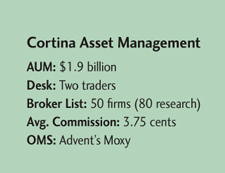

Self-trading has been on a tear. One industry study predicts that buyside do-it-yourself electronic trading will reach 42 percent of total volume by 2011. However, that doesn’t impress Kurt Kujawa, the head trader at the small-cap firm Cortina Asset Management in Milwaukee.

He thinks algorithms are overrated and would only tip off the marketplace for the stocks he trades. And he hasn’t had much luck with gray pools or most dark pools, either.

“Because small-cap trading is more liquidity-based, it does you no good to be in an algorithm,” he reasons. “I need to be the action, not the reaction.”

Kujawa isn’t so concerned about not having an EMS. And he’s used trade-cost analysis before, but finds the best methodology sits in the head of his portfolio manager.

“If the PM makes a good decision on a stock, it’ll look like a good job. If he didn’t, it won’t.”

Kujawa’s no Luddite. He makes a point to try most new tools that come out to see if they can help him with the names he trades.

For trading the blocks that commonly cross his desk, he’s found negotiating with a familiar voice over the phone works best. After 17 years on the sellside at Robert W. Baird & Co.-12 as a sales trader, and five a market maker-Kujawa has an idea of how traders work. He learned a number of different trading styles from the various clients he covered over the years.

“All of that history and knowledge goes a long way when it comes to talking to other traders and being able to get things done in block fashion,” he says.

So in a growing electronic world, how does Kujawa find liquidity? He starts with “advertisements of volume” mostly. Then he looks to see who makes a market in the name or who’s been active in it recently.

If it’s someone Kujawa’s had a good relationship with, a give and take starts. He’ll give the other side some information, hear him out and maybe give him some more.

“We’re acting as a team, negotiating the block,” Kujawa says. “Sometimes the bids and offerings get shown to me and sometimes I’ll start the process.” The trading environment can be brutal, though. Kujawa is concerned when market volatility hammers his small caps.

“I’m watching a stock right now,” he says. “It hasn’t traded, yet I’ve seen the bid and ask change six times. It’s because all those algos are pegged to each other.”

In his four years on the buyside, Kujawa said he’s seen the quality of sales trading-both the service and the knowledge-drop precipitously. The largest brokerages, he says, are just bringing in recent college grads “to dump” the orders into their algorithms.

“I’d rather go to someone who’s been in the business and has relationships and can get something done quietly.”

(c) 2008 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/