The one thing that I have loved about trading in the Forex markets over the years is the ability to go long or short in any pair. You can do pretty much the same in equity or bond markets as well. So as an active trader, it doesn’t matter which way is the market moving on a particular day, you can go with the trend. However, the case is a little different with cryptocurrencies — it is much easier to buy digital assets than to sell them. Although BTC futures provide you this functionality, it is still very limited.

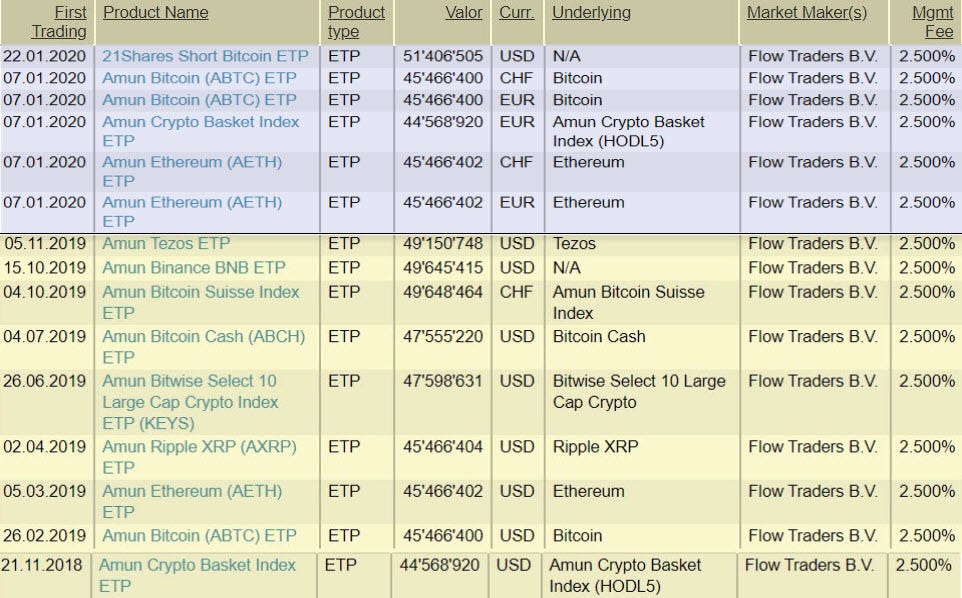

Swiss Fintech startup Amun AG has been at the forefront of such endeavors to bring you innovative crypto trading products since November 2018, when they launched their first crypto ETP. Since then, the company has launched multiple crypto ETP trading products of which there are now a total of 15 with the most recent addition. The list includes 11 individual crypto ETPs and the remaining 4 are crypto index ETPs (chart below).

For those of you, who are not familiar with ETP, it is an Exchange-Traded Product bearing a close close resemblance to an ETF (Exchange-Traded Fund). Both of them are traded on stock exchanges like common shares, where the price is determined by the performance of the underlying asset or index. However, ETFs have minimum diversification requirements & the fund is only allowed to be invested in certain categories of the underlying asset.

The most recent addition by Amun AG is a pretty interesting one — it has listed an inverse bitcoin exchange-traded product (ETP) on Switzerland’s primary stock exchange SIX. An inverse ETP allows you to make a profit when the price of the underlying asset falls, which is bitcoin in this case. Basically, you can profit from the falling prices in the premier digital coin.

Amun has also listed five other ETPs since the beginning of the year, but all of them are designed to profit from an increase in the price of the underlying crypto. The World’s first inverse ETP has the following features:

- The new trading product is dubbed as “21Shares Short Bitcoin ETP (SBTC)” — 21 refers to bitcoin’s fixed supply of 21 million coins.

- If you buy SBTC ETP worth $100 & the price of BTC drops by 10%, you would make a profit of 10% minus the trading costs.

- The annual management fee is 2.5%, comparable to all other listed ETPs.

- Unlike shorting via crypto derivatives, SBTC does not require borrowed capital.

- And SBTC is reset at the end of each day, so it is ideally suited for short term day traders since the performance is not carried forward to the next day.

Amun has already received regulatory clearance from the Swedish Financial Supervisory Authority to expand its offerings in the European Union. It plans to list its ETPs to at least two European exchanges by end of 2020. Crypto trading opportunities continue to expand & evolve.