Gareth Coltman, global head of trading automation at MarketAxess, said the next focus for the electronic platform for fixed income trading and reporting is to make it as easy as possible for the buy side to automate trading and unlock their potential liquidity.

Coltman told Markets Media: “We will see a rapid growth in the buy-side becoming more active price-makers and we are a big believer that automation will be the key to unlocking that latent buy-side liquidity.”

He continued that MarketAxess has built the protocols to allow clients to automatically respond to request for quotes (RFQs), to post to MarketAxess anonymously, to use the Live Markets order book and Mid-X, the new session-based protocol in Europe.

“The next big area of focus is to make accessing all these protocols as easy as possible and a completely seamless part of the buy-side’s existing workflow in an automated way in the background,” added Coltman.

Live Markets is a protocol for Open Trading, the all-to-all model, which creates a single view of two-way, actionable prices for the most active bonds. Mid-X is session-based and allows firms to trade against the mid-point price established by CP+, MarketAxess’ composite pricing tool.

Coltman said clients are already starting to use these automation tools and there is a big desire from them to see more integration into their execution/order management systems, which can slow adoption due to the significant technical uplift required from OMS/EMS vendors.

“So we are also focused on letting clients use these tools directly inside the MarketAxess platform as well as via their OMS/EMS,” he added.

Coltman envisages a future where a client is able to set their urgency, their appetite for price improvement and place their order into MarketAxess defining how they would like to participate in different protocols. A highly urgent order could go out straight away for automated execution as an RFQ, but if they had more time the order could participate throughout the day in other protocols such as Live Markets or Mid-X.

MarketAxess has been developing machine learning analytics and CP+ to predict scenarios such as how many responses are likely to sending out an RFQ or how long a client might wait for inbound liquidity after making a price.

“We are doing similar work to predict the results clients might get with other protocols to help guide clients as to the best type of order use,” added Coltman. “It is quite a futuristic vision but we are very close to having the right data, stronger analytics, and the right pathways to access different protocols within MarketAxess automatically.”

He highlighted that for buy-side firms building a multi-billion dollar portfolio, the opportunity to save the entire bid-ask spread will be a significant cost saving.

“Some of the biggest buy-side firms are using this technology as it is too good of an alpha generation opportunity to pass up,” said Coltman.

Open Trading

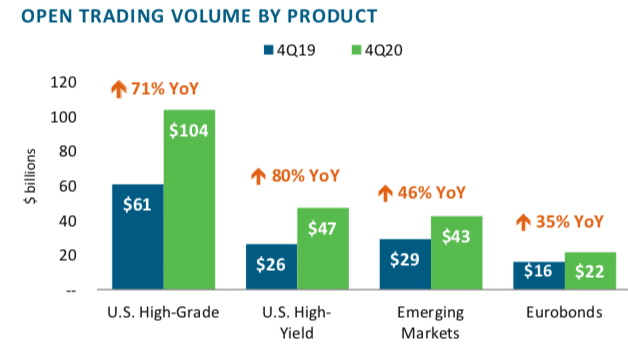

Open Trading is MarketAxess’ all-to-all trading mechanism allowing multiple parties in a network to come together to trade, rather than the traditional model of only banks supplying liquidity to the buy side.

Coltman said: “Open Trading will absolutely increase on a long-term basis and our vision is that it will continue to become an increasingly significant part of how clients trade.”

In the fourth quarter of last year, Open Trading credit volume was $218bn, up 63% from the last three months of 2019, with estimated total system-wide cost savings of $225m.

Coltman added there has been rapid growth in participants such as banks who want to find ways to efficiently unwind, rather than warehouse, risk and also from traditional buy-side firms who are seeking price improvement.

Last month Open Trading total credit trading volume was $94.4bn.

MarketAxess reported a number of trading volume records in March 2021, including total credit average daily trading volume of $12.7bn and total credit trading volume of $292.6bn.