Two newcomers are establishing themselves in the wholesaling business.

Two Sigma Securities, the broker-dealer unit of the quantitative hedge fund Two Sigma Investments, and Goldman Sachs are starting to win customers away from the established wholesalers. Both firms have seen their shares of retail brokerage orders grow since last August.

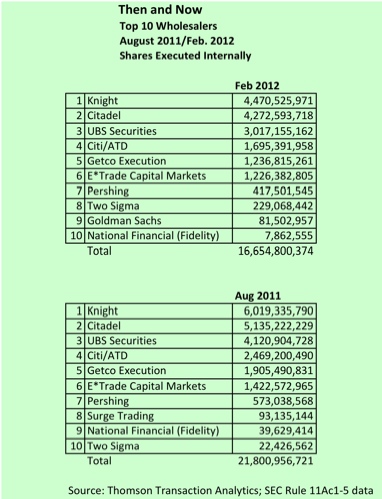

That was when Surge Trading shut its doors and Two Sigma jumped into the game. Together, in February, according to statistics provided by Thomson Transaction Analytics, they accounted for about two percent of the business, up from less than a percent last August.

For its part, Goldman is betting that its dark pool Sigma X, where trades are typically done at the midpoint of the bid-ask spread, is the key to success. “One of our biggest competitive advantages is having a diverse pool of liquidity to potentially match against retail flow,” Greg Tusar, Goldman’s head of electronic trading, said at a recent industry conference. “We have a very large pool of natural buyers and sellers that are generally willing to pay mid.”

Orders filled at the midpoint of the spread are considered to be “price improved” as the buyer pays a lower price than the quoted offer and the seller receives a higher price than the quoted bid. Price improvement is key service provided by wholesalers.

Despite their progress, the two firms face stiff competition. The bulk of retail flow sent to wholesalers, as measured by the Securities and Exchange Commission’s Rule 11Ac1-5 statistics, is still captured by the major firms (see table). The largest, Knight Capital Group, executed 4.5 billion shares internally in February, followed closely by Citadel Derivatives.

Two Sigma, however, has come out of nowhere, filling about 229 million shares in February, or nearly every share it was sent, according to Thomson. It also offered one of the highest levels of price improvement-81 percent of all shares. That’s second only to E*Trade.

Two Sigma Securities was formed in 2008 by the statistical arbitrage hedge fund Two Sigma Investments. The move is similar to that of Citadel Investments, the giant hedge fund, which formed its wholesaler unit about five years ago.

Two Sigma Securities is run by Kevin Farley, Michael Stupay, and Dave Weisberger, according to regulatory reports. Farley and Weisberger are both former employees of Citigroup’s equities division. Weisberger spent 12 years at Citi, involved in many aspects of electronic trading. Farley handled compliance for the equities trading department. Both joined Two Sigma in 2009.

Two Sigma also brought electronic trading veteran Simon Spenser on board last year. Spenser joined after a six-year spate at D.E. Shaw, and, before that, seven years with Knight.

An ex-Knight executive is leading the wholesaling drive at Goldman Sachs as well. Joe Valenza spent two years with Surge Trading as head of broker-dealer sales before the firm failed last year. He joined Goldman last spring in a similar role.

Goldman is one of three institutional shops to try their hand at wholesaling in recent years. Credit Suisse has had a program targeting retail brokers for a few years. Cantor Fitzgerald launched its initiative this year. It also tapped an ex-Knight executive-Jim Smyth-to head up its broker-dealer efforts.