UBS is partially pulling out of the U.S. options trading business.

According to a recent report by the Wall Street Journal, the Swiss bank is exiting the automated options market making business. However, the firm will continue other aspects of its options trading business.

The move came as the bank looks to boost profitability and trim its trading business lines. The bank has already left the fixed-income trading business and commodities trading.

The Swiss bank has contacted clients and options exchanges in the U.S. this week to notify them of the change, the Journal quoted.

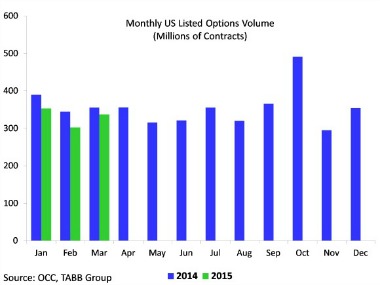

Options volumes have trended lower this year; according to data from the Options Clearing Corp. Exchange-listed options volume in March fell 5 percent from a year ago while average daily options volume has fallen 9 percent from a year ago. However, market consultancy Tabb Group reported that U.S. listed options volumes came in at 337.0 million contracts for March, up from last month’s 302.5 million contracts, according to the Tabb Options Liquidity Matrix. During March, MIAX and BATS delivered triple digit volume growth rates compared to March 2014 levels, according the consultancy.

Also, BATS Global Markets has announced they are opening a second U.S options marketplace, EDGX Options. According to BATS, EDGX Options will be based on a customer priority/pro rata allocation model. The new exchange will complement the BZX Options exchange, BATS’ first options market (previously called BATS Options), which is a price-time priority market.

The target date for the opening of the newest BATS marketplace is November 2015, pending SEC approval.

The launch of EDGX Options will enable BATS to compete for a new segment of order flow that does not trade on the price-time markets that BATS currently operates, the exchange said in a release.

The move out of the options market making business follows a shake-up at UBS’s equities division. Traders reported that the firm hired Chris Leone and Dushyant Chadha as co-heads of its Americas equities group to jump start the bank’s trading business which has been in disarray of late. Last year, the firm also brought on Roger Naylor and Robert Karofsky as its global equities co-heads last September.