Last year was a tipping point for mainstream institutional investors entering digital currencies markets, with Bitcoin leading the way, according to a report from Citi GPS.

Citi Global Perspectives & Solutions said in a report, Bitcoin: At the Tipping Point, that they first wrote about digital currencies in 2014 when Bitcoin was five years old and had a market value of around $6.2bn (€5.2bn). At that time they assessed Bitcoin as a ‘wannabe asset’ and a ‘wannabe means of transaction.’

The new report said: “Not only has Bitcoin increased in usage and value (hitting $1 trillion in market capitalization in February 2021), but it has created a whole ecosystem around it — including crypto exchanges, crypto banks, and new offerings into savings, lending, and borrowing. In a search for yield and alternative assets, investors are drawn to Bitcoin’s inflation hedging properties and it is recognized as a source of ‘digital gold’ due to its finite supply.”

Indications of increased institutional activity in Bitcoin include open interest in CME Group’s Bitcoin futures which grew by more than 250% between October 2020 and January 2021. At the end of last year, the CME’s open interest for Bitcoin futures stood at $1.66bn, accounting for 18.1% of the total global open interest. The exchange also offers options on Bitcoin futures and launched Ethereum futures last month.

In addition, the holding period for Bitcoin has increased across periods of one to five years, ranging from over 50% for a holding period of at least one year to over 10% of Bitcoin being held for five years or longer highlighting that Bitcoin is no longer seen simply as a short-term speculative play but as a long-term portfolio diversification tool and macro hedge.

Citi GPS also said Bitcoin is also evolving as the ‘North Star’ in the digital asset space and is a compass for the evolution of a broader ecosystem of crypto commerce and pressure is building for central banks to consider their own digital currency options.

The bank said that in seven years Bitcoin could become the currency of choice for international trade due to its global reach, neutrality and its role in global payments, including its decentralized design, lack of foreign exchange exposure, fast (and potentially cheaper) money movements, secure payment channels, and traceability. However there are risks and obstacles such as concerns over capital efficiency, insurance and custody, security, and environmental, social and governance considerations from Bitcoin mining.

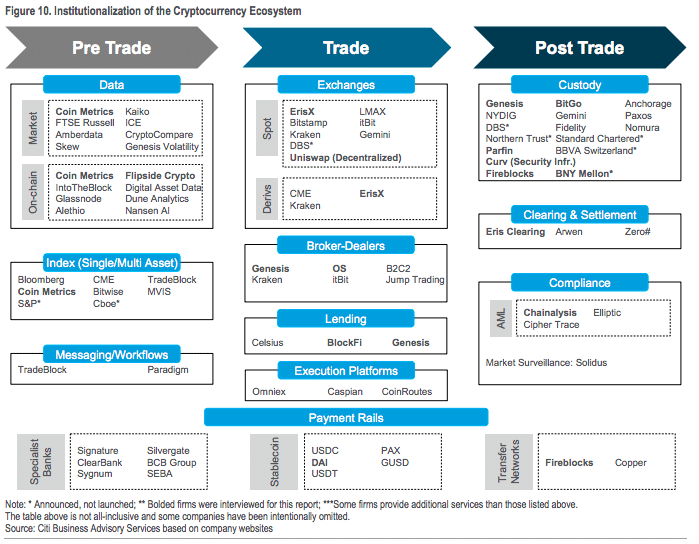

Exchanges

Cryptocurrency exchanges that were vulnerable to technology disruptions and liquidity concerns in 2017 have become more secure, can stream their prices via APIs, have introduced a broad set of risk and analytic tools, and offer specialized algorithms to improve execution said the report.

The study highlighted that a small number of crypto exchanges have sought differentiation by aligning to institutional grade requirements. They are pursuing regulatory licensing, improving their governance with enhanced risk and control procedures, forging greater connectivity to the off-chain banking system, and upgrading their technology infrastructures.

“LMAX, a leading foreign exchange trading venue, launched an institutional-only crypto exchange in 2018 and Development Bank of Singapore (DBS) announced plans for a crypto exchange in late 2020,” said Citi GPS.

David Mercer, chief executive of LMAX Group, told Markets Media that the crypto exchange has industrial infrastructure and more than 400 institutional customers. He continued that the clients include approximately 35 banks, who have all become more interested in crypto trading.

“Three years ago there was zero interest from the banks in crypto trading and now one third take crypto market data from us,” he added. “I expect two to three major banks to be trading crypto with us by the end of this year.”

Mercer predicted that the number of banks trading crypto on LMAX Digital will be in double digits in three years time.

The ecosystem for institutions expanded last month when Cobalt, a provider of risk and settlement infrastructure, announced a partnership with EPAM System to provide providing connectivity to digital asset exchanges and market makers with the first institutional-grade FIX gateway for the digital asset markets. The FIX protocol is a standardised messaging system used by institutions to automate trading of securities, derivative, and other financial instruments.

Adrian Patten, chairman and co-founder of Cobalt, told Markets Media: “The infrastructure in crypto is bad, maybe worse, than in FX.”

He continued that most crypto exchanges do not have FIX APIs which is necessary for institutions. The FIX protocol, for example, includes acknowledgment of messages which prevents lost orders.

Patten added that Cobalt partnered with EPAM as they provide connectivity to more than 50 digital asset exchanges and market makers, as well as an excellent matching engine and order routing.

“We can uniquely offer the total technology stack out of the box for institutions to start trading digital assets,” Patten said. “Our services include pre-trade credit checks, distribution of trading limits and settlement.”

Patten agreed that institutional interest was growing.

“We have engaged with more digital asset firms this year than we did in the whole of last year,” he said.

Ilya Gorelik, vice president at Real-Time Computing Lab at EPAM, said in a statement: “The combination of our time-tested software and experience of institutional trading firms with Cobalt’s post-trade FX services should set a new standard for trading in FX and digital assets”.

Ecosystem growth

Over-the-counter trading desks are facilitating larger order sizes and derivatives are gaining open interest. In addition prime brokerage offerings are providing best execution services and margin financing, while third-party custody solutions are creating viable options for safekeeping and are obtaining insurance to protect against loss and theft of assets said Citi GPS

Growing confidence in crypto custody capabilities is also being led by the entry of established industry participants. Last year traditional custodians Northern Trust, Bank of New York Mellon, Nomura, Standard Chartered, BBVA, and DBS have said they will enter the digital asset space.

Anton Katz, founder and chief executive of Talos, which provides an institutional-grade technology infrastructure that supports the full lifecycle of digital assets trading, said financial institutions like BNY Mellon are responding to client demand. He continued that over the past nine months the sentiment has rapidly changed from “the institutions are coming” to “the institutions are here.”

“At Talos, we’ve seen tremendous growth in both overall usage and inbound requests from institutions looking to provide end-to-end trade lifecycle support for digital assets to their clientele.” Katz added. “It was only a matter of time before the larger financial institutions entered the market, and we’re extremely excited about this next phase of digital assets evolution.”

In addition regulators are starting to offer guidance, and in some jurisdictions, register and license cryptocurrency participants while pressure is growing for governments to issue their own digital currencies. Citi GPS said a recent study of 60 central banks by the Bank of International Settlements found that 86% indicated they were engaged in some work on central bank digital currencies and 60% were either running experiments or proofs of concept.

“If these efforts progress to the actual issuance of central bank-backed digital currency, blockchain would become a mainstream offering,” added Citi GPS. “Connectivity between the traditional fiat currency economy, public cryptocurrency networks, and private stablecoin communities would become fully enabled.”

The bank continued that in this scenario, Bitcoin may be optimally positioned to become the preferred currency for global trade as it is immune from both fiscal and monetary policy, avoids the need for cross-border foreign exchange transactions, enables near instantaneous payments, and eliminates concerns about defaults or cancellations as the coins must be in the payer’s wallet before the transaction is initiated.