Over the last year, the buyside has been asking for greater transparency of its orders. But for Franklin Templeton, that request has already been fulfilled, according to David Lewis, the company’s head trader for U.S. stock trading in Fort Lauderdale, Fla.

Lewis, a 14-year veteran, spearheaded a project at the global money manager to get real-time trade information for each execution. Every broker fill reveals an order-routing and execution footprint: Where it was executed and where it was routed, as well as whether Franklin Templeton took or added liquidity.

The information is then received and displayed by the trade blotter, giving traders new insight into the market and their strategy.

"What I’m learning is that I’m able to watch the algos: how they interact with the market, before they execute, while they are executing and afterward, how they revert," Lewis explained. "I’m getting a much better view of the marketplace."

Global director of trading Mat Gulley tapped Lewis to oversee the project. Early in his career, Lewis worked the night shift trading Asia. In 2001, he moved to trade U.S. stocks, working alongside Bill Stephenson, who is now director of global strategy. Lewis was promoted to head trader about three years ago.

For Franklin Templeton, the May 6 "flash crash" pushed the issue of transparency to the forefront, Lewis said. The firm began working with some other managers to get standardized tags for the new trade data through the FIX Protocol Organization (see related story).

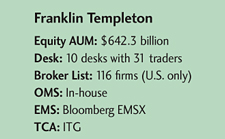

Getting increased insight into its algorithmic orders has been a priority. Franklin Templeton uses about 45 algorithms from roughly 20 different brokers. All the brokers complied with the firm’s request to provide real-time data and did so within a few weeks, Lewis said.

The real-time data will offer a number of benefits. First, it will show a broker’s routing logic, whether or not its routing is based on pricing–rebates and fees–at the various exchanges and dark pools. "We want to know if a broker is routing based on economics and not necessarily for best execution," Lewis said. "It is our fiduciary responsibility to know what our brokers are doing with our orders."

Information leakage is always a top concern on the buyside. Traders often intuitively know when it occurs, but it is hard to pinpoint without an execution trail with data, Lewis said.

Franklin Templeton has suspected leakage in certain venues, but it has not turned any off. That could change, however, with its enhanced information. If the desk believed leakage was happening in a venue, it would just ask a broker to reprogram its algo to remove that destination. To date, to protect itself, Franklin Templeton has limited the use of algos it thinks are prone to leakage.

"The algos that access those venues where we think there is a lot of leakage, we can just turn those destinations off," Lewis explained. "I need to get more data before I start doing that."

(c) 2011 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/