IEX Exchange has announced a new version of The Signal, also knows as the Crumbling Quote Indicator, a predictive model that targets adverse price changes and powers IEX Exchange’s signature protective order types.

The Signal is designed to predict imminent changes to the National Best Bid/Offer and allow order types including D-Peg and P-Peg to react advantageously to unstable market conditions.

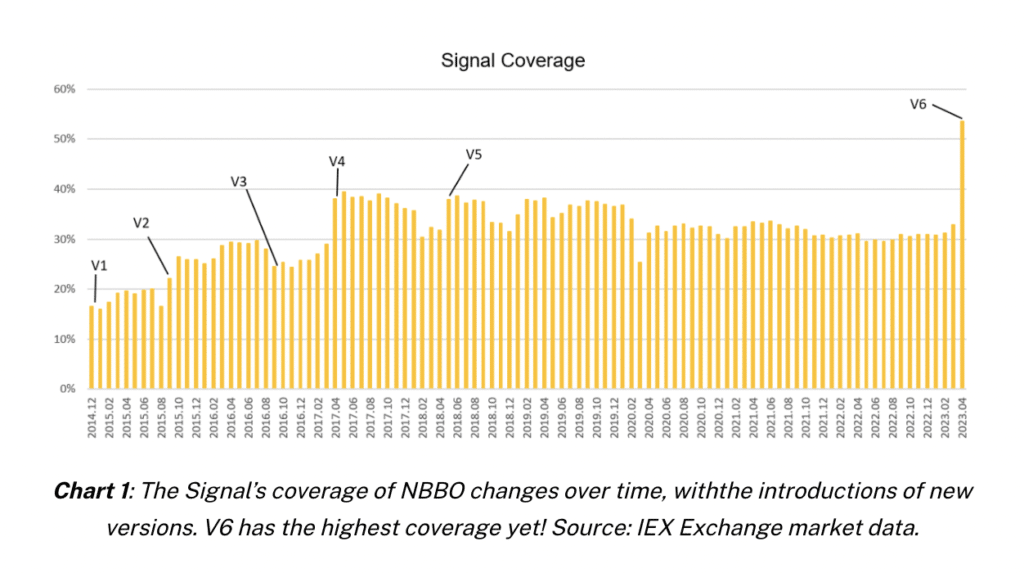

Since IEX Exchange’s inception, The Signal has been updated five times; the last update was introduced in May 2018.

Since then, IEX Exchange released D-Limit, a groundbreaking new order type that incorporates the Signal and which has dramatically changed the market composition of trading on our venue. There have been major changes in overall market conditions since 2018 as well: Retail trading and volatility surged during the Covid-19 pandemic, increasing market volumes as well as the average number of NBBO quote changes.

Additionally, three new US equities exchanges have come online, and their presence directly affects the NBBO prediction problem.

The newest iteration of The Signal (V6) brings a new level of performance for pegged orders on IEX Exchange.

Some of its enhancements include:

- Looking at both size and number of venues (rather than just venues)

- Adding 3 new venues (MEMX, MIAX, Nasdaq PSX)

- Shifting from a logistic regression to a rules-based model

The current version of the Signal (V5) predicts 33% of NBBO changes in the volume-weighted average symbol and the new version of the Signal (V6) is predicting 54% of NBBO changes (numbers reported over the week of 4/3/2023-4/7/2023) without sacrificing its true positive rate.

Here’s the breakdown in coverage improvement by spread from the current version of The Signal (V5) to the new version (V6).

In V6 of the Signal, the mathematical model is being updated in three main ways: Changing from logistic regression to rules-based logic; Online performance evaluation; and Adding size update data.

The result of these changes is a new aggregate statistical model that, like all prior versions of the Signal, is deterministic and reproducible from its market data input.

Next Steps & What This Means for Members

In its previous update cycles, IEX pushed the latest version of The Signal to all Members at once. This time, in response to client feedback, Members are invited to opt in and make the change at their preferred pace. The current production model (V5) will remain the default.

Beginning April 18, 2023, clients may elect through a port request form to use the new Signal formula for all of their D-Peg, P-Peg, and C-Peg orders or can designate via a FIX tag to opt-in on a per-order basis (see Trading Alert #2023-008).

Rolling out the new Signal version in this way will allow Members to transition from the current model to the new model for their pegged order types at their own pace (or even elect to stick with their current experience), IEX said.

If desired, this will allow for live A/B testing of comparable models in a way that was not possible in our prior Signal updates.

“With market conditions changing rapidly, protection against adverse selection is more important than ever. We’re excited to continue improving the performance of our flagship order types to help democratize access to sophisticated trading tools and continually improve IEX Exchange’s execution quality,” IEX said.