By Virtu Financial

INTRODUCTION

The conditional order type is a useful and efficient tool for sourcing block liquidity. In this paper, we seek to provide more clarity on conditional order function and the benefits in the context of a block-seeking algorithmic order.

Although conditional orders are widely used in North America and Europe for seeking block liquidity, the Asia Pacific (APAC) region has been slower to adopt. However, APAC buy-side traders are increasingly requesting that sell-side providers add the conditional order type to their order routers, leading to interesting implications for liquidity-seeking algorithms, as well as the venues that accept conditional orders.

While interest in conditional orders is growing, the order type is often misunderstood both in terms of its application and how it interacts in electronic block crossing networks. This paper explains how Virtu’s Frontier execution algorithms (1) use conditional orders, and looks at how they interact with Human Users in Virtu’s block indications network, POSIT Alert (2).

CONDITIONAL ORDER DEFINITION AND REFERENCE TERMINOLOGY

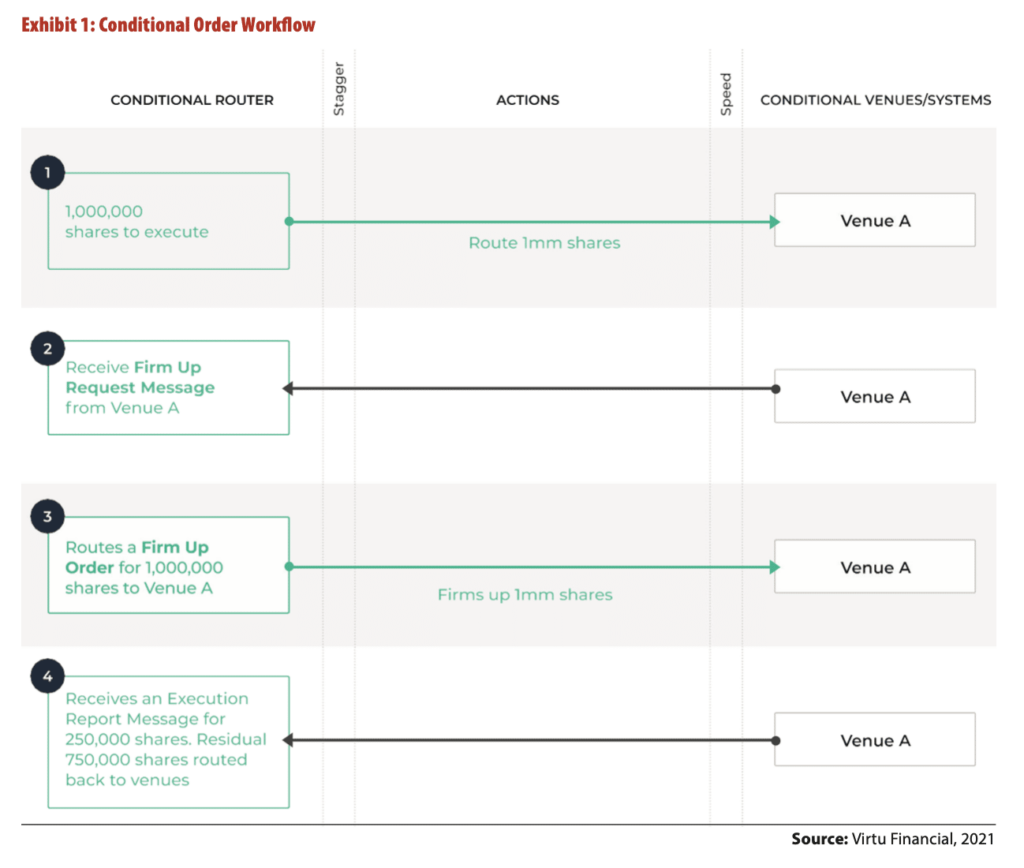

The practicality of the conditional order type is to enable an order router to submit an uncommitted order to a venue that accepts the conditional order type. The conditional order is not a firm order. If contra liquidity exists, a message is sent to the conditional order submitter, requesting to send a Firm Up order. If both parties send Firm Up orders, and the Firm Up orders are marketable with each other, a match can occur.

Conditional Order An uncommitted order that is not a firm order and will not execute. If contra liquidity exists, a message to submit a Firm Up order is sent. Conditional orders allow a user’s order to rest in full size at multiple venues.

Conditional Venue A venue that accepts or uses the conditional order type.

Firm Up Request Message A message that is sent in response to a conditional order signifying contra liquidity exists.

Firm Up Order Upon receiving a Firm Up Request message, the routing broker can send a Firm Up order to the conditional venue. The Firm Up order will contain the number of shares the user wishes to execute.

Execution Report Message In response to a Firm Up order, this message will contain execution details from the conditional venue.

Conditional Router A broker’s smart order router which includes conditional orders (in some cases brokers use both firm and conditional order types in their smart order routers).

The below conditional order terminology will be referenced throughout this paper. These terms and their associated workflows are depicted in Exhibit 1.

Exhibit 1: Conditional Order Workflow

CONDITIONAL ORDER USAGE AND QUESTIONS

The primary benefit of the conditional order type is to help solve the liquidity fragmentation problem by enabling routing brokers to rest their full-size orders at a conditional venue, while executing smaller firm orders on other venues. If a contra block order is available on the conditional venue, the conditional routing broker can cancel its outstanding firm orders and Firm Up with a block-sized quantity at the conditional venue. Conditional order types can help improve an execution algorithm’s ability to seek block liquidity and achieve larger execution sizes relative to algorithms that do not employ conditional orders.

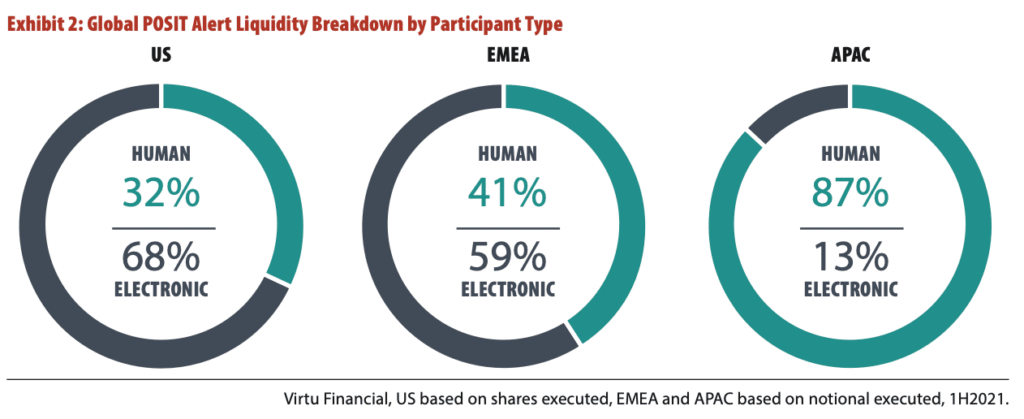

In the US and Europe, buy-side institutions have driven the growth in conditional order usage by shifting a portion of their block liquidity-seeking order flow away from blotter-scraping desktop applications, to algorithms that incorporate conditional orders. Consequently, most large broker-dealers in the US and Europe incorporate conditional orders in their order routing logic, and many venues in the US and Europe support conditional order matching. This move has resulted in a divergence in the liquidity makeup in Virtu’s POSIT Alert block indications system by region, where conditional liquidity (Electronic Users) makes up the majority of the resulting executed volume in the US and Europe, while in APAC, potential liquidity coming from the POSIT Alert desktop application users (Human Users) still makes up the majority of indications and resulting executed volume (see Exhibit 2).

Exhibit 2: Global POSIT Liquidity Alert Breakdown by Participant Type

As the level of interest in conditional orders increases in the APAC region, so have the number of questions on how conditional orders function, specifically on topics such as information leakage prior to execution. The remainder of this paper explains how conditional orders interact in Virtu’s POSIT Alert block indications system and how Virtu’s liquidity-seeking algorithms utilize conditional orders in their routing.

CONDITIONAL ORDER INTERACTION IN POSIT ALERT

POSIT Alert is one of two venues in the APAC region that currently accepts conditional orders. Conditional orders routed to POSIT Alert can interact with other conditional orders (Electronic Users) and orders originating from users who use the POSIT Alert front-end application (Human Users).

Conditional order does not interact with firm orders in POSIT. POSIT Alert accepts conditional orders in all 12 APAC markets (3) the system supports.

When POSIT Alert identifies a potential match between an Electronic User and a Human User, only the Human User is sent a message that contra liquidity is available via a pop-up window on their desktop (termed as Light Up). No information is sent to the Electronic User. The Human User is then given 30 seconds to respond to the Light Up by submitting a Firm Up order. If the Human User fails to act or declines to send a Firm Up order, then no match takes place, and the Electronic User never receives any information that a potential matching opportunity existed. If the Human User responds with a Firm Up order (by clicking the Send button), only then will the Electronic User receive a message to route a Firm Up order. The Firm Up Request message POSIT Alert sends to the Electronic User is anonymous and contains no information on the Human User’s total order size, or the size the Human user firmed up with. The Electronic User has two seconds to respond with a Firm Up order.

For potential matches between two Electronic Users, POSIT Alert will route Firm Up Request messages to both users simultaneously. Again, the message is anonymous, and no information related to contra order size is included in the messages sent to the Electronic User. Each Electronic User will then have two seconds to respond with a Firm Up order.

HOW VIRTU SEEKS LIQUIDITY USING CONDITIONAL ORDERS

Virtu believes that in order to achieve optimal execution for clients, our algorithms need to be connected to multiple liquidity sources, as well as utilize the variety of available order types. Whilst internalization via executions in POSIT is a byproduct of our algorithm’s trading, internalization is not the objective, for that misses the mark in terms of satisfying the execution objectives of our clients.

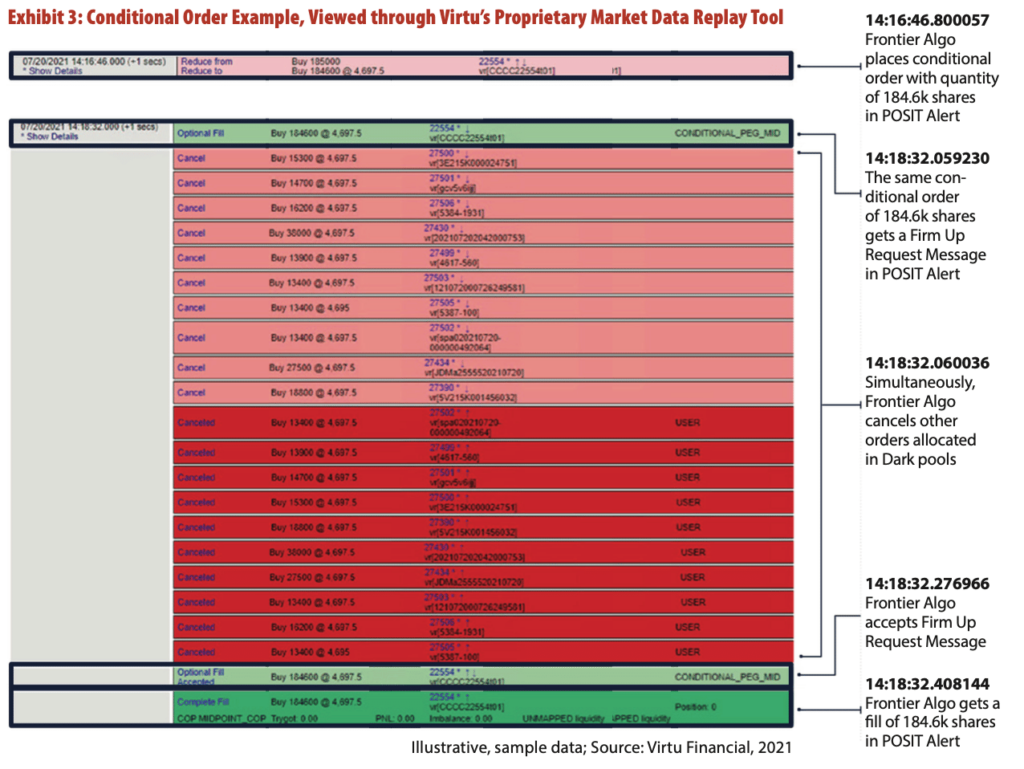

In APAC, Virtu’s Frontier execution algorithms will leverage conditional orders in all available conditional venues where appropriate, particularly when using Covert (4), Oasis (5) & Catch (6) strategies. Virtu generally will route a parent order’s full order size as a conditional order type to all conditional venues while working smaller child orders in both non-displayed venues and lit exchanges. If the algorithm receives a conditional Firm Up Request message from a venue e.g. POSIT Alert, the algorithm will first cancel all outstanding firm orders — which is done to determine how many shares to route to POSIT Alert in the Firm Up order, as well as to ensure that the router does not overfill the client’s parent order. Once the algorithm receives all cancel acknowledgments back on its firm orders, a Firm Up order is routed to POSIT Alert with a quantity that generally equals the remaining share balance of the parent order. If the algorithm receives a partial fill, the residual quantity will be re-indicated into POSIT Alert, while new firm orders are sent to other venues. Exhibit 3 below illustrates an example of the order routing sequence Virtu’s algorithms use for conditional order interaction.

Exhibit 3: Conditional Order Example, Viewed through Virtu’s Proprietary Market Data Replay Tool

CONCLUSION

The conditional order type is a useful and efficient tool for sourcing block liquidity.

From the perspective of POSIT Alert, conditional orders provide a unique and differentiated source of block liquidity to POSIT Alert’s Human Users. In terms of concerns around information leakage, the Electronic User of a conditional order does not receive information on contra order interest until the Human User commits and sends a firm order. In fact, Human Users in POSIT Alert receive the Firm Up Request message before Electronic Users of contra conditional orders. From the perspective of Virtu’s algorithms, conditional orders provide a means of helping to manage market fragmentation by increasing the probability of achieving block fills in POSIT Alert, while minimizing opportunity cost by remaining in the market with firm orders in numerous venues.

END NOTES

1 Frontier execution algorithms: Virtu’s global and comprehensive suite of single stock, portfolio and pairs strategies combine the firm’s execution technology with access to liquidity from a wide array of sources to help solve for the execution objectives of our clients.

2 POSIT Alert: Virtu’s global block indications network, POSIT Alert delivers block liquidity to subscribers in 38 countries. POSIT Alert unites liquidity sourced directly from trader OMSs with conditional orders from electronic participants for matching that does not require negotiation.

3 POSIT Alert supports markets in: AUS, HKD, IDN, IND, JPN, KOR, MYS, NZL, PHL, SGP, THA, TWN.

4 Covert (dark aggregator algorithm): This strategy aggregates non-displayed liquidity by routing firm and conditional orders to non-displayed venues.

5 Oasis (dark with take triggers algorithm): This strategy aggregates non-displayed liquidity but will interact with displayed liquidity when certain conditions present themselves.

6 Catch (implementation shortfall algorithm): The strategy balances the trade-off between impact & timing risk, exposing part or all of the parent order in conditional venues.

(This article first appeared in the Q3 2022 issue of GlobalTrading.)