Firms will need to more deeply integrate their front, middle, and back offices to support the business environment of tomorrow, according to a survey from Northern Trust, in partnership with Coalition Greenwich.

“Outsourcing some or all processes can be an integral part of that strategy,” Grant Johnsey, Head of Client Solutions of Capital Markets at Northern Trust, said.

The survey titled “The Evolving Asset Management Landscape: Only the Fittest Will Thrive” reveals that while many asset managers will remain on their current course, there is a gap between how firms ought to be preparing for future challenges and the actual level of preparation they have made.

The industry is anticipating growth, so there needs to be a significant focus on preparing for it, Johnsey said, adding that there are many factors asset managers must consider when deciding whether to outsource.

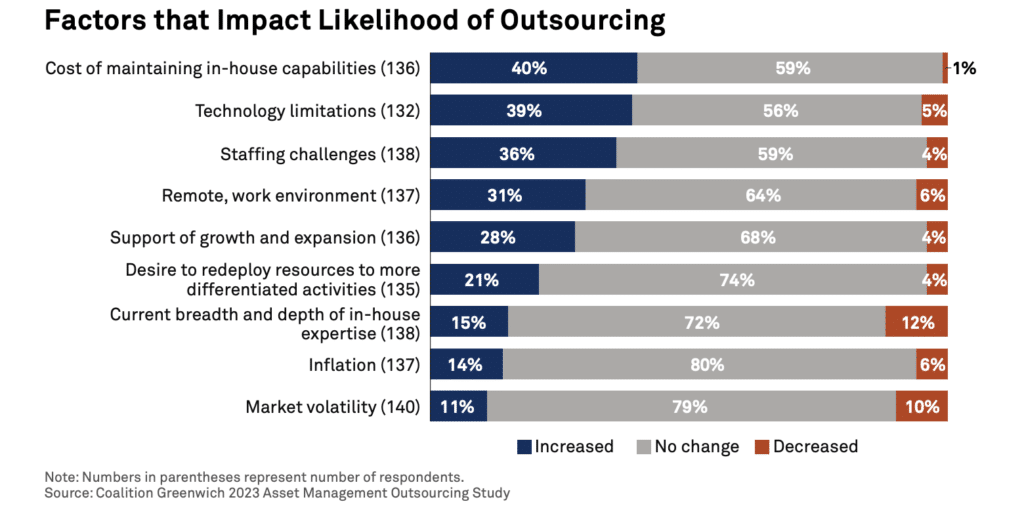

The factor most likely to increase outsourcing is the cost to maintain a firm’s current platform, with 40% of respondents stating these costs increase the likelihood they would outsource. “Issues with technology and staffing are also top of mind, and adding cost through new technology and new personnel may be a non-starter,” Johnsey said.

Operating models need to contemplate a broad range of costs, he added.

“While the explicit fees of a vendor’s pricing relative to in-house costs tend to be the dominant consideration, there needs to be a shift to include implicit costs as well,” he said.

For example, according to the paper, firms need to ask how their execution quality could improve compared to their current trading desk if it is outsourced.

Asset managers also need to quantify operational risk reduction via improved settlement rates and the impact on their business if automation increases, the research said.

Benefits of outsourcing accrue to core investment processes but will also extend to complementary ones—trade execution can naturally lead to trade reporting and to sophisticated transaction cost analysis (TCA) and pre-trade compliance checks, according to the paper.

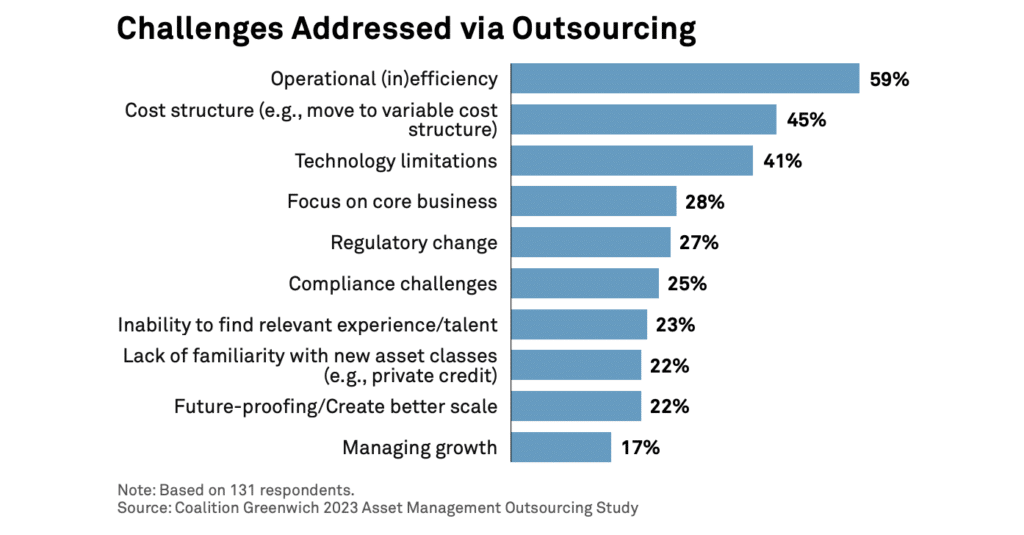

The challenges that outsourcing can address are diverse and supportive of strategic goals.

According to the findings, asset managers are aware of potential flaws in their operational processes with 59% citing operational inefficiency as a problem that outsourcing can address.

Cost structure and technology limitations are also key drivers of outsourcing, according to the results.

Imperfect operating and technology models lead to inefficiencies that can add risk to an enterprise. Additionally, firms are recognizing that they need to expand their product set and may not be optimized to do so.

“When an organization believes it has a combination of inefficient operations, costs incompatible with fees and underwhelming technology, a rethink is required,” Johnsey commented.

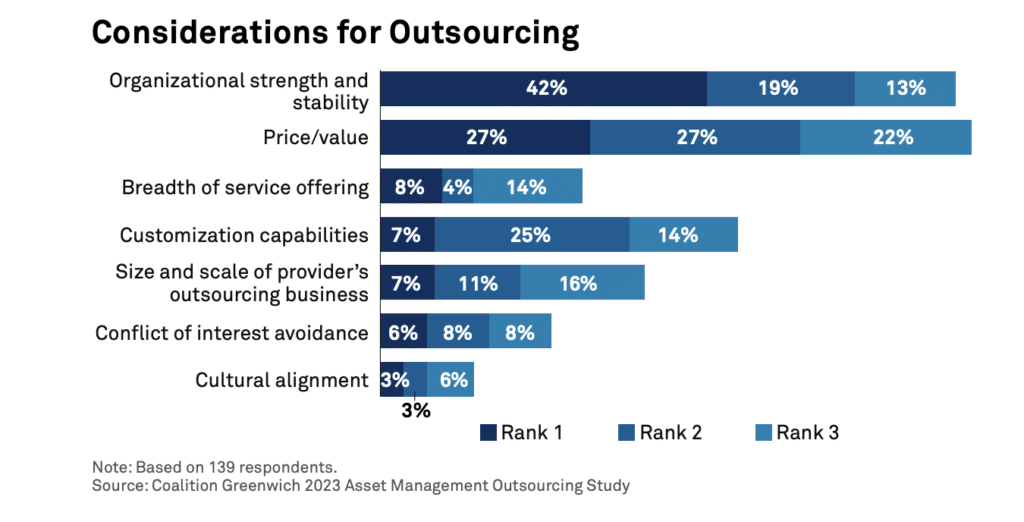

Moreover, according to the findings, 61% of asset managers cite organizational strength and stability as the first or second most important consideration in outsourcing. Breadth of service and the ability to customize are other vital considerations.

Johnsey said that the benefits and motivations for outsourcing today are a “continuation of the outsourcing evolution”.

Core custody was enhanced by complementary processes such as fund accounting to ensure smooth operations, he said, adding that then it became efficient to have these firms take ownership of certain activities that helped the performance of the fund, such as foreign exchange and securities lending.

This evolution has been on a steady path toward the front office, and solutions now are diverse and can be tailored to fit into multiple parts of the investment process, across the entire life cycle or across asset classes, he said.

“A well-thought-out operating model is a key contributor to success,” Johnsey stressed.

“Client demands are changing, and an asset manager’s strategy must evolve with those demands. But the strategies of 2025 will not succeed if they are run on platforms designed for the environment of 2018,” he added.