Paco Ybarra, chief executive of the Institutional Clients Group at Citi, said the bank is targeting private capital after suffering in debt capital markets due to its conservative approach to risk in leveraged finance.

Ybarra presented at the Citi Investor Day on the Institutional Clients Group (ICG), which includes the banking, markets and services businesses.

He said the business has three interconnected strategic priorities – to accelerate investment in services, grow the commercial bank and to expand the investment banking and market franchises.

“We are continuing the improvements we have made in our equities franchise and retaining leadership in fixed income while keeping a very close eye on returns and capital,” Ybarra added.

He continued that investment banking and markets have scale, produce high revenues and solid returns but Citi is convinced that it can improve its current position and return.

Investment banking earned revenues of $6.6bn in 2021 with a return on common equity of 28%, and was ranked fourth in debt capital markets and fifth in equity capital markets.

“We have a strong market position across all elements of our investment banking franchise and in recent times we have improved our share in mergers and acquisitions and ECM,” said Ybarra. “We have suffered somewhat in our DCM franchise because of our conservative approach to the leveraged finance market.”

Citi’s strategy is to gain share by making targeted investments. The three strategic priorities are to redirect coverage to key growth sectors; recalibrate the franchise to recognise that private capital and financial sponsors are going to be big drivers of banking; and to capture the cross-selling opportunities in the Institutional Client Group, especially with the growth in commercial banking.

Citi has hired 70 managing directors in investment banking between 2019 and 2021 and changed its long-established industry sectors to reflect the four “super sectors” that are driving change in the economy and where the bank is underweight compared to its competitors – digital disruption, health and wellness convergence, sustainability and the energy transition.

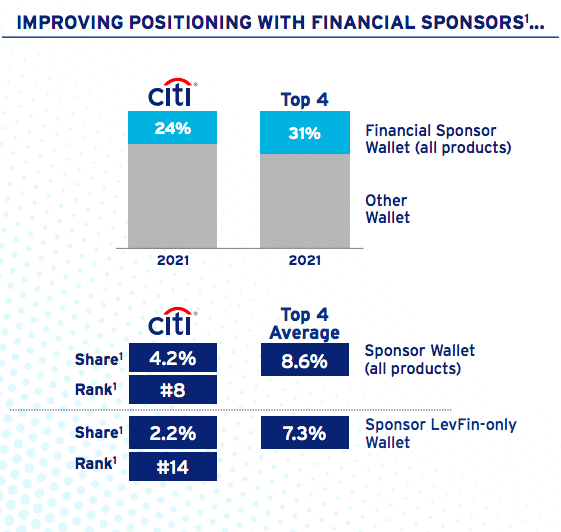

In addition, the bank is recalibrating the franchise in recognition of the significant shift towards private capital. Ybarra said Citi’s share with financial sponsors, and therefore leveraged finance, is disproportionately small given its footprint and strength in financing, securitization and private debt.

“But our share has deteriorated over the last few years because of a very conservative risk stance,” he added. “Capitalizing on the private asset opportunity will require us to increase our capital allocation and we believe we can do that while retaining a prudent approach to risk.”

Citi believes that connecting investment banking with the rest of ICG and Wealth Management can provide a multiplier of growth in investment banking revenues.

Markets

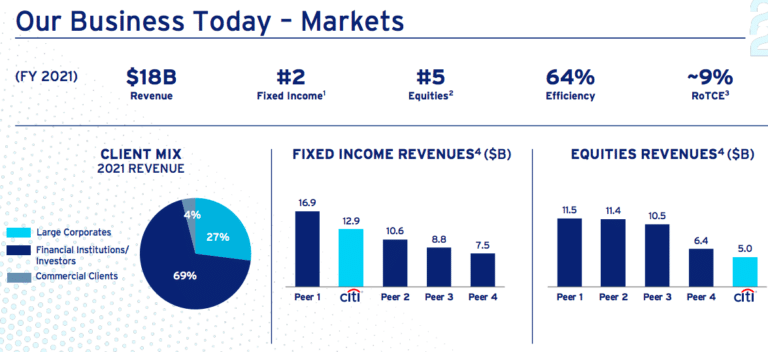

Markets earned revenues of $18bn in 2021 and was ranked second in fixed income and fifth in equities, which Ybarra said was a significant improvement in recent years.

“In recent years, we have become more client oriented,” he added. “So our revenues are more correlated to activity and less to market direction, and therefore are more stable.”

The bank aims to increase relevance to clients and profitability by improving capital efficiency; focussing on higher margin businesses; and making its core flow businesses more efficient with automation and digital solutions.

Citi wants to raise the ratio of revenue to risk weighted assets in markets from 4.5% to 5.5% over the medium term as a 10 basis point change in this ratio corresponds to change of between 60 and 70 basis in returns.

Ybarra said: “Getting towards the upper end is critical for the business.”

Ways of achieving this target include focussing on high margin activities; repricing activity; developing hedging and distribution capabilities and improving data and analytics to allow for more intelligent decision making. As in investment banking, Citi wants to increase business with financial sponsors and private capital asset managers.

“This creates huge opportunities for markets and in particular for a leading financing and securitizations business,” added Ybarra.

Citi also aims to transform its flow businesses through electronic trading and becoming more operationally efficient so that trades are processed automatically and embedded in clients’ workflows.

“We are very aware of how automation and connectivity will transform these activities into something akin to where our services businesses are today,” he said.

Differentiation

Ybarra continued that Citi can differentiate itself by offering a complete set of products and services across 95 countries in an integrated way as a single institution by treating the client as one global relationship.

“This is the result of a deliberate strategy not to exit products or services that met core financial needs of our clients,” he added. “This is not easily replicable, and we see our role growing in importance.”

Large clients are becoming more global and mid-size clients are also becoming global sooner, especially new digital clients who are scaling up very quickly. Nearly all, 85%, of revenue comes from companies that have subsidiaries outside the 60 largest countries and Ybarra argues that Citi is uniquely capable of offering this coverage.