By Phil Mackintosh, Senior Economist, Nasdaq

There are many reasons for market trading volumes to increase. For example, we know from previous work that market volumes tend to be higher on index rebalance dates or when broader macroeconomic events cause an increase in trading. Triple Witching, or the expiration of multiple derivatives products simultaneously, is another key event that causes volumes to be higher than average.

What is triple witching?

On the third Friday of every month, multiple derivatives products expire, giving rise to greater than normal trading volumes. It’s commonly called “triple witching” day.

“Triple-Witching” is based on traditional, third Friday quarterly expirations of:

- Index Options: expire in the open auction;

- Index Futures: expire in the open auction;

- Single Stock Options: expire in the close auction.

That means all open derivatives need to be delivered (or at least the profit and losses for cash-settled contracts). For a market maker, at the instant that the derivatives expire, their hedge is no longer needed. In order to collapse their hedge safely, they need to close their hedge in the same auction that is used to price the derivative’s expiry. That causes a lot of trading on the expiration of the derivatives.

Why is it sometimes called “quad witch?”

Technically, when single stock futures began trading in late 2002, expiration day used to be referred to as “Quadruple Witching.” However, with the close of OneChicago in September 2020, single stock futures ceased trading, so the day is now just a “triple witching.”

However, derivatives expiry isn’t the only thing that happens on the third Friday of every third month of the quarter. To take advantage of the additional liquidity generated by triple witching, some very large indexes also schedule their quarterly (or, in Nasdaq’s case, annual) rebalances to coincide with this date. That includes:

- S&P U.S. Indexes

- FTSE Global indexes

- Nasdaq-100 (which does its annual rebalance on the third Friday in December)

As we noted before, index rebalances also add significantly to closing auction volumes. On index rebalance days, we estimated 40% of the Market-On-Close (MOC) flow was likely due to index funds, and close volumes were typically six times larger. That compares to index funds adding to around 5% of the smaller close auctions on normal days.

Given index rebalancing is at least as significant as derivatives expiries, many still refer to the date as “Quad Witch,” although the quad now refers to the impact of index trades on the close.

What time is the “witching hour?”

In short: It depends. Not all trades need to happen at the same time.

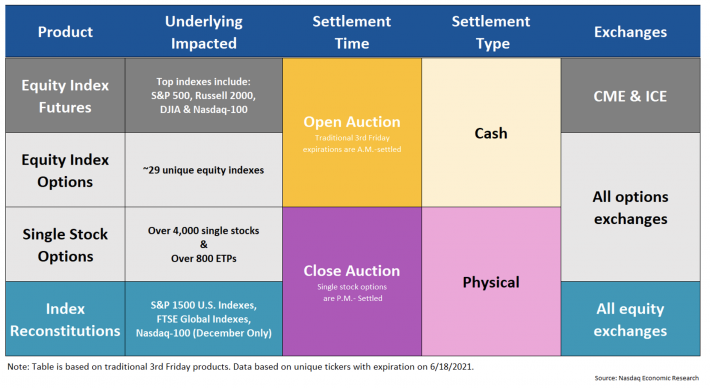

For this study, we look at traditional futures and options, which expire on the third Friday of each quarter’s final month (March, June, September and December). However, even within them:

- Single stock trades happen in the close auction (including single stock components of index rebalances), while

- Index products need to trade in the open auction. That’s important as it means opening stock auctions are all more “index weighted”—making trade imbalances less concentrated on single stocks and easier to trade at a macro level.

Importantly, not every derivative expires with the underlying stock needing to be delivered.

- Single stock options have physical delivery, meaning that those options that are exercised require one party to deliver the actual stock to the other.

- Index derivatives are “cash settled,” meaning the profit on the position needs to be settled in cash. For example, NDX options are settled with the exchange of cash, reflecting profit or loss on the business day following expiration.

However, in both cases, market makers need to “un-hedge.” In the case of physically delivered options, unexercised options hedges need to be closed. For cash-settled derivatives, the hedge needs to be closed out, which (in theory) should create a profit or loss that offsets the settlement cash flow.

Table 1 below highlights how each of the trading components on “Quad-Witch” day works:

Table 1: How triple witch expiry date works

How A.M.-settled derivatives work is interesting for a holder. The underlying equity index options and futures generally cease trading the day prior (usually a Thursday). But any investors that still hold open contracts will receive profits (through cash settlement) based on the prices set in the next morning’s open auction. That means there remains an overnight risk, but typically no way to hedge gamma (the rate of change in delta hedges required for options to be completely hedged).

How much does volume change?

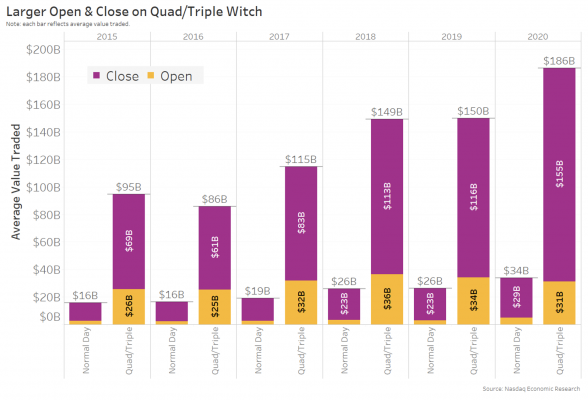

Data shows that auction volumes on triple witch dates are significantly higher than normal. As the data in Chart 1 below shows, on average:

- Open Auctions are around 10 times, or $28 billion, larger than normal.

- Close Auctions are around five times, or $80 billion, larger than normal.

The data also shows that over the past five years, the size of both witching auctions has grown. Overall, the average combined cross has been around $108 billion larger on triple witch dates.

Chart 1: Auction volumes are elevated on expiration dates

Overall, total daily share volume is also typically 44% higher on “witching” days compared to a “normal” day. We also typically see a higher lit market share due to an increase in more volume trading on-exchange in the opening and closing crosses.

Note: This doesn’t capture all derivatives

These days, there are plenty of other derivatives that expire on different dates too.

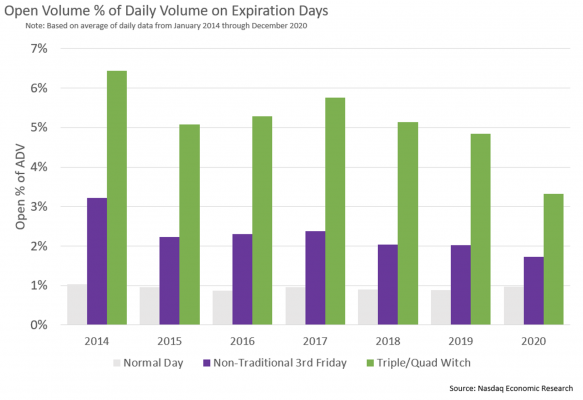

Some derivatives have monthly expiries that also settle on the third Friday (of each month). Many of those are still A.M.-settled, which still creates a noticeably larger opening auction, but still not as significant as the quarterly witching days (Chart 2).

Chart 2: Comparing opening auctions to those with quarterly and monthly expiries

There are yet others that don’t follow traditional rules. That includes Nasdaq’s weekly N-100 index option (NDXP) with expiries on all Mondays, Wednesdays, and non-traditional third Fridays (using a P.M. settlement process, even though traditional index options use opening prices for settlements).

Conclusion

Witching days are important because they set expiry prices for so many derivatives, both futures and options, as well as prices for index additions and deletions. Staying hedged (or correctly exposed) results in significant trading in the auctions.

We can’t always know whether underlying stocks will go up or down in these auctions, but we can say we consistently see much higher volumes than usual.

Robert Jankiewicz, Research Specialist for Economic Research at Nasdaq, contributed to this article.

The Powerful Impact of ‘Triple Witching’ first published on Nasdaq.