Do You Own any Stocks?

A Gallup poll shows that following the so-called “Great Recession,” fewer Americans invest in the stock market, dropping on average from 62% in 2001–2008, to 54% in 2009–2017. The decline was greatest among younger Americans, who have the longest time horizon to make up any market losses.

If you owned stock during the “Great Recession,” you may well have concluded that owning stocks is hazardous for your financial health. However, if you look in the long term, nothing could be further from the truth, and if you hold only cash, you may as well burn your money!

Ben Le Fort published an article about the riskiest things people do with their retirement money. Among his many excellent points, Le Fort states that, “The longer the time horizon the less you need to worry about investment risk and the more you need to worry about opportunity cost.”

Personally, not only do I agree with that sentiment, but I’d go further and say that most people in most situations should seriously consider investing in stocks, even 100% of their portfolios. Of course there are situations when it doesn’t make sense to take on investment risk like that, but IMO those are the exception, not the rule.

If you owned stock during the “Great Recession,” you may well have concluded that owning stocks is hazardous for your financial health. However, if you look in the long term, nothing could be further from the truth!

What Do the Data Say about the Risk of Investing in Stocks?

Considered by many as the “father of value investing,” Benjamin Graham said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” In other words, in the short term, you have to guess which stocks will go up, or at least if the market as a whole will. However, in the long term, the economy tends to grow, so on average the stock market will go up.

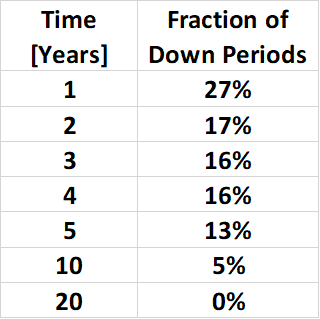

Looking at annual returns of the S&P 500 index (with dividends reinvested) from 1926 to 2018, we see that the market lost money in just a bit more than a quarter of years. As you increase the time period length, the fraction of losing periods drops to about 1 in 8 for 5 years, 1 in 20 for 10 years, and none at all for rolling 20-year periods.

Stock market losses are less frequent for longer investment periods

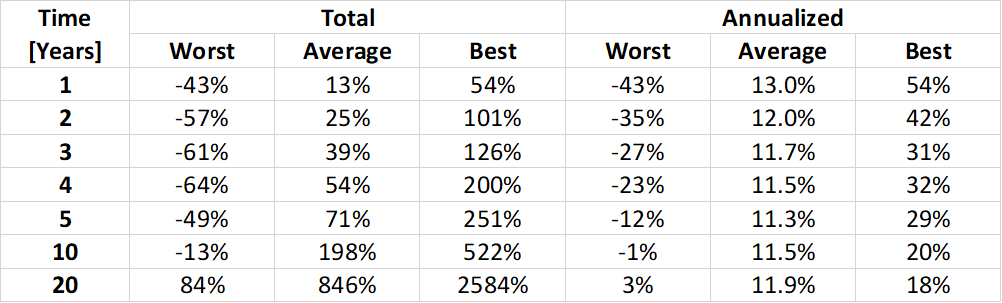

If you’re planning to spend the money right after the period in question, you’d be justified in considering the maximum loss possible too. In that regard, the worst one-year loss was 43%, and the worst-case total loss increases as you look at longer periods until you start dropping from 4-year periods to 5- and 10-year periods. For 20-year periods, the worst case total was actually a gain of 84%!

Looking at annualized returns, each time you look at a longer period, the worst case becomes better, and the best case becomes worse. Whereas the difference for a single year is 97% (between 54% gain and 43% loss), for 5-year periods that range drops to 41%. For 20-year periods, the best-to-worst range narrows to 15%.

Over longer periods, the best- and worst-case market performance get closer to the average performance

Inflation Becomes a Real Problem in the Long Term

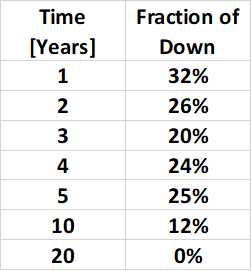

The problem with the above data is that they don’t take into account that over time, the dollar’s purchasing power tends to go down as a result of inflation. From 1926 to 2018, the dollar lost value in 7 out of every 8 years. As you look at longer periods, that fraction goes up to 100% of rolling 20-year periods.

Cash losing value is MORE frequent for longer periods

Especially if you’ve been paying attention to how tame inflation has been recently, you’d be forgiven for thinking inflation isn’t a big concern anymore in absolute terms. However, looking at the long term, it’s still a major factor.

Over the long term, inflation eats away at your money’s purchasing power for all long-enough periods of time, with a whopping 52.8% loss for the average 20-year period.

In fact, holding cash would have lost you an annualized average of 3–4% for all holding periods, with total losses growing from 3.7% for the average single year to a whopping 52.8% for the average 20-year period. That means you’d be able to buy less than half as much after holding cash for the average 20-year period! Know what the worst period for cash was like? If you had held cash from 1966 to 1985, you’d have lost more than 2/3 of its value!

Even with low average inflation, loss of purchasing power becomes significant over long enough periods

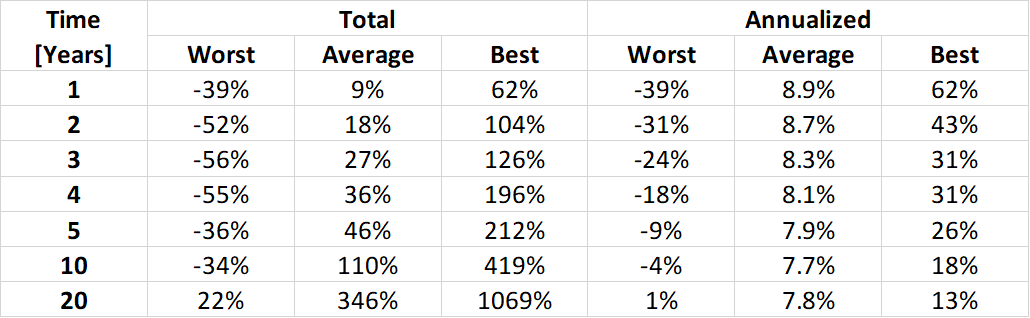

Comparing Stock Investment Risk to the Risk of Holding Cash

To figure out what stock returns really mean for you, you have to adjust returns for inflation. Doing that, we see that the worst one-year loss was 39%, For 20-year periods, the worst case total was a gain of 22%. For annualized returns, each time you look at a longer period, the worst case and best case still get closer to each other. Whereas the difference for a single year is 101% (between 62% gain and 39% loss), for 5-year periods that range drops to 35%, and for 20-year periods, the range narrows to 12%.

Even considering the Great Depression and Great Recession, the worst 20-year market performance was a total gain of 22%

Looking at how frequently the stock market loses purchasing power, we see losses about 1/3 of single years, 1/4 for rolling 5-year periods, 1/8 for 10-year periods, and not a single losing 20-year period.

Stock market losses are less frequent for longer investment periods even after adjusting for inflation

While these results are less inspiring than the pre-inflation returns, we have one last step to take, comparing them to the risk of holding cash.

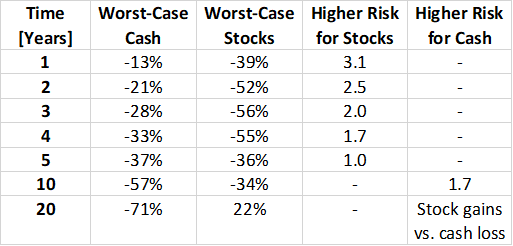

Comparing how bad worst-case inflation-adjusted losses were for stocks vs. cash, we see the loss was about 3x worse for stocks compared to cash for single years, 2.5x worse for 2-year periods, 2x worse for 3-year periods, and 1.7x worse for 4-year periods.

For 5-year periods, the worst-case inflation-adjusted loss was comparable for stocks and cash.

For 10-year periods, cash lost about 1.7x more than stocks in the worst case!

Once you hit 20-year periods, worst-case inflation-adjusted stock market returns were 22% up, compared to 72% down for cash!!!

The worst-case market performance for 10- and 20-year periods was better than the worst case of holding cash for comparable periods

The Bottom Line

Considering that the upside is far greater for stocks than for cash, it’s clear that for time horizons longer than a few years, investing in stocks is the winner compared to holding cash.

For 5-year periods, the worst-case inflation-adjusted loss was comparable for stocks and cash. For 10-year periods, cash lost about 1.7x more than stocks in the worst case! Once you hit 20-year periods, worst-case inflation-adjusted stock market returns were 22% up, compared to 72% down for cash!!!

Disclaimer from Author

This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

The views represented in this commentary are those of its author and do not reflect the opinion of Traders Magazine, Markets Media Group or its staff. Traders Magazine welcomes reader feedback on this column and on all issues relevant to the institutional trading community.