This report is the first of a two-part series.

By Rumman Iqbal, Consulting Partner, Wipro

At the end of June, participants in the US equity markets submitted their comments1 to the Securities and Exchange Commission (SEC) on its “Market Data Infrastructure” rule2 proposed in February 2020. The comments make for an interesting read. The fact that this wide range of market participants depend on consolidated data feeds for order routing, trade execution, cost evaluation, regulatory reporting, and research, speaks to the importance and impact of this potential regulation.

At Wipro we believe this well-intentioned and progressive step to modernize the market data infrastructure may have unintended consequences for the buy and sell side market participants. This change could impact a range of functions like Smart Order Routing, Best-Execution Obligations, and Transaction Cost Analysis. In a two-part series, Wipro’s Capital markets team assessed the proposed regulation and the cascading impacts it may have on the U.S. equity market and its various participants. The posts are divided as below:

Part 1: Current challenges with U.S. Equity Consolidated Data

Part 2: Changes proposed by SEC and the anticipated impact to market functions

U.S. Consolidated Equity Market Data

The consolidated equity market data was put in place as a result of the National Market System plans3 (NMS plans) through Regulation NMS Rule 603.4 A critical component of the U.S. equity markets, NMS plans support the distribution, consolidation, and display of information with respect to quotations for, and transactions in, NMS stocks5. While NMS plans played a central role in providing price and transaction transparency in the equity markets, the plan has not been updated since it was implemented in the late 1970s. Since then, the market and its participants have taken huge leaps in technology and infrastructure.

Recent market developments have raised concerns about the existing NMS plans–as currently structured, whether they continue to fulfill their regulatory purpose, which is to ensure the timely availability of information with respect to quotations for and transactions in NMS securities to all market participants.

The current centralized model

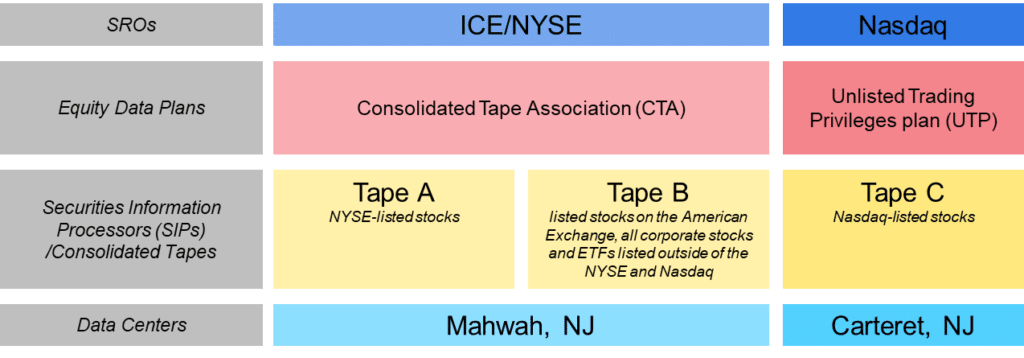

Today, as per Regulation NMS the rules 601, 602, 603, 608 and 609 together govern the collection, consolidation, and dissemination of NMS information6. The dissemination of NMS information is based on a centralized consolidation model, where the national securities exchanges and the Financial Industry Regulatory Authority or FINRA (collectively, referred to as the self-regulatory organizations, or SROs) act jointly under three NMS plans (the Equity Data Plans – Consolidated Tape Association, Consolidated Quotation, Nasdaq/Unlisted Trading Privileges) to collect, consolidate and disseminate the information. SROs provide the information for each NMS stock to an exclusive Securities Information Processor (SIP7), which then consolidates that information and makes it available to the public via the three tapes – A, B and C.

Figure 1: The Equity Data Plan Structure

Source: SEC proposed rules

Note: (1.) OTC transactions are reported by Broker-Dealers to FINRA trade reporting facilities (TRFs), which are FINRA/Nasdaq TRF in Carteret, NJ, FINRA/ Nasdaq TRF in Chicago, IL, and FINRA/ NYSE TRF in Mahwah, NJ (2.) The BCP/DR data center for both the exchange groups are in Chicago (3.) The fee schedule for Tape A8, Tape B9, and Tape C10 are available at their respective plan providers

The collected, consolidated, and disseminated data

For each NMS stock, the SROs are required to provide certain quotations and transaction data to the designated exclusive SIP for each Equity Data Plan. Each exclusive SIP collects, consolidates, and disseminates NMS information to the public on the consolidated tape, a set of information that includes “Core Data” that constitutes: (1) the price, size, and exchange of the last sale; (2) each exchange’s current highest bid and lowest offer, and the shares available at those prices; and (3) the national best bid and offer or “NBBO”.

In addition to the above, the SIPs provide certain regulatory data including information addressing extraordinary market volatility (‘‘LULD Plan’’)11, regulatory halts and market-wide circuit breakers (‘‘MWCBs’’)”, regarding short-sale circuit breakers, and certain administrative messages.

Challenges with the consolidated feed

The adoption of Regulation NMS in 2005 led to fundamental changes in the U.S. equity market structure. These changes included the proliferation of execution venues leading to liquidity fragmentation and the advancements in high-frequency electronic trading to profit from latency arbitrage and other market inefficiencies. The advancement in technology, and the introduction of Electronic Communication Networks also led to electronic order routing and trading strategies that grew increasingly complex, automated and algorithm based.

The NMS plans plays a central role in providing price and transaction transparency in the equity markets. However, the plans have not been updated since their implementation in the late 1970s. The changes in market structure and advancements in technology driven by Regulation NMS led to the need for proprietary data products, that consisted of detailed order, quote and trade information that could be consumed by the automated trading systems., This created an opportunity for the exchanges to develop enhanced proprietary data products, to market participants who only had access to the less sophisticated SIP data. This data has been available to market participants at a significant premium to SIP data. Those could afford it can subscribe to these information-rich proprietary data feeds from individual exchanges and consolidate that information (or source it from a data aggregation vendor who consolidates it for them) for use in their front office systems.

This decentralized model for enhanced proprietary data and the exclusive centralized model for SIP data gave birth to a two-tiered market data environment based on differences based on latency and content.

- Latency: The centralized consolidation model of the Equity Data Plans and the exclusive SIPs suffers from three specific sources of latency disadvantage: (a) Geographic latency, (b) aggregation or consolidation latency, and (c) transmission or communication latency; and the proprietary direct data feeds are faster by 1.5 milliseconds12.

- Content: Today the consolidated tapes collect, process, and publish quotation data to vendors, including the best bid, best offer, quotation sizes, and aggregate quotation sizes. The consolidated tapes are missing certain data elements that have become increasingly important with the advancement in electronic trading like odd-lots and Depth-of-Book (DOB).

In addition to the above, there are additional areas of concern

- Cost of Data: The market considers the current cost for real-time SIP to be much higher than the expenses incurred by the SIP processor and SIP data contributors. A benchmark for comparison emerged as IEX published IEX’s market data infrastructure13costs which was around $1.8 million annually and $800,000 to offer physical connectivity; compared with the $292 million distributed to exchanges from the SIP(s) for tapes A, B, and C14 combined in just the first 9 months of 2019

- Governance Complexity: The plan is administered by multiple other plans, consolidated and disseminated through multiple SIPs, operating out of three geographies, introducing unwanted complexity.

- Conflict of interest: The exchanges that are responsible for the governance and operation of the Equity Data Plans, may not be incentivized to improve the content or latency of SIP data since many exchanges have their own proprietary data feed service that offer better data and latency that SIP feeds.

The timeline on SEC response

The usefulness of SIP data and the cost of market data were all active topics during industry discussions among market data consumers, with the exchanges defending their position quite strongly, given that market data is a significant part of the exchange revenues.

- On October 1, 2019, the SEC published a proposal15 to improve the procedure for public comment and SEC review of proposed fee changes by NMS plans. Later that month, there was an animated debate between market data producers and consumers during a SEC roundtable.16 in October 2018.

- On January 8, 2020, the SEC issued a notice of proposed order directing the SROs to submit a new, single NMS plan for NMS stocks (‘‘New Consolidated Data Plan’’) in order to increase transparency, address conflicts of interest, and other issues presented by the current governance structure of the existing NMS plans.

- On Feb 14, 2020, the SEC released a proposal17 to improve the market data infrastructure for exchange-listed NMS stocks, introducing for the first time, competitive forces into an exclusive market space.

- On May 6, SEC issued an order directing the SROs to submit a new NMS plan with a modernized governance structure for the production of public consolidated equity market data and the dissemination of trade and quote data from trading venues.

As per SEC Chairman Jay Clayton18, “Both the content of NMS market data and the technologies used to collect, consolidate, and disseminate that data have lagged meaningfully behind proprietary data products and systems offered by the exchanges. By expanding the content of this data and introducing competitive forces into the market, the proposals would enhance transparency and ensure that improved NMS market data is available on terms that are accessible to a wide variety of participants in today’s markets.”

The Market Data Infrastructure over the years has been segmented into a two-tier market. This disparity has created information asymmetry that puts retail investors, and certain market participants at a disadvantage, compared to larger institutions that consume the direct feed. Given the significance quotations and transactions have on price transparency, Smart Order Routing, Best Execution Obligations, Transaction Cost Analysis, we believe that this is a significant SEC regulation that will have an impact on the equity market microstructure.

In the next part, we look at the changes proposed by SEC in the Market Data Infrastructure regulation and response from various market participants on the same.

References:

- Comments on Proposed Rule: Market Data Infrastructure https://www.sec.gov/comments/s7-03-20/s70320.htm

- Proposed Rule on Market Data Infrastructure – https://www.govinfo.gov/content/pkg/FR-2020-03-24/pdf/2020-03760.pdf

- NMS Plans – See Securities Exchange Act Release Nos. 10787 (May 10, 1974), 39 FR 17799 (order approving CTA Plan); 15009 (July 28, 1978), 43 FR 34851 (Aug. 7, 1978) (order temporarily approving CQ Plan); 16518 (Jan. 22, 1980), 45 FR 6521 (Jan. 28, 1980) (order permanently approving CQ Plan); and 28146 (June 26, 1990), 55 FR 27917 (July 6, 1990) (order approving UTP Plan).

- Regulation NMS, Securities Exchange Act Release No. 51808 (June 9, 2005), 70 FR 37496, 37561 (June 29, 2005), 15 U.S.C. 78k-1; Rules 601–603 of Regulation NMS, 17 CFR 242.601–603.

- NMS Stocks – Exchange Act Release No. 60997 (November 13, 2009) (the “Proposing Release”)

- NMS information Exchange Act Release No. 60997 (November 13, 2009) (the “Proposing Release”)

- SIP – See 15 USCS § 78c (22) (A)

- Plan A Fee Schedule https://www.nyse.com/publicdocs/ctaplan/notifications/trader-update/CTA%20Network%20A%20Pricing%20-%20Jan%201%202015.pdf

- Plan B Fee Schedule https://www.nyse.com/publicdocs/ctaplan/notifications/trader-update/CTA%20Network%20B%20Pricing%20-%20Jan%201%202015.pdf

- Plan C Fee Schedule http://www.utpplan.com/doc/DataPolicies.pdf

- On May 31, 2012, the Securities and Exchange Commission (SEC) approved, on a pilot basis, a National Market System Plan to Address Extraordinary Market Volatility, known as the Limit Up – Limit Down (“LULD”) Plan. https://www.finra.org/filing-reporting/trf/limit-uplimit-down-luld-plan

- How Slow Is the NBBO? A Comparison with Direct Exchange Feeds https://www.modernmarketsinitiative.org/archive/2018/11/14/how-slow-is-the-nbbo-a-comparison-with-direct-exchange-feeds

- The Cost Of Exchange Services: Disclosing the Cost of Offering Market Data and Connectivity as a National Securities Exchangehttps://iextrading.com/docs/The%20Cost%20of%20Exchange%20Services.pdf

- https://www.ctaplan.com/publicdocs/Q3_2019_CTA_Quarterly_Revenue_Disclosure.pdf and http://www.utpplan.com/DOC/UTP_Revenue_Disclosure_Q32019.pdf

- SEC Proposes to Require Proposed NMS Plan Fee Amendments to Follow Public Notice, Comment, and Approval Procedure https://www.sec.gov/news/press-release/2019-204

- SEC Staff to Host Roundtable on Market Data and Market Access https://www.sec.gov/news/press-release/2018-210

- 17 CFR Parts 240, 242, and 249, Market Data Infrastructure https://www.sec.gov/rules/proposed/2020/34-88216.pdf

- SEC Proposes to Modernize Key Market Infrastructure Responsible for Collecting, Consolidating, and Disseminating Securities Market Data https://www.sec.gov/news/press-release/2020-34

Rumman Iqbal, Consulting Partner, Wipro

Rumman Iqbal is a Consulting Partner at Wipro focused on Business & Technology Consulting in the Securities and Capital Markets practice. Rumman’s area of interest include Market Structure, Post-trade Services and Regulations.