By Phil Mackintosh, Chief Economist, Nasdaq

We’ve recently discussed how passive orders benefit from order types that trade slower and signal less. How M-ELO has the best markouts, which is great for a trader with a long time horizon. We then looked at midpoint and resting limits and found they have much better chance of a fill, partly because Nasdaq’s market has the most advertised and hidden liquidity at the National Best Bid and Offer (NBBO).

Data shows that liquidity takers benefit too. There is not only more liquidity than advertised, but price improvement is available for takers as well.

Nasdaq midpoint orders improve provider and taker outcomes

We’ve previously discussed why trading slow isn’t for everyone. If you think some news is positive for a stock, waiting too long to buy adds to opportunity and execution costs. Either you won’t get your trade finished, or you will miss out on good early prices.

For those kinds of trades, it often makes sense to cross the spread for a guaranteed fill.

Our data shows that there are two reasons the Nasdaq exchange is a great place to lift liquidity:

- Agency orders that cross the spread can often get “overfilled” (see Chart 2 here). That’s thanks to the hidden liquidity that is also on the Nasdaq exchange.

- Those orders also get price improved.

That means that the average marketable order on Nasdaq does not really pay the full bid-ask spread, as some of the executed shares trade with midpoint, hidden limit and odd lots at prices better than the NBBO. This is called “price improvement.”

In fact, on high-priced stocks, as much as 40% of shares filled are typically price improved, with actual price improvement averaging more than one cent on many stocks priced over $100.

Chart 1: As share prices rise, price improvement becomes more likely and larger

That’s where Nasdaq’s midpoint market share creates an important ecosystem for passive and active traders.

By having the most midpoint orders of any market (Chart 2), a taker is more likely to receive midpoint fills, and price improvement, when they attempt to cross the spread. That makes crossing the Nasdaq spread more attractive than other markets.

That in turn makes it more likely that midpoint orders will get filled, improving their fulfillment.

It’s another benefit of less fragmented markets, where natural investors can meet in the same market without intermediation.

Chart 2: Nasdaq trades around 117 million midpoint shares a day

Nasdaq provides the most price improvement, even for small cap

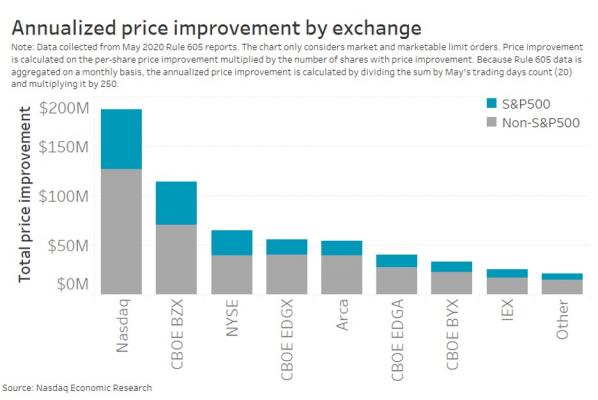

Using May Rule 605 statistics of all exchanges, we can in fact see that all these midpoint and inside NBBO fills add up to significant cost savings for investors each year. Annualized, this adds to $597 million per annum of price improvement, with 31% of that coming from Nasdaq.

Chart 3: Nasdaq saves takers $188 million per year, with 67% in small and mid-cap stocks

Importantly, around two-thirds of the price improvement on Nasdaq comes from smaller cap (non-S&P500) names. That’s good for small cap traders too.

We’ve discussed the choices an algo has to make. But we learn much more when we start to quantify the costs and benefits of different markets and market structures for investors.

Where you route can often include more savings than first appear to exist. It can result in significant savings to investors.