Top Technology Trends for Capital Markets, 2021

For capital markets entities, 2021 could be “do or die” when it comes to business model decisions. Technology investment decisions must focus on supporting a clear business model and the culture must change.

By Monica Summerville, Head of Capital Markets, Celent

Senior executives within capital markets, like most people, are hoping for a return to normalcy in 2021, but know that their world will never be the same. Technology is now more closely entwined in the business of capital markets than ever before. COVID-19 accelerated the digital and cloud transformation that had already begun for financial institutions (FIs) and market infrastructures (MIs). Entities that had already migrated their application, infrastructure and/or delivery models to the cloud could rapidly shift to the work from home (WFH) model. Yet the challenges of legacy systems and regulation persists; the day of reckoning is coming in 2021.

According to a survey of trading leaders conducted by Celent, 90% of the biggest drivers of change in the trading businesses are technology and regulation. As senior executives from both business and technology divisions look to ride the momentum of digitization and mobile services deployment, and accept that the rapid rate of regulatory change is set to continue, significant changes to technology strategy must be made. The technology estate delivery model and organizational mindset must evolve.

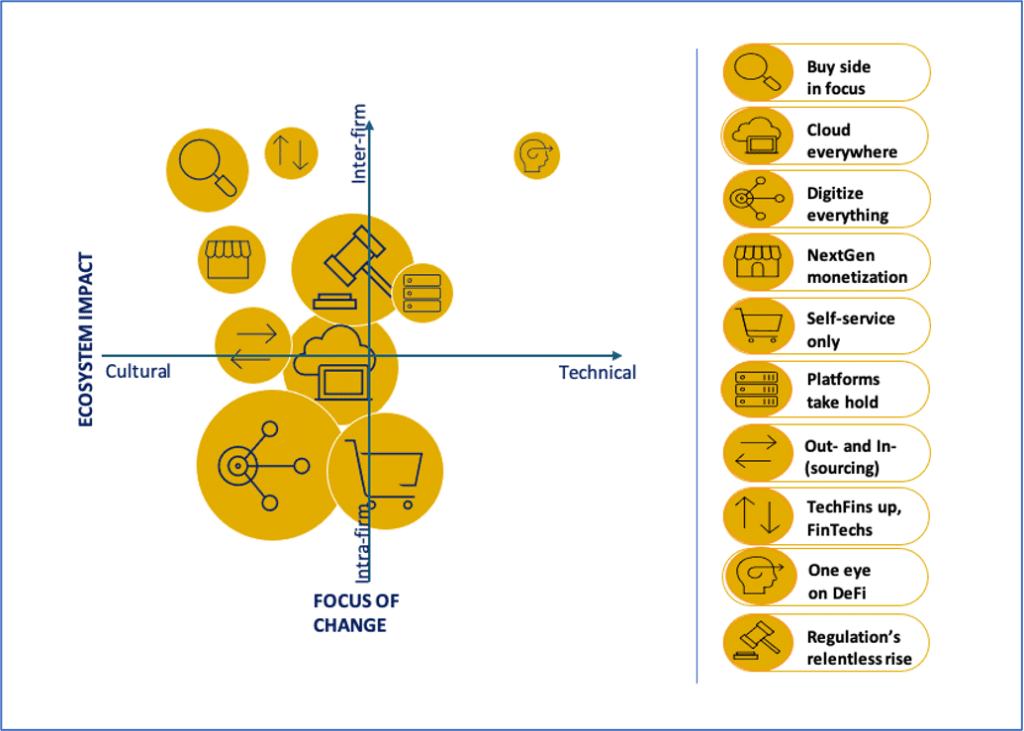

In 2021, as financial entities decide on short-to-medium term business strategy, technology investment decisions will hinge on multiple considerations. What will provide the greatest impact, at both inter- and intra-firm levels? What will best address each entity’s technical state and organizational culture?

Converging Technologies

The prevailing trend is that financial entities will focus technology resources to leverage core competencies, create value differentiators, and work with partners or outsourcers for commodity activities. Among the multiple shapes this will take:

- Buy side: Increasingly, the buy side is taking more control of its technology and buying data, technology solutions, and/or platforms. As the range of entities looking to provide solutions to the buy side widens, the sell side realizes it must increase its investment in understanding their buy side clients to keep them coming back.

- Digitization: As everything is digitized, senior management must address the organization’s approach to data. Crucial to the implementation of key technologies will be: defining the business’ idea of success in the digital world; the impact of integration (or lack thereof) across front, middle, and back offices; and how to identify and leverage data in order to be competitive. The success of artificial intelligence (AI), APIs, blockchain/distributed ledger technology (DLT), cloud, data management, microservices, and other technologies all rely on clear goals—and a willingness to transform the organization’s culture and structure (such as the elimination of data silos) to support new solutions. Caution around technical debt, the consequence of poor or rushed development decisions, is also critical.

- Outsourcing & Insourcing: Many asset managers are looking to outsource everything, including trading desks, data management, foreign exchange, and middle office functions. Both the buy and sell side are considering outsourcing portfolio/pricing analytics or outsourced services for noncore/nonstrategic client services. Smaller dealers may look to technology partnerships for access to particular technologies and skills. For asset owners, however, insourcing may grow, as the volatility of COVID-19 highlighted the need to insource (manage) assets in-house and ensure adequate, secure communications infrastructures.

- Platforms: Platforms in financial services can help FIs rationalize their architectures and vendor estates. In 2021, the open platform-as-a-service (PaaS) and monetization projects (such as data-as-a-service platform) are those to watch most closely. The key word is “open.” The new paradigm is to buy, then build: buy an open platform with best-of-breed plug-in components in order to meet 80% of your needs, then utilize open standards and low code development methodologies to allow both technologists and business users to build the required remaining customizations. The involvement of non-technology staff in building solutions is a key trend for 2021.

Cloud in Capital Markets

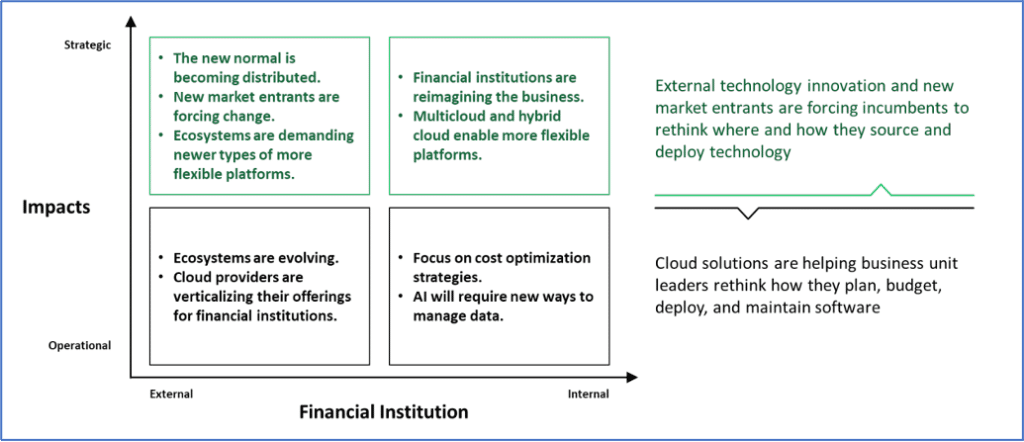

Uniting many tech trends is the move to cloud. In short: cloud is everywhere. For the capital markets industry, cloud-native approaches and deployments are well underway. Cloud is advancing in the front office, where trading system providers and market data vendors offer solutions based on cloud deployment models. But that’s far from the only progress cloud is making in the capital markets space.

Cloud’s enabling technology—paired with emerging technologies like intelligent automation, data management, DLT, low-code/no code, modern APIs, and open source—helps create ecosystems with minimal financial commitment and low continuing overheads. Cloud offers scale, massive compute, the latest AI, and enhanced data analytics.

To make the most out of cloud, FIs are now becoming cloud-first, which means thinking, coding, and partnering in cloud-native ways. In 2021, the predominant deployment models for capital markets will be hybrid cloud (with a mix of on-premises and externally hosted clouds) and multi-cloud (leveraging different cloud solution providers for unique cloud services offerings).

Cloud-enabled FIs embrace DevOps and continuous delivery methodologies, with IT operations and software development units collaborating to automate software delivery and infrastructure changes. One of the main goals here is to support a rapid release cycle that’s more responsive to customers and market needs. New technologies (including containers, container orchestration, microservices, and modern HTTP APIs) support the process of building applications as independent services. This offers business users a more flexible and cost efficient technology estate; services can be reused across the enterprise improving time to market and changes can be made without impacting production systems, which promotes innovation.

Sector- and service-specific financial services clouds (such as Salesforce Financial Services Cloud for wealth services and IBM Cloud for Financial Services for security/compliance) are also on the rise. Financial extranets (such as Colt’s PrizmNet, DXC’s Fixnetix, and IPC System’s Connexus Cloud) provide managed services and data and venue connectivity specific to capital markets firms, with extremely low latency connections that support transactions and compliance/regulatory requirements.

Meanwhile, while FinTechs are focusing on shoring up funding and facing even longer sales cycles in capital markets, TechFins—the Big Tech firms that are moving into finance (including Alibaba, Amazon, Apple, Baidu, Facebook, and Google)—are also on the rise. Those offering public cloud services are well-situated to expand capital markets offerings, either working in partnership with capital markets incumbent firms or independently, as the industry’s cloud adoption accelerates. TechFins have established client bases, are free from the problems of legacy technologies, have proven track records with emerging technologies and data handling, and vast investment capital which can ease entry into new markets such as this.

Finally, while Bitcoin’s impressive price rise has gotten headlines, institutional adoption of digital assets has been steadily increasing for some time. The term “decentralized finance,” or DeFi for short, is one all financial executives will become familiar with. Whether decentralized exchanges (DEXs), stablecoins, or new end-to-end replacements for wholesale financial intuitions, this is a movement with growing momentum—partly thanks to the recent rise in cryptocurrencies’ value—with extensive capital behind it. Incumbent financial entities are entering this market to compete with well-established native digital asset players. This is the year for every FI to add DeFI to its strategy and innovation vocabulary.

Investing in Infrastructure

The past year brought some of the most volatile trading days on record. Capital markets entities adapted. Challenges of the pandemic accelerated the industry’s commitment to digital transformation, highlighting the ways in which flexible technology infrastructures can provide significant benefits. Now is the time to not only reflect on how agility can provide a competitive advantage, but to carefully consider how to invest in the technologies that support it.