Over the past six weeks, investors around the globe have experienced some of the most significant equities market volatility and disruption ever.

Both the buy side and sell side have had to adjust quickly to market movements and continued uncertainties, all while rapidly transitioning to working from home.

To learn more about the impact COVID-19 has had on equities markets and how brokers have responded in this crisis, we asked nearly 100 buy-side investors in the U.S. and Canada for their views.

Market Volatility

Extreme market volatility over an extended period poses a significant challenge under any conditions. Having to deal with it while forced to work remotely is unprecedented.

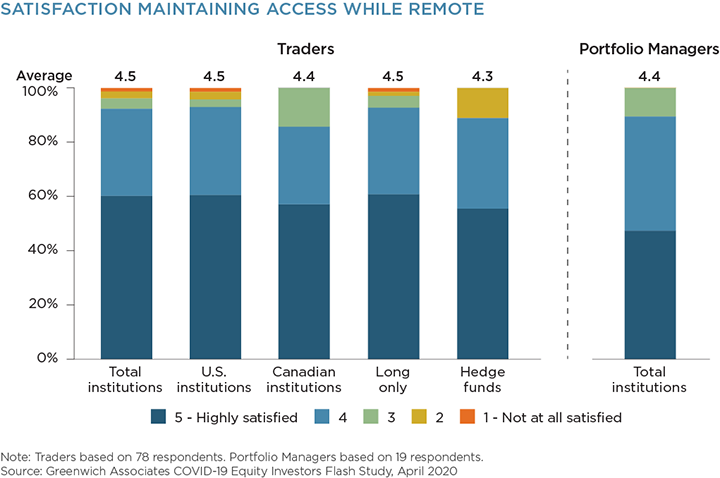

In that light, it is remarkable that 90% of the portfolio managers (PMs) and traders are satisfied with their ability to maintain full access to news, research, market data as well as colleagues and providers, including 60% of traders and nearly half of PMs who are highly satisfied.

Satisfaction with Brokers

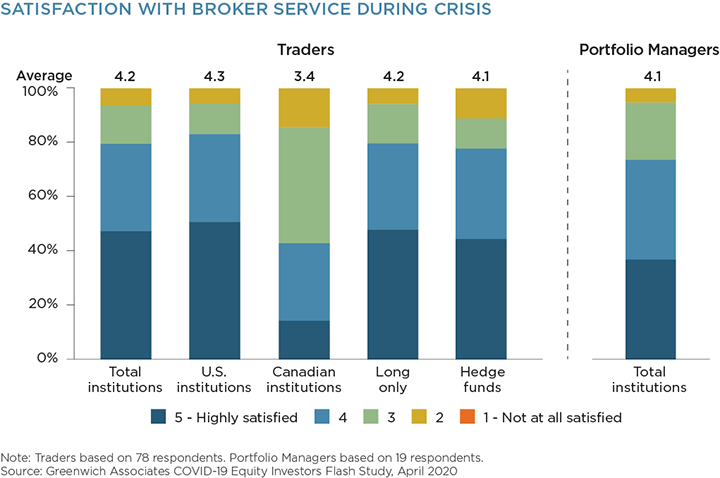

Equally encouraging is the generally high level of satisfaction expressed by both PMs and buy-side traders with how well the sell side has helped them navigate the volatile markets stemming from the COVID-19 crisis.

When asked to consider their degree of satisfaction with broker insights on accessing liquidity, hedging exposures, developing investment ideas, forecasting investment implications, restructuring portfolios, and general market color, fully 80% of traders are satisfied with how their brokers have helped, including nearly 50% that are highly satisfied.

Similarly, among PMs, nearly three-quarters are satisfied with sell-side coverage during the market turmoil, including a third that are highly satisfied.

Shifts in Trading

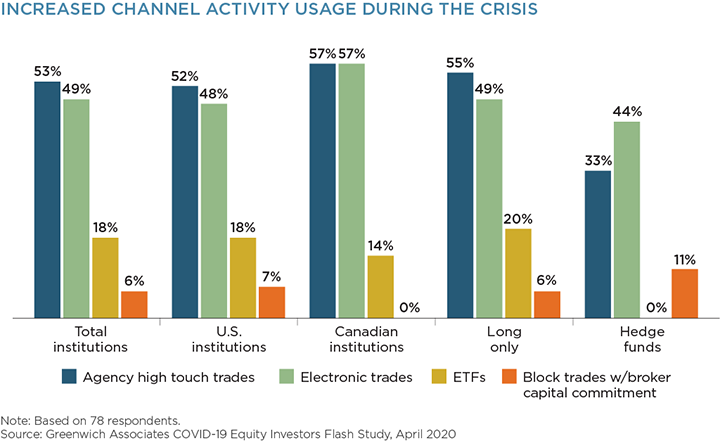

Since the COVID-19 outbreak, just over half of institutions shifted their equity trading volume mix toward more agency high-touch trades, while a nearly equal proportion significantly increased the use of electronic trading. Approximately 20% made much greater use of ETFs.

In contrast, only 6% have done significantly more block trades that required broker capital commitment, which is not surprising as few brokers are willing to risk too much capital in these extraordinarily volatile markets.

Meeting Research Needs

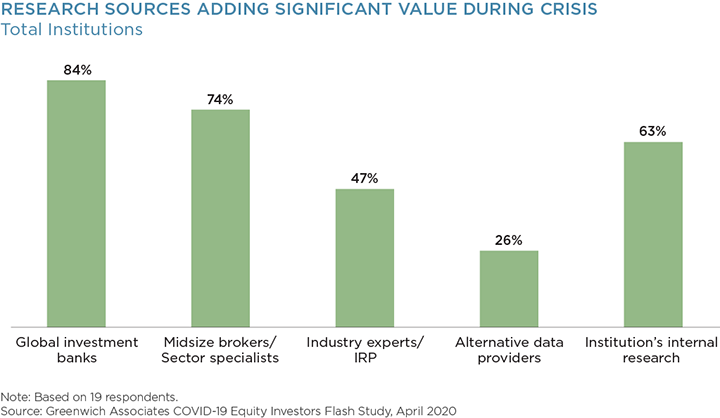

Between 75-85% of PMs feel that both global investment banks and midsize/specialist brokers have significantly added value to their COVID-19-related research needs. Furthermore, about 45% also obtained significant insights from industry experts or independent research providers, while one-quarter said the same about alternative data providers.

In addition, nearly two-thirds also commended their internal research teams for strong contributions to COVID-19-related investment insights.

Conclusion

We have seen volume and volatility at unprecedented levels during the COVID-19 crisis. Although these metrics have subsided somewhat throughout April 2020, they remain at levels higher than we saw prior to the crisis.

That the financial industry was able to shift to a work from home environment during such turbulent times is a testament to the foundations that have been planned over more than a decade to prepare for market and business disruptions (even if the plans originally did not anticipate the disruptions to last for quite so long). The ability of firms to stay connected with their brokers, systems, and services, along with the overall amazing resiliency of the market infrastructure itself, translates into the relatively high sentiment shown in our study.

Of course, we all know that the crisis is ongoing. We see that the market has been fundamentally altered by COVID-19, and we will see these changes play out over the months and years to come. We continue to monitor these events and how the market continues to evolve in response.Greenwich