Kevin Chapman has seen it before: tight capital, plunging markets and high volatility. The main difference between today and past markets is a matter of timing-and degree.

“All those crises [are] rolled up into one,” he says. “It’s all hitting at the same time.”

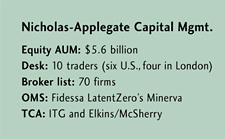

Chapman has some perspective, having traded 16 years. The last 10 he’s spent at growth investor Nicholas-Applegate Capital Management in San Diego, where he’s headed equity trading operations for the last four years.

In this hostile trading environment, Chapman has stuck by his process. But he’s also tweaked that process to meet the changing conditions.

Case in point: Amid the price swings and scarce capital, his desk has handled much more of the trading itself. Previously, the desk relied heavily on broker capital for its portfolio trades, but algos have done much more of the heavy lifting as of late.

“If I’m making all these strategy changes, it’s easier to click the button myself than call a broker, or have them update their system or change their instructions,” Chapman says. “It’s more efficient with the huge swings.”

Second, even when capital got scarcer, Nich-App found a viable alternative for rebalancing one of its 12 quantitative portfolio strategies each week: program trading algorithms. During the volatility, the PMs often sent more portfolio trades Chapman’s way.

The desk had been testing and using program algos during the past five years. But prior to September, it had been using capital for portfolio trades about 90 percent of the time. Now capital/algo use is at roughly even. And the algos have delivered, Chapman says, particularly in small caps.

How the portfolio trading process had worked: The trader would get a pre-trade cost estimate for, say, 30 buys and 30 sells. He’d then compare the estimate to a few brokers’ blind bids.

If the bids came in at a similar price to the estimate, Chapman might opt for the capital to eliminate the timing risk. Otherwise, he’d trade it agency using an algo.

As those blind bids are now far fewer in number, the algos must pick up the slack until the capital returns-if it ever does.

The best algos would try to trade over a reasonable period of time to reduce the overall cost, he says. They would choose the optimal sells to offset the most costly stocks to stay dollar-neutral.

“We don’t want to take on market risk by selling stuff and then having to wait to buy something,” Chapman says. “You want to trade it over the same period of time; you want the buys to offset the sells.”

On a related note, DMA for single stocks also increased in September and October because the desk wanted to respond to changing markets faster.

During the period, the firm used DMA 25 percent of the time for its single-stock trades, up from 15 percent. This compares with 5 percent two years ago, he adds.

(c) 2008 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/