Young traders-those who grew up with electronic gadgets-must be reminded to seek "the voice," of the sales trader, says Bob Luckey, a trading lifer.

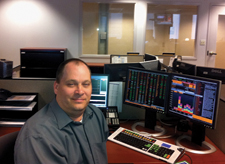

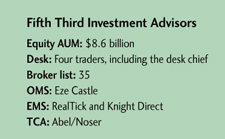

Luckey, the private bank desk chief for Fifth Third Investment Advisors in Cincinnati, works with portfolio managers whose clients are well-heeled individuals and trusts. Most of the portfolio is in large caps.

He concedes a generation gap in the trading business. Young traders’ first impulse is too often to look for an algorithm. Luckey believes algos rarely work with mid-and small caps. "I have found very few algorithms do a great job in finding liquidity in those names."

In trading, "There’s a sense that the machines can do it all and the value of speaking with the sales trader has gone away," he said.

Luckey reminds his traders that they must remember "the voice." The voice is that person at the other end of a telephone.

"I believe there is great value in the voice," he said. That voice, he added, can be helpful even on electronic trades.

"If I see a stock running, I’m making a phone call. Tell me what’s going on. If I need to put on or take off a trade," he said.

Yet Luckey is no Luddite. He uses algorithms. And he says "they can be terrific for large caps when they can be customized."

But some algorithms react aggressively to volatile markets. "This leads to chasing, which could lead to increased execution prices," Luckey notes.

Take a stock that trades a half million shares a day but one day you must buy or sell 100,000 shares. "You’re not going to make that trade using an algorithm without affecting price," he said.

Luckey believes that good traders with years of experience have an innate sense of judgment about certain stocks.

"Experienced traders know how a thing trades. And no matter if it is 1,000 or 100,000 shares, they know who are the holders and know how to go get it. The algorithm doesn’t," Luckey said.

Luckey describes himself as "very fortunate." All his education was local. He never had to leave Cincinnati to pursue a trading career. Luckey began trading in 1998 after four years working on settlements at the bank. He was trained by the head trader of the bank’s asset management arm. A decade later he was running the private bank’s trading desk.

During a successful career, Luckey has learned that algos are helpful, but one must always remember the usefulness of the voice at the end of the telephone.

"As the offerings and use of algorithms have expanded over the last few years," he says, "my trading desk has embraced them, but has not lost the value of the trading relationship. New traders have grown up with electronic tools and make the mistake of thinking algorithms can do it all."

But ultimately, he says, successful trading is a relationship that no machine can duplicate.