The following is an excerpt of a whitepaper, Reassessing Risk Management with Corporate Event Data

By Christine Short, VP Research, Wall Street Horizon

Understanding and Identifying Risk

A well-known pillar of risk management is that one must first understand risk in order to manage it. “Understanding risk requires the ability to quantify a given risk so that mitigating controls can be put in place to reduce the risk to an acceptable level, a level that is in line with the organization’s risk appetite framework. Without the ability to effectively quantify risk, no risk program can be successful.”2 Once we define risk, we can calculate and manage it. However, assessing risk is not a simple task.

Risk is an inherent part of investing that even the most successful investors can’t avoid. To help minimize the impact, firms hire risk managers to analyze and attribute critical sources of risk in the market. The risk manager rifles through data for any insights that may improve investment behavior or portfolio construction. However, managing risk is not about eliminating it. Instead, investors or risk managers look for ways to take the right amount of risk at the right times. The goal is to make this determination with widely available financial statements. An experienced risk manager also knows that an overly cautious approach hurts expected returns while a more speculative mentality invites unwanted risk.

Standard financial formulas like price-to-earnings ratio, discounted cash flow, and dividend yield are usually front and center in a risk approach, while lesser known approaches take a back seat. One often-overlooked factor is corporate events.

For example, when a tech company postpones their earnings announcement by a week, it is traditionally a bellwether for weak results. Academic research suggests that the timing of specific events on the earnings calendar can foreshadow whether the company is getting ready to reveal positive or negative updates. When an earnings announcement moves back a few days or even weeks (delayer), bad news often follows. If the opposite happens and a company pushes up its earnings announcement (advancer), it can be telling of better-than-expected results3. In 2020, Wall Street Horizon found that approximately 800 companies in its universe of 9,000 revised their earnings dates.

All events indicate something different, and publicly traded companies disclose this information in plain sight. Understanding the pattern, frequency, and efficacy of each corporate event offers another method to manage risk. A risk manager who includes event data in their analysis can better support minimizing risk exposures.

Corporate Event Data in a Risk/Compliance Framework

Corporate events add another layer to investors’ risk management framework. Multiple calendar events combined with fundamental research can highlight potential risk considerations. When executives provide product and personnel updates on shareholder calls, for instance, it provides investors with another piece of intel to inform decision-making. Whether used in isolation or within a market data mosaic, investors can gain an edge by tapping into corporate events.

Why corporate events are important

Companies often leave a trail of clues to their financials. The key is knowing where to look well before something happens so that you can plan ahead for any potential strategy adjustment. For example, a significant movie release from Disney studios may bode well for revenue growth. A failed drug approval at a pharmaceutical company revealed on the PDUFA (Prescription Drug User Fee Act) date signifies a threat for the sponsor and partner companies involved in the trial.

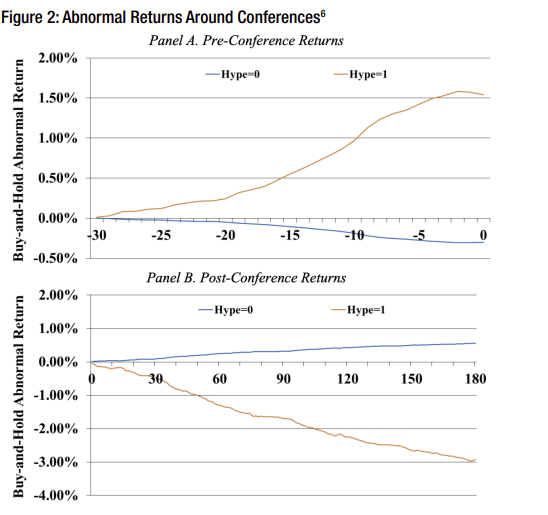

Conference Events can present a whole new realm of insights to investors. Information warranting attention around a key conference can include: dates and location of the event, presenters’ names and job titles, and even the topics discussed. Investor conferences can also cause volatility as they present the opportunity for managers to exploit heightened attention leading up to the conference as a way to push the stock higher5 (see Figure 2). In addition to identifying these events, it’s helpful to understand how frequently companies revise them and why a holistic perspective can drive better investment decisions.

Figure 2 plots market-adjusted buy-and-hold returns around the conference. Panel A presents market-adjusted buy-and-hold returns over the 30 days leading up to and including the conference. Panel B presents market-adjusted buy-and-hold returns over the 180 days following the conference. Market-adjusted returns are demeaned by firm and quarter. Hype is an indicator variable equal to one if, in the [–10,0] window before the conference, the firm both issues voluntary disclosure and insiders are selling, and zero otherwise.

Corporate events are also important because they are primary-sourced, meaning event details are derived from the company itself, SEC, or conference organizer. This is paramount not only for compliance purposes, but for general research strategies as you aren’t receiving the information as interpreted by a third party such as a journalist or analyst. Instead, the company is infusing information about itself into the market.

With market volatility nearing an all-time high, many investors and risk managers might be wondering how to weather the blow. Advances in corporate event fundamental data sourcing, algorithmic processing, and deep-bench human curation combined in a cost-effective approach can enhance the efficacy of any risk management operation. Using corporate events, together with fundamental research, provides risk managers better insights about new opportunities and potential threats.

Footnotes:

2 “Risk Management, Evaluation and Communication Workbook”, The Risk Management Association, 2017

3 So, Eric and Travis Johnson. “Time Will Tell: Information in the Timing of Scheduled Earnings News.” MIT Sloan School of Management and The University of Texas at Austin, July 2017, https://www.wallstreethorizon.com/news/So

5 Bushee, Brian, Daniel Taylor and Christina Zhu. “The Dark Side of Investor Conferences: Evidence of Managerial Opportunism.” The Wharton School University of Pennsylvania, September 2020, page 28. https://www.wallstreethorizon.com/news/darkside

6 Bushee, Brian, Daniel Taylor and Christina Zhu. “The Dark Side of Investor Conferences: Evidence of Managerial Opportunism.” The Wharton School University of Pennsylvania, September 2020, page 36. https://www.wallstreethorizon.com/news/darkside