Philadelphia native Gordon Gary drags himself from his slumber every working day at 2:30 a.m. The first phase of his trading day begins in the dark at his Chestnut Hill home. Before dawn he is checking European stocks he’ll be trading that day. Gary looks for news on these stocks, plus, who has been active and who is indicating a trading interest. As head of Philadelphia International Advisors’ (PIA) trading, Gary has the global markets covered, along with his colleague Anthony D’Amore. Gary covers the U.K. and the rest of Europe; D’Amore has Asia. Wrap trading is run by Brian Penhale.

Gary also scans D’Amore’s overnight report, which gives him and the firm’s seven analysts market color and stock-specific news. After getting a read on Europe’s open, he typically gets another 40 minutes of shuteye before getting to work at 6:45 a.m. That extra sleep didn’t happen last August and September. Fears of European sovereign debt defaults roiled world markets. “Europe was driving the bus more than following,” said the 32-year-old Gary.

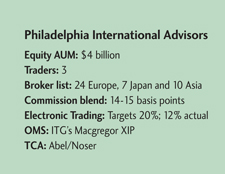

He began as an intern at Glenmede Trust. He then landed a full-time job there in portfolio administration after graduating in 2001. Six months later, PIA spun out. Prior to creating a trading desk in 2004, Gary was a liaison to Glenmede’s trading desk, which executed PIA’s orders. Once the desk started, Gary spent three years trading Asia. Since 2007, he’s traded Europe and was named head trader in 2010. Today PIA has $4 billion invested in foreign equities, with about 75 percent coming from institutional investors.

Gary has seen the difference that brokerage makes in a manager’s performance. He cited the advantage of trading in local market hours. This is a contrast with earlier in his career, when firms parked an order with a sellside desk overnight-and prayed.

Out of the 24 firms that PIA trades with in Europe, six are bulge bracket firms. The rest either have a region or sector specialty. Of those 24 firms, he deals with five desks in New York; the others are in London. “Establishing those relationships on the ground floor has been invaluable to us at times,” Gary said. “It’s not just the sales traders who know who’s been active, but also the sector traders, too, who’ve been watching these stocks for years and know what’s going on outside the general news flow.”

Gary’s afternoons are more administrative than trading. Before his day in the office ends at about 4:30 p.m., he’ll spend his afternoons working with marketing or the firm’s analysts and portfolio managers, once Europe closes at midday. But in a connected world, the work never actually stops. The next day’s orders arrive from portfolio managers at about 5:30 p.m. That’s roughly 90 minutes before Japan opens.

Soon Gary will be back at home. Soon it will be time to plan another trading day.

(c) 2012 Traders Magazine and SourceMedia, Inc. All Rights Reserved.

http://www.tradersmagazine.com http://www.sourcemedia.com/