Trading in U.S. futures hit 3.1 billion shares in 2014, according to Tabb Group.

Matt Simon, principal and head of futures research at Tabb Group, said with derivatives exchanges having reported their futures volumes for the full year 2014, there are some interesting trends to observe from last year and might occur in 2015 such as single digit trading growth.

“As investors increasingly adopt futures products as part of their investment strategies, dealing in futures markets reflects ongoing economic change and market structure developments,” Simon said.

He also said that the futures markets will continue to serve as a primary mechanism for investors to hedge investments and speculate on niche parts of the industry. Across the different asset classes, end users will maintain different objectives, with interest rate, equity and energy markets all showing good promises for better and more consistent volumes in 2015.

“The influence of product adoption, futurization of the traditional fixed income business, and energy market development all will be among the factors contributing to what will be another record year for the futures markets,” he added.

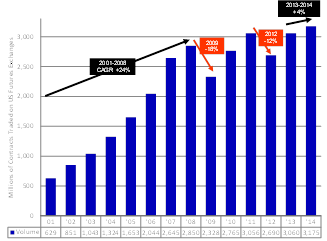

For 2014, reported volume topped 3.1 billion contracts, an increase of 3.7 percent over 2013. Simon said that volume was rockier and less predictable than in the past, however, with some months (including October and December) reporting significantly better volumes than other months.

In addition, when comparing recent volume growth to before the financial crisis, there is a noticeable slowdown. Between 2001 and 2008, Tabb Group noted that volumes increased in excess of 20 percent per year, with a couple of years topping 30 percent growth.

“On the positive side, this year’s single-digit volume growth is more promising than 2009 or 2012, when volumes reported were down (18%) and (12%), respectively,” Simon noted.

Interest rate futures.

Primarily responsible for the latest growth, the number of interest rate futures contracts traded in 2014 is up more than 16 percent. Even with interest rates at near-zero levels during most of 2014, interest rate trading activities picked up toward the end of the year and compensated for weaker volumes throughout the rest of the year. Investors expressed trading interest in the Eurodollar contract and standard bond futures, both of which reported significant volume upswings during Q4 2014. The use of these popular instruments, along with investor demand gravitating toward them during critical moments in 2014, illustrates the potential demand for interest rate products given any type of announcement by the Federal Reserve or interest rate volatility.

Interestingly, interest rate futures volume also continues to represent more than 2x the next most actively traded product type (equities). Going forward, the volume separation between interest rate products and the rest of the field is expected only to increase as interest rate volatility picks up again in 2015. With significant trading fees at stake for providers, product selection – including the futurization of the traditional fixed income business – will remain a popular topic for brokers and exchanges during 2015.

Equity and equity-index products.

In equity and equity-index products, volume reported is up 2% year-over-year. This must have been a disappointing level for futures exchanges and brokers in a year when the S&P 500 index gained 13%. Both brokers and exchanges also continued to struggle to find ways to monetize the equity business following lower margins and higher costs associated with supporting electronic trading developments. Going forward, profit margins will need to be assessed through either pricing increases or through new tangential revenue based on capturing market share via other parts of the business.

Another underdeveloped area for providers is the concentration of volumes in only a few well-known equity-related products (E-mini S&P 500 Index futures represent 62% of equity futures volumes). Yet, as firms look to adopt products that help managers benchmark and run passive investment strategies, they will become attuned to different product alternatives. With equity-linked market exposure required, market participants can expect a wider range of futures products (including volatility futures) to show better liquidity profiles.