By Michael Babushkin, CEO, Devexperts

With the impending shift from T+2 to T+1 settlement in US securities market set to take effect on May 28th this year, companies worldwide must prepare for operational adjustments to keep up with this change. This is not merely a national transition; it marks a global shift, with Mexico and Canada already announcing their adherence to a T+1 settlement cycle which will take effect on May 27th, and discussion ongoing in Europe to do the same.

Globally, companies engaged in trading US cash equities, corporate debt, and unit investment trusts face a major shift: it’s not just about adapting to a new settlement cycle, it’s about navigating an operational shift in the international financial landscape.

T+1 Driver: Cost Savings and Reduced Counterparty Risk

The acceleration of the US settlement cycle was adopted by the SEC (Securities and Exchange Commission) on February 15, 2023. The adoption follows discussions initiated by SIFMA (the Securities Industry and Financial Markets Association), ICI (the Investment Company Institute), and DTCC (the Depository Trust & Clearing Corporation). This rule is a consequence of extremely volatile markets since 2020, which highlighted the need to reduce risks. As more time to settle opens companies up to more credit, market and liquidity risks, the SEC has been considering the move to help mitigate these risks and reduce costs for market players.

The shorter time between execution and settlement should reduce the number of unsettled trades and the amount of industry exposure. According to the DTCC, on average $13.4 billion is held in margin overnight to manage counterparty risk. During stress testing of T+1, the volatility component of clearing house margin has been shown to reduce by over 40%, which results in a significant cost reduction.

This move will also push market participants to automate processes further, resulting in increased transaction efficiencies, while also reducing liquidity risk from unsettled securities transactions. In turn, this will help the entire industry improve operational effectiveness.

Challenges for EU Market Participants:

With no exceptions proposed for foreign investors, brokers located in global time zones face challenges in meeting the new daily settlement deadline. Furthermore, in European capital markets, the diversity and complexity of legal, fiscal, and regulatory frameworks will result in operational intricacies.

According to the Association for Financial Markets in Europe (AFME), “T+1 Settlement in Europe: Potential Benefits and Challenges” paper from 2022, European markets face multiple challenges in adhering with T+1 in the US:

- Participants will have 2 core business hours of post-trade operations time between the end of trading and the start of settlement, from a previous 12 hours.

- Liquidity processes will also have a short timeframe, which can be particularly challenging if an FX component is present.

- Possibility of failed settlement increases, meaning companies will be at risk of incurring more penalties.

There are many questions regarding how some of the above challenges can be resolved. Brokers in Europe need to consider whether they require teams that operate in specific time zones, whether they could outsource, or even move these teams to the US.

Brokers’ Considerations for Global Market Access:

Brokers accessing global markets will need to shift their attention to operational efforts and to mitigating settlement discrepancies when supporting markets with different settlement cycles. These could lead to overnight funding issues for investors who trade multiple markets looking to use funds from one market to settle another. The move to T+1 will shorten the time available to cover short positions, which in turn could lead to settlement failures and, under the new rule, incur penalties.

It is also to be expected that European markets will push to move to T+1 in the near future, so brokers are advised to consider what the right technology and operational models are needed to support market access across all sectors. One important consideration is whether the technology used has the ability to integrate with multiple clearing counterparties. Having the right, up-to-date integrations will be part of accelerating the settlement process.

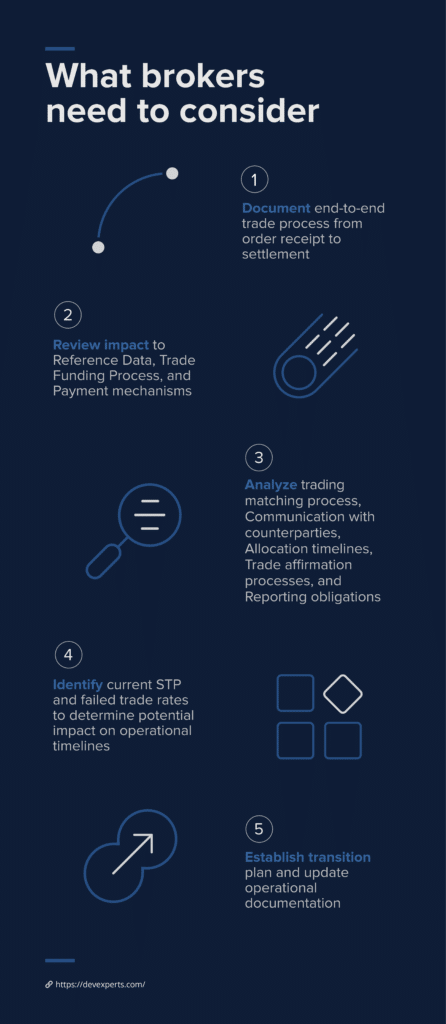

Preparing for T+1: What Brokers Need to Consider (Infographic):

Conclusion:

By now, market participants should be fully aware of the upcoming changes on May 28th. However, many have been in a state of inertia. With some brokers considering the move to still be months away, the operational changes have been overlooked in 2023. We expect to see a push from businesses to ready themselves in Q1 2024, if wanting to be successful and not liable to penalties.

The beginning of 2024 should be a wake-up call to the industry, and the implementation of T+1 by the US, Canada and Mexico needs to be a point of consideration for what is to come. As mentioned above, we do expect to see more markets align to T+1, but we also expect countries to start researching the feasibility of T+0 for added efficiencies. This is something that brokers can prepare for now, and take the need for operational changes as an opportunity to future-proof their businesses.