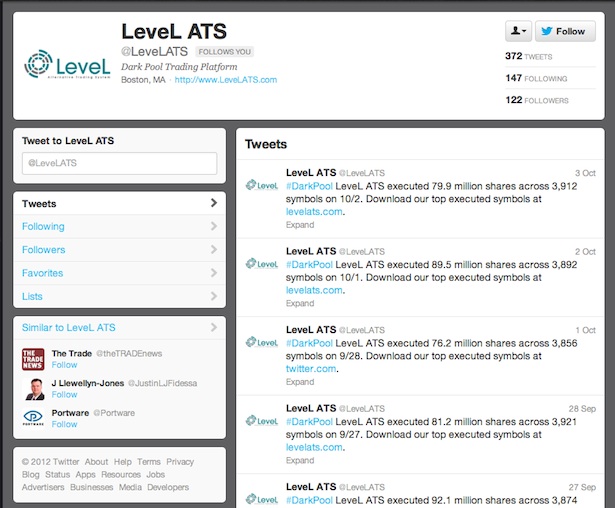

Level ATS has stopped providing daily updates on the volume of trading it handles in its dark pool.

The alternate trading system tweeted once a day about the number shares and symbols it handled each day, through the beginning of this month.

Those tweets stopped Wednesday, the day its parent, eBX, announced a settlement with the Securities and Exchange Commission on charges that Level failed to properly safeguard information in its dark pool on customers’ unexecuted orders.

The company’s chief executive, Whit Conary, did not respond Thursday or Friday to requests by phone and email for comment on how Level customers have reacted to the SEC settlement and for the statistics on trading volume on its system for Wednesday and Thursday. A Chicago communications company that represents Level, Sard Verbinen & Co., also did not respond, either day.

Level said, on its Twitter page, that it executed 79.9 million shares across 3,912 symbols on Tuesday, October 2; 89.5 million shares across 3,892 symbols on Monday, October 1; and 76.2 million shares, across 3,856 symbols on Friday, September 28.

Rosenblatt Securities, which tracks dark pools, reported this week that Level had average daily volume of 37.1 million shares in August, down from 38.4 million shares n July.

The agency brokerage’s volume statistics counts only matched shares and does not count shares at partner pools or displayed markets.