Utilizing technology for effective cash management amid a background of rising rates and economic uncertainty

By Jonathan Spirgel, Managing Director and Global Head of Cash and Liquidity Management, and Joseph Quinn, Director of Liquidity and Cash, Hazeltree

It may seem hard to believe when reading today’s headlines, but it wasn’t long ago that interest rates were nearly zero, leaving treasury managers for buy side firms in a difficult position – how do they optimize yield on cash balances, while minimizing risk?

Indeed, a whole generation of treasury managers have come of age in an environment where rates have been close to zero. From 2008-2015, the Federal Funds Rate was effectively zero; while 2016-2020 saw a brief period of hiking, rates were once again slashed to near zero in response to the COVID pandemic.

This environment provided little incentive for treasurers to overhaul cash management systems, as yields in money market funds and other equivalent short duration investments were minimal. Often, firms would opt to leave excess cash at banks or custodians, earning essentially nothing.

The traditional process of keeping track of your cash balances was also ripe for counterparty and operational risk. CFOs and other treasury managers would have to navigate a disparate set of Excel sheets and portals to get a sense of their cash balances, counterparty exposure, collateral requirements, margin calls, and more. Many CFOs lacked an easy snapshot of their cash balances and requirements in a centralized, easy to navigate location.

While the current environment of interest rate hikes presents its own challenges, it offers opportunities as well. Namely, with short duration investments now offering some form of yield, treasurers and CFOs should take this time to rethink their firms’ cash management systems to earn a return on idle cash, while reducing risk. It is against this backdrop that firms should consider investments in technology solutions to address these twin concerns.

Leaving returns on the table

All firms have different needs, and there is no one size fits all solution. For example, your typical long/short hedge fund needs to be acutely aware of margin calls and posting collateral, while other players in the space have fewer active short positions that require close monitoring.

That being said, the lowest hanging fruit at stake in today’s rising rates environment is earning additional returns on your excess cash balances. With your standard bank or custodian netting zero yield, firms are leaving cash on the table by not effectively investing excess cash balances in a money market fund, or similar short duration investment vehicle.

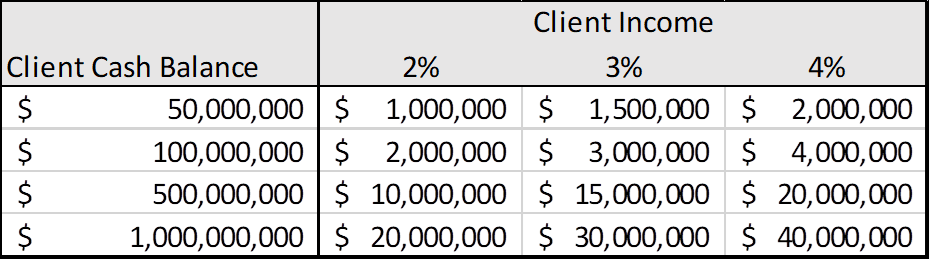

Take for example, a very simple analysis of returns a firm can earn by investing cash at different rates and amounts, when compared to a bank or custodian.

At the low end of the spectrum, a firm with a client cash balance of $50,000,000, in an investment vehicle with a yield of 2%, would earn an additional $1,000,000. Of course, this is a very simplified scenario, and other concerns would impact actual income, but the point remains – by not investing in the tools to help your firm optimize excess cash, you are leaving money on the table.

Additionally, while seemingly obvious, making sure these investments are liquid is of paramount importance. CFOs need to be prepared to meet short term cash obligations; one popular investment vehicle CFOs consider are money market funds. Technology can automatically direct excess cash into the firm’s preferred money market funds, and assist with cash withdrawals, when needed.

Technology as a risk mitigation tool

More difficult to quantify, but equally important, is the role cash management technology plays in minimizing risk. There are many risks to consider as a CFO or treasury manager, but two predominant concerns come to mind: counterparty risk and operational risk.

For counterparty risk, certain high-profile market events, such as the crash of Lehman Brothers and Bear Stearns, have made counterparty risk top of mind for treasurers. Through sweeps of excess cash balances with one counterparty, technology can optimize the process of diversifying your counterparties.

Additionally, ineffective cash management systems heighten operational risk. By cutting down on paper and spreadsheets, and consolidating information in one place, technology helps firms meet margin calls and post collateral in a timely and compliant fashion.

By automating these processes, a CFOs life is made easier, freeing up their bandwidth to focus on other initiatives.

How can treasurers, CFOs, and other streamline this process?

This raises the question – what are the steps treasurers, CFOs, and others should undertake to streamline this process? In short, it depends; however, it all begins with the firm’s own guidelines within their treasury department or function, and an honest assessment of what they can accomplish with the resources they have available to them.

In some cases, there may be simple changes that firms can implement to take advantage of changes in the liquidity landscape. Other firms, whose treasury departments are under-resourced, may require a third party who can assist with an assessment of current processes and systems, and help them organize, streamline, or implement new systems as needed.

While there is no general timeline for how long it would take to implement or tweak the technology used in a firm’s cash management system, the sooner a CFO or treasurer begins considering these questions, the better. The broader interest rate environment is constantly evolving, and firms who drag their feet may be missing out on the opportunity to earn additional income while at the same time reducing risk.

Any investment made in technology in a volatile macro environment comes with a conversation scrutinizing the costs and benefits. However, improving risk management and efficiency – knowing where your cash is, how quickly you can access it, making certain it can get to where it is required, while having the workflow and approvals handled within the firms’ guidelines – is a conversation worth having for a treasurer. Today’s interest rates make such technology investments potentially more valuable than ever.