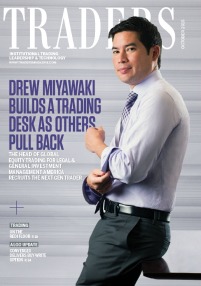

Things are happening inside Legal & General Investment Management America (LGIMA) — and, as head of global equity trading, Drew Miyawaki is at the center of the action. When Legal & General Investment Management (LGIM), the U.K. fund service firm known as one of the largest index fund manager in the world and the parent company of LGIMA, offered to transfer Miyawaki to Chicago, it had a clear mission in mind. LGIM-with a reported $714 billion in index funds under management-wanted to grow its wholly-owned subsidiary LGIMA, which was founded in 2006.

There were clear opportunities in the Windy City. Last December LGIMA launched its U.S. index fund management business and it needed a head trader. The U.K. parent company seeded $60 billion in pension assets into the U.S. arm and dispatched to Chicago two leading London staffers from the trading floor. Along with the 38-year-old Miyawaki, who had worked at the London offices as global head of equity trading since 2011, they sent over Aodhagan Byrne, index portfolio manager of LGIM. Last fall, both joined Chad Rakvin, head of U.S. Index Funds, and Shaun Murphy, director of index funds, to lead the U.S. initiative in Chicago.

LGIMA is on a path for growth. In July, LGIMA announced that it would manage the newly launched Legal & General Collective Investment Trust funds maintained by Reliance Trust Company of Delaware. These domestic and global funds boast three index strategies, with an additional three index strategies set to debut this fall. A press statement declared that these indices “provide exposure to the key segments of the global equity opportunity set.” The Chicago-based investment advisor also named Robert J. Moore to the role of chief executive officer that was previously held by Mike Craston, who will continue to serve as vice chairman. LGIMA has more than $119 billion in assets under management as of July 2015.

Miyawaki gets to his desk at the South Wacker Drive office at 8 a.m. to trade on behalf of his institutional and corporate benefit plan clients. “We have close relationships with a number of the larger index providers throughout the world: FTSE, MSCI, Russell, Standard & Poor’s. We have index funds that will track all of those indices, and trading within those is done in conjunction with the fund management team to match the risk and returns of those indexes,” Miyawaki said.

Along with trading, Miyawaki has a mandate to grow the U.S. business’ trading desk. While he demurred when asked to give hard numbers of how large the current two-person trading desk will become, he said he would keep it “commercially responsible … As the index business grows and as the LGIMA total business grows, we’ll keep right up alongside it, if not be ahead of that for a little bit,” he said. “We don’t have any hard goals. We’re pretty dynamic and we have a good idea of the pipeline on the sales side, and we’ll keep in lockstep with that.”

The Hunt for Talent

Miyawaki is currently joined by Joe LaPorta, a veteran trader of Northern Trust who focused on asset allocation research, short duration fixed income and index management before joining LGMA. “I started a junior portfolio manager after coming out of the rotational development program, and over the years I transitioned into a portfolio fund manager for three years,” said LaPorta, who joined LGIMA in July.

Besides an expertise in trading index funds learned and developed at LGIM, Miyawaki is also adopting the hiring practices of his London days as he expands the U.S. office. He tends to look past the typical trader resumes so that he may discover what he called “a bit of diversity on the investment cycle… We made a lot of hires from the sellside and hedge funds and now we’ve made a hire from actual fund management. We turned a fund manager into a trader, and I think that’s an important dynamic.”

This new method in hiring is a byproduct of the past decade’s convergence between the buyside and sellside. Thanks to the blending of capabilities, talent and skillsets that have moved from broker-dealers to asset managers and hedge funds, the hiring pool is far less regimented than it was before the first decade of the 2000s. “The buyside is now more empowered with technology and has an increased access to liquidity,” he said. “We think that talent should go the same direction and follow the same path.”

In short, Miyawaki said that LGIMA is “looking for something slightly different than that typical mold of the buyside trader.”

So far, he is not seeing an exodus of young talent away from U.S. capital markets to say, Google, Twitter or Facebook or to startups like Slack and CloudFlare. Miyawaki sees no shortage of candidates, especially in sellside brokers eager to join the buyside, and he says the firm’s robust intern and recruitment program has helped. “We have heard that a lot of talent goes to Silicon Valley or into the Internet space, but we haven’t seen any shortage of it here in finance.”

Miyawaki and LaPorta’s trading day is centered around index funds. “A lot of the trading is done with the closing valuation point in mind, depending on what index series we’re managing and trading toward, Miyawaki said. “Then you’ve got your periodic rebalances and your re-weightings within those indices. A lot of the trading is tied into the fund management and working very closely with the fund managers.” Miyawaki sits at the same desk as the fund managers, which means the traders are part of the investment cycle much earlier than the end execution point of the trade. “We provide that access to the marketplace for the fund managers,” he said.

When asked how many broker-dealers he works with, Miyawaki replied, “We’ve got quite a deep list. If you combine it with the U.K. affiliate’s list, it could be 50-plus in terms of equity brokers.”

The reason for such a large list of brokers is the varying requirements Miyawaki maintains with different providers. With some of the international and less liquid emerging markets, for example, he said he looks for local brokerage coverage. “Obviously the criteria for them to succeed are much different than your big bold bracket investment banks that can provide multi-asset, multi-regional and multi-instrument coverage. We have a set of criteria that we ask of the larger brokers, a different certain set of criteria we ask of our agency brokers, and a different set of criteria that we would ask for our regional brokers as well.”

LGIMA’s Winning Formula

LGIMA trades with algorithms and in dark pools if the trade calls for these methods. In fact, Miyawaki’s background is steep in algorithmic trading. Before joining LGIM’s London office, he served as director of global program trading for Knight Capital. Prior to that he was head of international trading at Liquidnet and served on the algorithmic and program trading desks at broker-dealer Jefferies. When asked if he dreams in code, Miyawaki laughs. “I speak enough of the language to make it efficient, but I’m not a programmer.”

LGIMA does not have a basement full of Russian mathematicians writing its custom formulas. Instead, the traders rely on formulas from its sellside brokers. The firm advises the brokers on the formula behavior and desired outcome.

LGIMA has access to multiple global trading venues-dark pools, alternative trading systems, other venues-and Miyawaki relies on the firm’s methodology and policy to determine the appropriate venue for certain orders. “For every order, we make that analysis and deem a trading strategy that is responsible for that order rather than just force everything into an algorithm or into a certain dark pool. We’re making a conscious decision to route accordingly,” he said.

When it comes to dark pools, Miyawaki looks for transparency and said he appreciates the proposals coming from regulators that push for greater insight into these unlit trading venues. But until the new rules are passed, he evaluates the dark pools on their merits and does not see them as equals. “There are certain venues that should be prioritized over others when you search for liquidity. Dark pools certainly have a place in there and they have a higher or lower place depending on the aggression or sensitivity of that order,” he said.

“There are certain dark pools that are better suited for large orders, and that’s what they specialize in, and the results are in their average execution size and the amount of block trades that are going through them,” he said. “Others are much more prevalent in the lower volume, lower average size execution space. So certain dark pools should have priority for certain orders and others should not.”

As for traditional stock exchanges, Miyawaki said his firm’s volumes tend to be skewed more toward typical exchanges due to the concentration of closing auction orders. “There aren’t many dark pools out there that do a significant amount of volume at the official closing price after the market has closed. Therefore our numbers tend to be skewed much higher toward the public exchanges,” he said. “That’s because of the concentration of an index fund around the closing price.”

As an index manager, LGIMA doesn’t need to trade near the speed of light. “There’s no proprietary trading going on here. We’re an index manager for large institutions and corporations so there’s no high-frequency trading going on,” Miyawaki said. “What do I think about it? It adds an element of liquidity to the marketplace. It helps contribute to lower spreads in many cases.”

Miwaki did not change his trading during the recent spate of volatility when reports of a slowdown of China’s manufacturing and rumors of an interest rate hike sent the Dow Jones Industrial Average plummeting for a single day. These market swings are not always a bad thing, he said. “Volatility is a natural part of the marketplace, and if it wasn’t, there’d be a lot fewer jobs on Wall Street.”

Bonding with the Buyside

When Miyawaki arrived in Chicago last year, he made sure to connect with the Security Traders Association of Chicago (STAC). He had an idea: He was looking to build a buyside network and a forum with other members of the Chicago trading community. He helped form the STAC Buyside Forum to hold both online and in-person meetings for buyside traders. “We’re averaging around 20 people per meeting now. We’re looking to grow that,” he said.

STAC was instrumental in helping Miyawaki build the network, he said. “They provided the resources and support not only to myself but to let all Chicago-area buyside traders have a forum where we can discuss best practices and industry topics.” Those topics include the changing role of the buyside, best execution, new regulations and transparency in dark pools.

“The role of the buyside and the buyside trading job has changed and that’s the exciting part. That’s been one of the catalysts for networking and in sharing best practices. The job has become a lot much more than just execution. We’re very close with operations, investment technology, and compliance and risk, and trading can be a differentiating marketing factor,” Miyawaki said.

“There’s a lot of dark pools and algos out there. There are a lot of fines and pitfalls if you’re not careful. Sharing best practices is common in many other industries, and buyside trading should not be excluded.”