Execution rates on global equity trades have declined significantly in 2018 as markets began to feel the impact of MiFID II.

MiFID IIs separation of execution commissions and research payment has brought new scrutiny on trade costs, and many asset managers have responded by both negotiating lower commission rates with brokers and increasing their activity in lower-cost electronic trading.

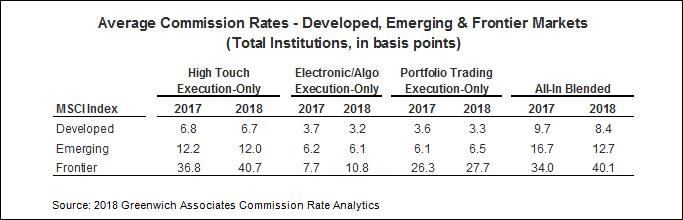

The decrease in rates, coupled with a global shift from high-touch to electronic trading, lowered weighted All-In Blended rates across markets, says Greenwich Associates Director and Institutional Relationship Manager Will Llamas. Understandably, the largest decreases were seen from fund managers that fall under the purview of MiFID II and have become globally compliant across regions.

With the brighter spotlight on fees, investment managers are actively analyzing their global commission rate structure to identify markets where their cost-per-trade is higher than their peers. This has created a pressing need for reliable data on rates.

Greenwich Associates Global Commission Analytics is the premier benchmark in this market.Hundreds of global investment managers are using the latest Global Commission Analytics as hard-data to compare their rates in negotiations with their sell-side counterparties. Close to 90% of managers who have used the Global Equities Commission Rate Analytics in these negotiations, have been able to successfully lower their rates.