It’s been a big two weeks for markets. Not only is the election (mostly) over, but we now have a more certain timeline for vaccines to be widely distributed. As expected, the market has instantly priced in both bits of news.

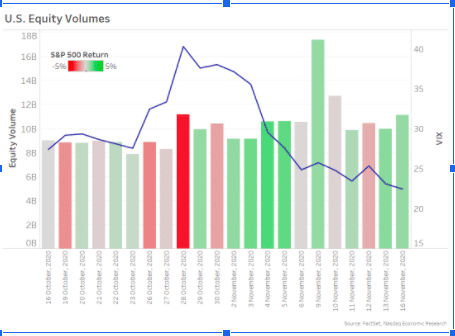

Expected volatility has fallen almost in half as two key items of uncertainty seem to be resolving themselves (blue line in Chart 1). Volumes in November have been mostly in line with the new 2020 normal of around 10 billion shares per day.

That’s almost 50% above prior years, but actually represents a relatively quiet trading period this year. However, we did see volumes spike on November 9 (height of bars in Chart 1). That was the day we saw a combination of Biden claiming the election and news that Pfizer’s mRNA vaccine was found over 90% effective in Phase 3 testing.

Chart 1: Volumes, volatility and returns around the election

The Biden trade

In the days immediately before and after Election Day, as polling data pointed to a Biden win, markets turned consistently positive (green bars in Chart 1) and rallied back toward all-time highs.

Later that week, as Washington appeared headed for gridlock, with a Republican Senate and Democrats in the House and White House, markets seemed to adjust while remaining net positive. Gridlock means most of the larger initiatives in the Biden agenda will be much harder to implement, resulting in smaller stimulus and deficits. That, in turn, cuts down the potential money supply expansion, reducing the risks of inflation and leading to interest rates rising, which would be bad for stock valuations in the short to medium term. Instead, bonds rallied, which means yields came down.

As risks to the market fell, the stock market also generally rallied. We also saw clean energy, one of Biden’s core policy changes, outperforming other classic stocks. Growth and tech stocks, which are more sensitive to rates, also outperformed.

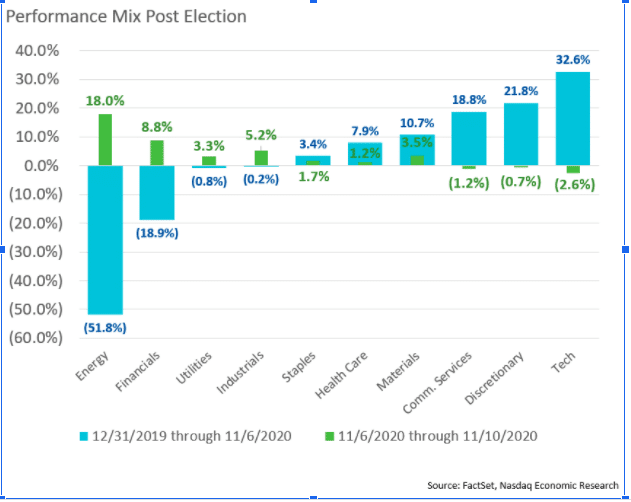

Chart 2: Markets increased around Election Day with clean energy outperforming; many trends reversed post vaccine news

The vaccine trade

The impact of Biden’s more official claims of victory on the weekend was mostly overwhelmed by news from Pfizer of a successful vaccine. Both affected the market open on Monday, November 9. Gold fell and rates rose (bonds sold off) as risk appetite returned to the market.

On that day, volumes spiked back to over 17 billion shares (Chart 1), and many of the sectors’ performances we’ve seen during COVID were reversed.

Specifically, as Chart 3 shows, many of the worst-performing sectors year-to-date (blue bars) saw strong positive returns (green bars), and vice versa.

In contrast, stocks that had been most impacted by the coronavirus, including airlines, hotels and energy stocks, rallied as expectations for a return to more normal levels of revenues and profits were brought forward. Last week, energy gained 18% while oil also firmed up more than 10% on news of the vaccine. The JETS ETF traded more shares than any day during the earlier coronavirus selloff on expectations of travel habits returning to normal much sooner than previously expected.

Financials, which were potentially exposed to credit defaults from bankruptcies, also gained over 8%.

Many of the new economy stocks that had performed the best since the bottom of the coronavirus selloff underperformed—including Communication Services, Discretionary, and Technology—all lagged the market as traders adjusted for the fact that we might not be working-from-home for quite so long.

Chart 3: Post vaccine the performance of the COVID trade reversed trends in many sectors and factors

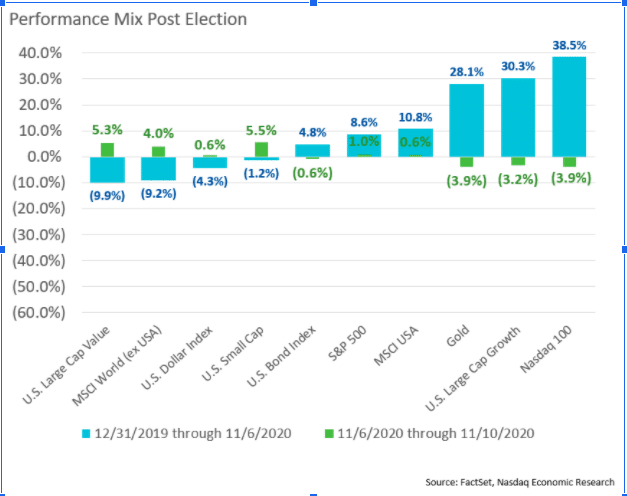

We also saw some reversals in factors that had become quite stretched under the ultra-low interest rate, pandemic world (Chart 4, green bars are consistently opposite to longer term blue returns).

Small cap, which had lagged large cap in the recovery, moved positive for the year, making a year-to-date return of +4.7%. While the outperformance of large-cap growth over value stocks contracted 8.5%, value remains almost 32% behind growth year-to-date and at one of the biggest relative discounts in decades.

Chart 4: Post vaccine, the performance of the COVID trade reversed style trends too

Top 25 ETFs follow market outperformance

Our ETF scorecard, which looks for ETFs with unusually high price moves, asset flows or returns (up-or-down), was also overwhelmingly green post-election. That coincided with U.S. equity ETFs seeing inflows of $36 billion over the past two weeks, according to Credit Suisse data.

Consistent with sector and style performance above, ETFs with gains had exposure to

- Energy, especially green energy funds

- Value and small cap

- Financials, especially banking ETFs

- Airlines and leisure ETFs

- And some international funds including Spain, the U.K., Russia, China and Mexico

Chart 5: Top 25 ETF Scorecard in the two weeks since the election

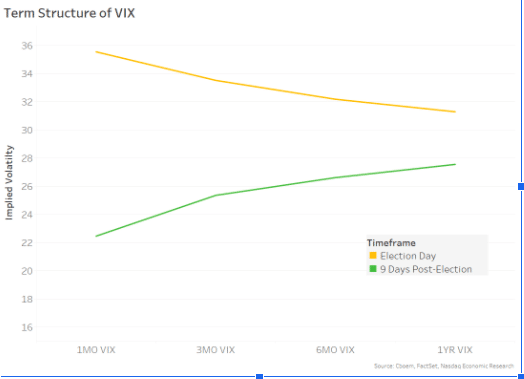

Options markets show risks over the next 12 months have reduced

As one-month implied volatility shows (Chart 6), the expected spike around Election Day occurred but has already reduced significantly. Longer-term volatility expectations have also fallen, which seems to show vaccine news has also removed a significant amount of risk from the market. Even three-month volatility has fallen significantly, which seems to indicate the market has few concerns about the inauguration on Jan 20, 2021.

Chart 6: Volatility expectations have shifted but remain elevated out 12 months

Despite that, overall levels of implied volatility remain high. It’s more common in “normal” markets for the VIX to sit closer to 17, not the current 22+. So, although vaccine and election uncertainty looks to be reduced, short-term headwinds remain. None the least being the new spike in COVID cases in Europe and the U.S., which is already leading to regional shutdowns of specific businesses and activities. Companies most affected by the coronavirus are likely to see revenues fall before they recover, meaning they still need to survive to around July 2021 based on expectations for a widespread vaccination.

As Dr. Anthony Fauci and Chairman Jerome Powell have said, this is likely to be a tough winter.

“Post-Election Market Trends 2020” was originally published by Nasdaq.