The Tick Size Pilot Program has resulted in increased liquidity for included small-cap stocks-but that comes at a price.

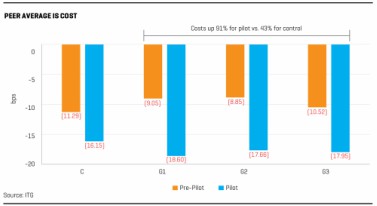

ITGs analysis, which draws on its proprietary Global Peer database of tick pilot trading by more than 100 institutional investors, finds that trading costs since the pilot launched in October 2016 are almost 50% higher,on average, compared with the control group. Costs for the control group are up 43% since the start of the tick pilot due to changing market conditions, but costs for Groups 1 through 3 in the pilot are up far more – an average of 91% since the start of the pilot (Chart 1).

With the Tick Pilot Test Groups accounting for about 4% of U.S. trading volume, this dramatic cost increase can put a drag on trading performance.

Here are some suggestions for managing the impact of the Tick Pilot on a trading P&L:

Favor algorithms with effective passive routing strategies; many brokers are struggling to execute passively.

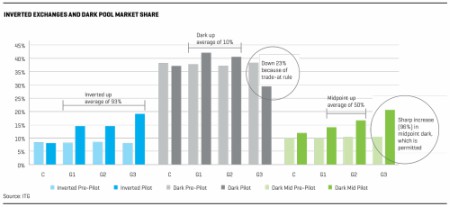

Increase routing to inverted pricing (i.e., taker-maker) venues. One of the main changes we have seen in tick pilot stocks is a big increase in inverted venue usage, up almost 65% for the Test Groups (Figure 2). This is primarily because of large queues on the NBBO.

Avoid liquidity-seeking algorithms that dont post and only cross the spread.With wider spreads and higher costs, these algorithms are more expensive, as there are not opportunities to trade with narrow spreads.

We recommend dark algorithms to take advantage of the increased dark liquidity in tick pilot stocks and spread savings at midpoint. Be sure your settings are set to peg midpoint.

While initial data from the tick size pilot suggest quite clearly that trading costs are higher across the board, overall the pilot has run relatively smoothly, with no major issues despite a large technology lift across the industry. Nonetheless, it is still in the early days of this experiment and we are going to continue evaluating the outcome to determine the pilots true costs and impact on market structure.