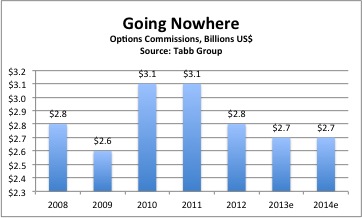

Despite healthy growth in volume, commissions paid to brokers for options trades are expected to remain flat for the next two years. That’s the prognosis from a new report by Tabb Group.

The research house sees volume in options contracts rising by 6 percent this year and next, but total commissions will decline slightly to $2.7 billion in both those years. In 2012, commissions were $2.8 billion.

Behind the decline in total commissions is a decline in the average rate paid by the buyside for options trading services. The biggest drop is for electronic trades. The buyside is expected to pay 64 cents per contract, on average, for electronic trades in 2013. That’s down 18 percent from last year when the average rate was 78 cents, according to Tabb.

For high-touch, or voice, trades the trend is similar, although the decline is milder. Last year, the buyside paid $2.56 per contract for high-touch trades of options selling for more than $1. This year, Tabb says they are paying $2.36. That’s a decline of 7.8 percent.

For options trading for less than $1, the buyside is paying $0.99 per contract. That’s down from $1.08 in 2012, or a decline of 8.3 percent.

A more competitive environment accounts for much of the decline, according to Tabb. Brokers are tiering their rates, offering discounts to high volume traders. Plus, agency and inter-dealer brokers are challenging the full-service houses by offering steep discounts on trades by as much as 50 percent, Tabb noted.