A month after theSecurities and Exchange Commissionadopted the Investment Company Act rule 22e-4, fund managers are still digesting its implications.

The rule, which was adopted Oct. 13, requires mutual funds to establish management programs that consider liquidity risks during both normal market and reasonably foreseeable stressed conditions. The earliest fund compliance date for the liquidity risk management program requirement is Dec. 1, 2018.

Under the Securities and Exchange Commissions Investment Company Act of 1940, open-end mutual funds are required to meet investor redemption requests within seven calendar days. In its review of mutual fund liquidity management practices in September 2015, the SEC expressed concern that mutual funds employ varying approaches to evaluate and monitor portfolio asset liquidity. The SEC also noted that fund practices ranged from comprehensive and rigorous to minimal and basic.

Corporate bond funds dynamically manage their liquidity risk over the course of a cycle, UBS analysts Stephen Caprio and Matthew Mish said in a report published last month.

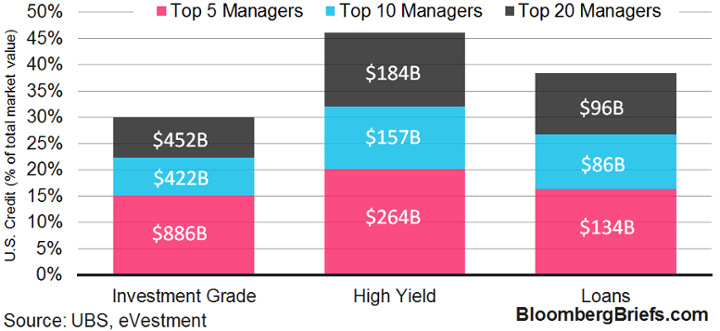

Their research revealed that the top 20 managers held a substantial portion of the total market value of investment grade debt, high yield corporate bonds, and U.S. loans (see chart).

In more tranquil markets, funds will meet redemptions out of cash reserves and will resist selling bonds, they said in the report, titled Fund-Heavy: The Owners of U.S. Credit. But in periods of heightened volatility, funds will sell corporate debt to increase cash buffers. And if the market for lower-quality credit seizes, funds have empirically displayed no qualms selling higher-quality, liquid securities first to minimize trading and market impact costs.

Under the new rule, each fund will be required to classify each portfolio investment into one of four liquidity buckets – highly liquid, moderately liquid, less liquid and illiquid.

The rule identified additional factors that a fund should consider in developing a plan, including a concentrated portfolio, large positions in particular issuers, borrowing and derivatives.

Individual funds may classify the same set of bonds as highly liquid investments in their respective portfolios. In the event each fund experiences an increase in redemption activity, if all of the funds attempted to rely on the same set of bonds for liquidity, the collective selling efforts may result in unanticipated illiquidity of the bond positions or dilution of the remaining fund interests.

One of the challenges for fund managers may be in identifying the liquidity management risks that may result from this type of concentration. This would involve being mindful of the positions held by other funds, reviewing publicly available information such asForm N-Q and considering how overlapping holdings may impact the funds own liquidity risk management program.

In response to several comments to the proposed rule that prescriptive requirements could cause the very conditions that the rule sought to prevent, the SEC removed some of the provisions that specifically mandated how managers needed to manage liquidity during times of stress, such as the prohibition on purchasing assets other than highly liquid investments if the funds highly liquid investment minimum was breached.

SEC Commissioner Michael Piwowar noted in his statement on Sept. 22, 2015 that market participants stressed the importance of investing in a manner consistent with the funds investment strategy. Some market participants also believed that having the ability to purchase less liquid assets would help prevent a deterioration of their liquidity. By allowing flexibility in designing and implementing fund liquidity risk plans, the SEC preserved the ability of natural liquidity to emerge when it is needed most.