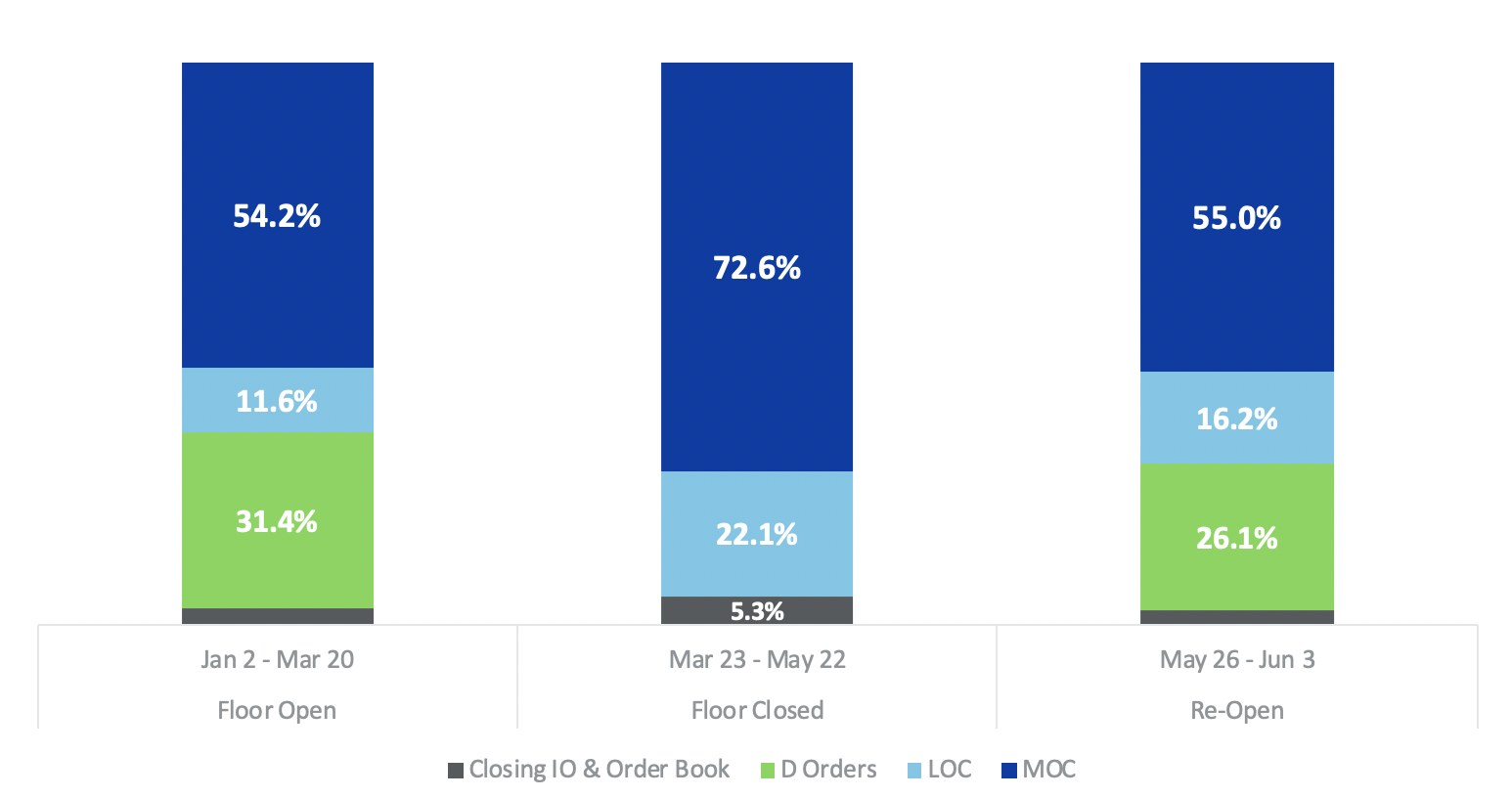

Floor Brokers have quickly adapted to a new, socially distanced environment and contributed more than their fair share of liquidity. Despite the reduced headcount, D Orders, which are available only via Floor Brokers, have returned nearly to their prior share of auction activity.

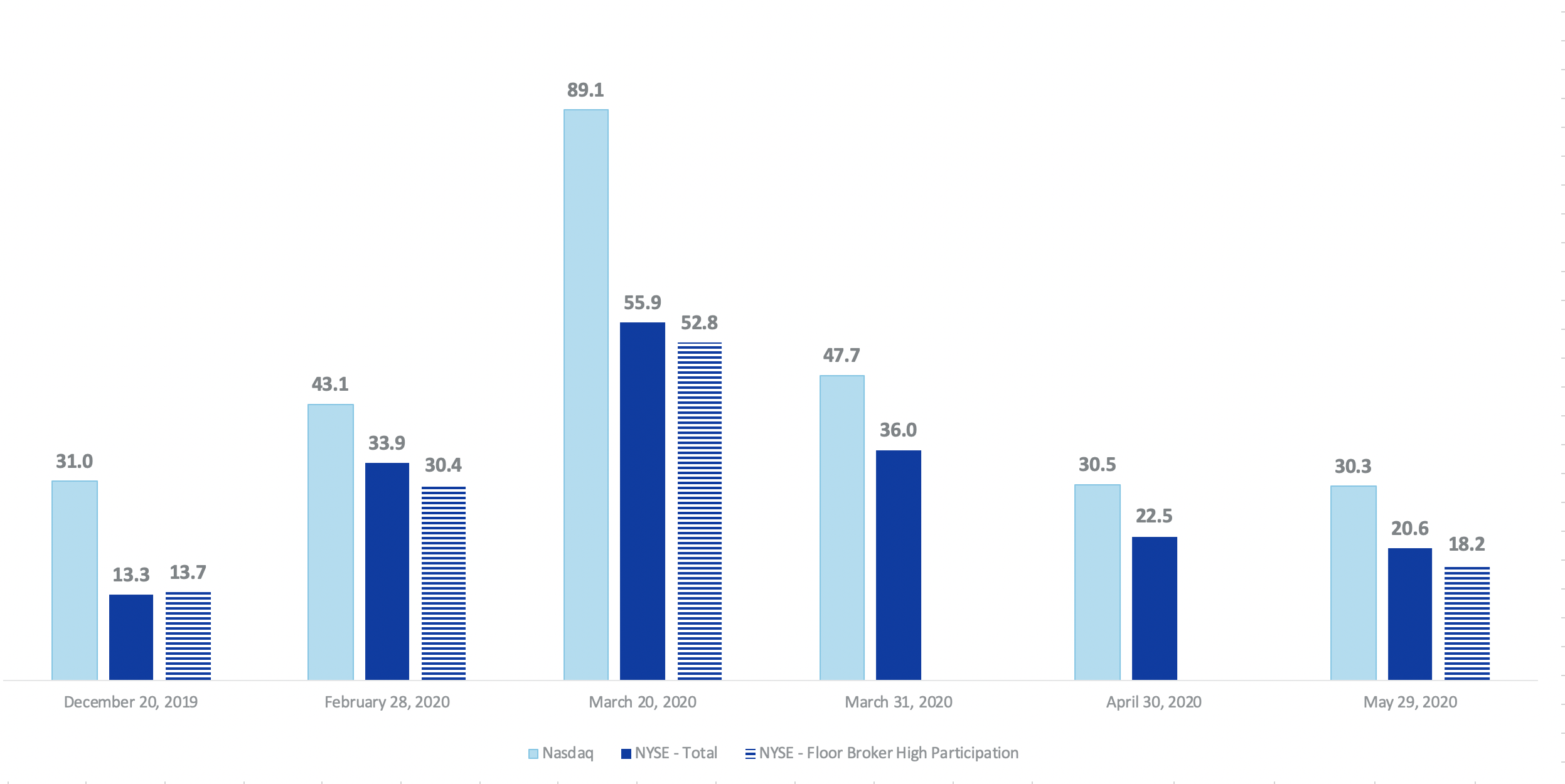

Closing Auction Order Type Share of Executed Volume

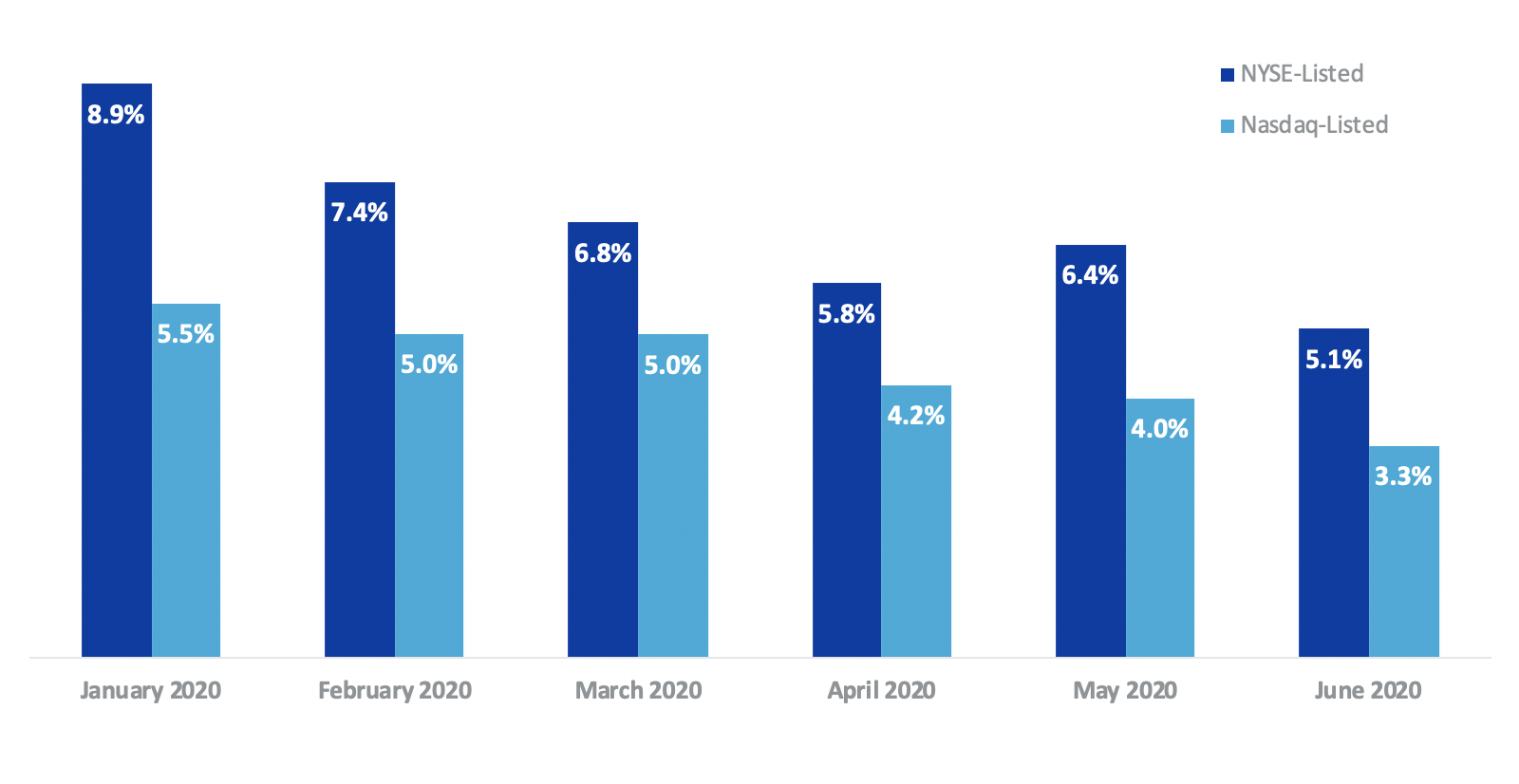

With the return of Floor Brokers ahead of the MSCI Index rebalance, the NYSE Closing Auction has again established its leading role in aggregating liquidity in a fragmented marketplace. The flexibility of the NYSE Closing Auction allows a broad range of participation, leading to larger auctions than other exchanges.

Closing Auction Share of Total Trading

Closing Auction Case Study: MSCI Rebalance

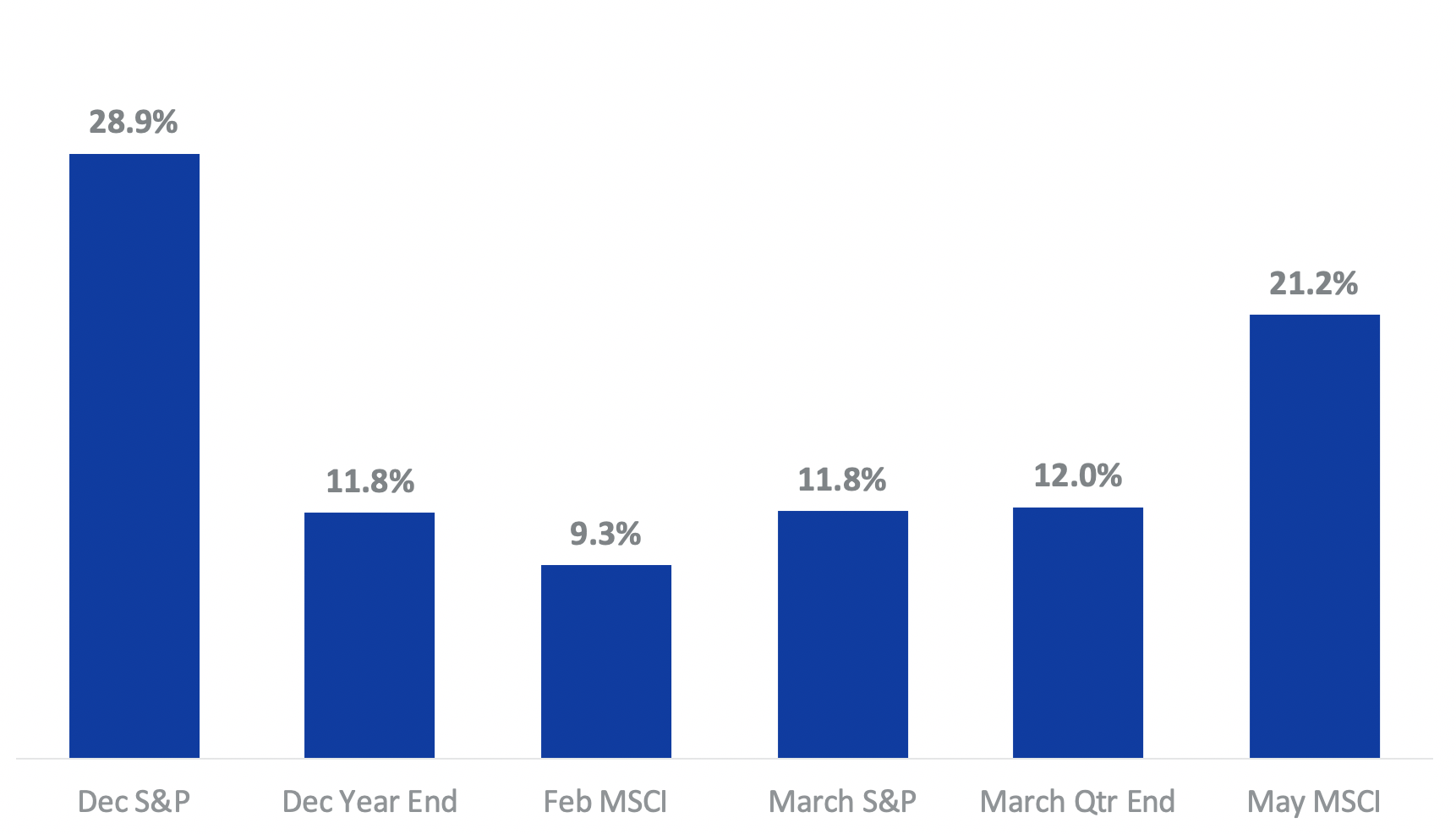

The first week of the partial reopening ended with the May 2020 MSCI Index Rebalance on Friday, May 29. Index rebalances are finalized via the closing auction, increasing the number of shares changing hands. This rebalance was no exception – May 29 was the 7th largest closing auction of all time, with 1.55 billion shares and nearly $60B notional traded.

Auction Size

The May 2020 MSCI Rebalance accounted for 21.2% of total NYSE-listed trading volume on May 29. This exceeds most recent quarter-end and index rebalance days, which are typically the largest auctions. On an average trading day, the closing auction accounts for 5% to 8% of NYSE-listed volume.

Closing Auction Share of NYSE-Listed Volume

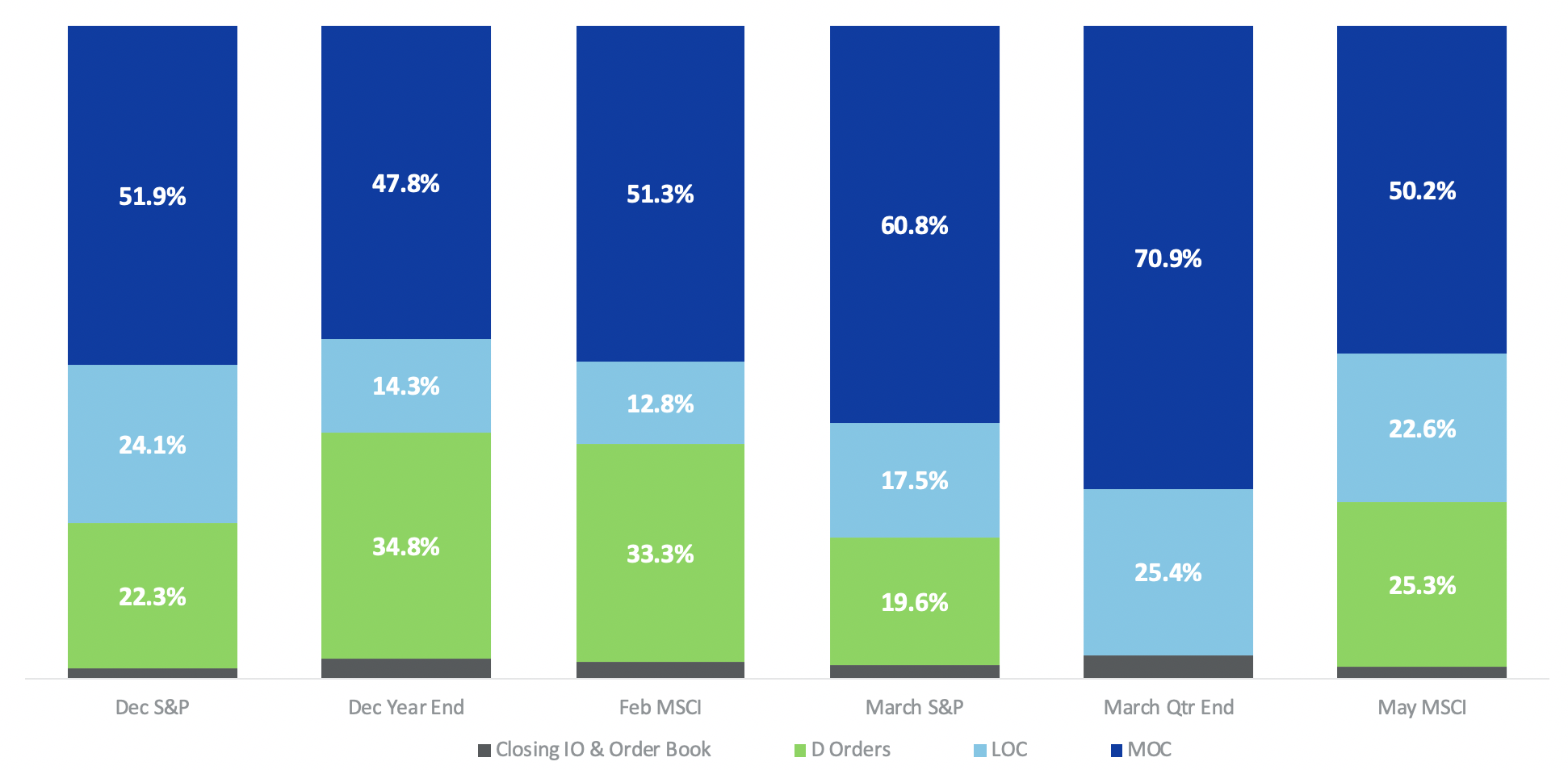

For the MSCI Rebalance, Floor Brokers executed over 780MM shares in the Closing Auction, over 25% of all volume.

Closing Auction Order Type Usage

Floor Brokers Improve Execution Quality

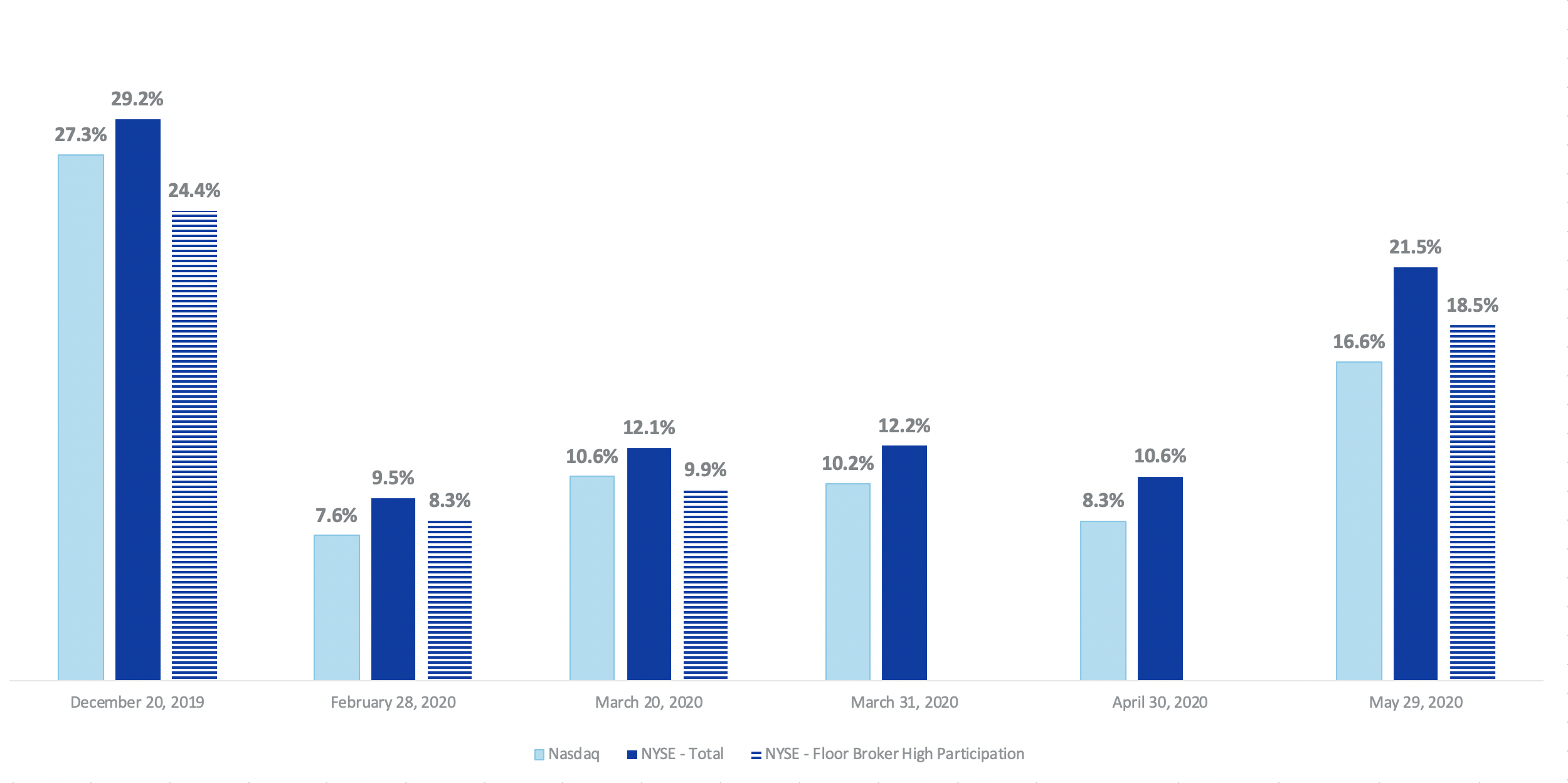

Consistent with independent research, including recent analyses from RBC Capital Markets and university academics Jonathan Brogaard, Matthew Ringgenberg and Dominik Rösch, we find that Floor Brokers’ participation improves market quality. In one example, we examine Closing Auction price dislocation for the May MSCI Rebalance and other recent significant auctions and find that, while the NYSE Closing Auction consistently outperforms electronic auctions, the outperformance is frequently enhanced by above-average Floor Broker participation. Importantly, above-average Floor Broker participation usually occurs in smaller auctions, making Floor Broker liquidity facilitation even more valuable.

Below, we measure Closing Auction dislocation as the difference between the Closing Auction price and the market VWAP from 3:58 to 4:00. We include all common stocks with a closing price above $1, closing volume of at least 100 shares, and 10 trades or 1,000 shares traded from 3:50 to 4:00. Floor Broker High Participation identifies auctions where Floor Broker participation was above the median participation level across all auctions.

Closing Auction Price Dislocation (basis points)

Closing Auction Share of Consolidated Volume

Moving Forward

As public health conditions allow, the NYSE will continue a phased reopening process for the Trading Floor. We expect returning additional elements of the NYSE market model, such as full DMM participation, will continue to improve market quality.