Factor investing is built on the premise that investors can manage risk and returns by applying an appropriate mix of equity factors such as Value, Quality, Size, Momentum and Low Volatility. Often referred to as ‘Smart Beta’, factor investing is an approach that has gained traction rapidly over the last decade and is now used to manage over $1 trillion of investor assets. [1]

This potential for unlocking returns through a factor-based approach may explain why FTSE Russell’s annual Smart Beta Survey for 2019 revealed record adoption by 58% of asset owners globally, up 10% since 2018. A growing majority of asset owners—government organizations, corporations, unions, insurance companies, sovereign wealth funds and family offices from North America, Europe, Asia Pacific and elsewhere—are discovering the potential advantages of smart beta. All this has helped move factor based investing from a niche approach undertaken by a small number of sophisticated investors to the mainstream.

Factor-based strategies that incorporate ESG, or sustainable investment considerations are also on the rise. In Europe, of those who had an existing or anticipated smart beta allocation, 77% said they might incorporate ESG considerations into that allocation. This expanding interest helps explain why BlackRock estimate factor-based strategies to be worth an estimated £3.4 trillion by 2022.[2]

Factor-based approaches can also help investment managers address portfolio concentration risk and adapt portfolios to suit changing macro-economic conditions. For example, it is well-known that Quality and Low Volatility have proven effective defensive factors during market downturns, while cyclical factors such as Value, Momentum and Size have performed best during periods of economic growth.

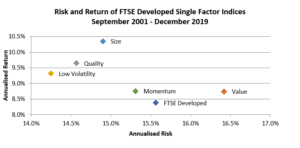

For example, during the 2008 financial crises a Low Volatility tilt provided some downside protection to the FTSE Developed Index, as lower volatility companies experienced smaller drawdowns. The graph below compares the risk and return characteristics of FTSE Developed Quality, Momentum, Value, Low Volatility and Size single factor indexes between September 2001 and December 2019; all five factors outperformed the benchmark over the period and four of them did so while also providing lower volatility of returns.

Source: FTSE Russell. Data from September 2001 to December 2018. Past performance is no guarantee of future results. [Factor index data represents hypothetical, historical data.] Please see the end for important legal disclosures.

As a global index provider, FTSE Russell has witnessed the growing traction this approach has achieved over the last decade, but also continues to innovate in order to solve problems faced by investors using a factor approach.

For example, capturing desired factor exposures consistently over time without introducing exposure to undesired factors, called off-target exposures, can prove problematic.

To help investors address this challenge, FTSE Russell has introduced FTSE Target Exposure indexes. The new indexes allow users to achieve a variety of explicit exposure objectives, ranging from risk factors, to industries and countries, as well as sustainable investment objectives consistently over time. The indexes are designed to deliver set levels of factor exposure at each rebalance and are regularly rebalanced to ensure this level is maintained. The launch comes as asset owners and money managers are demanding greater transparency from index providers on factor-based benchmarks and the ability to monitor factor exposures over time.

FTSE Russell does not use an optimizer. Instead, appropriate tilt strengths are determined by solving a series of equations in order to align factor and sustainable investment exposures with investment goals. This methodology allows exposures to be targeted in a precise, but more transparent manner compared to optimised approaches. This is a key differentiator for FTSE Russell.

FTSE Russell’s Target Exposure indexes give investors the ability to achieve a variety of explicit factor exposures, while maintaining market, country and industry neutrality.

This can be used for a variety of applications covering pure play single factor indexes, multi-factor indexing and to incorporate specific levels of climate objectives, such as carbon emissions from the stocks in an index.

Another reason exposure control is important is the growing demand for sustainable investment products that meet certain ESG objectives, often with a focus on reducing carbon emissions by a specific amount, or to consistently align a portfolio with the Transition Pathway Initiative goals.

Time will tell which factors perform best in 2020. Yet, as investors continue to allocate capital to smart beta funds this year, the need to provide a full suite of tools that will offer consistent exposure to desired factors while minimising exposure to unwanted factors is becoming increasingly important.

By Andrew Dougan at FTSE Russell, the global index provider with over $15 trillion of assets tracking its benchmarks.

© 2020 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) MTSNext Limited (“MTSNext”), (5) Mergent, Inc. (“Mergent”), (6) FTSE Fixed Income LLC (“FTSE FI”), (7) The Yield Book Inc (“YB”) and (8) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “MTS®”, “FTSE4Good®”, “ICB®”, “Mergent®”, “The Yield Book®”, “Beyond Ratings®“ and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, MTSNext, FTSE Canada, Mergent, FTSE FI, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of the FTSE Russell products, including but not limited to indexes, data and analytics or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing contained herein or accessible through FTSE Russell products, including statistical data and industry reports, should be taken as constituting financial or investment advice or a financial promotion.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back- tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, MTSNext, Mergent, FTSE FI, YB, BR and/or their respective licensors.

[1] Financial Times, Smart beta funds pass $1 trillion in assets, December 2017

[2] BlackRock, What is Factor Investing?, Andrew Ang, Ph, Nov 7, 2018