Fredric Tomczyk, chief executive of Cboe Global Markets, said the group is carrying out a strategic review as it reported record revenue in 2023 and record trading volumes for options.

Tomczyk said on the results call on 2 February that Cboe’s outstanding results were driven by record derivatives trading volumes, growth of the data and access solutions business and disciplined expense management.

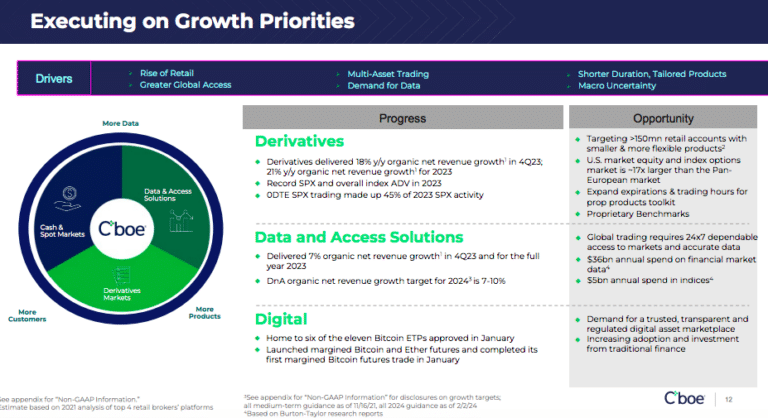

In the fourth quarter of last year, derivatives markets organic net revenue increased 18%. Options average daily volume increased to a record 14.9 million contracts, driven by a 24% increase in index options. There were record volumes in SPX, or S&P 500 index, options products which rose 31% to a record 2.9m contracts in 2023 and a solid performance in the volatility, or VIX, product suite with options volumes up 40% to a record 743,000 contracts. All of Cboe’s top 10 SPX volume days occurred in 2023, seven of which were in the fourth quarter.

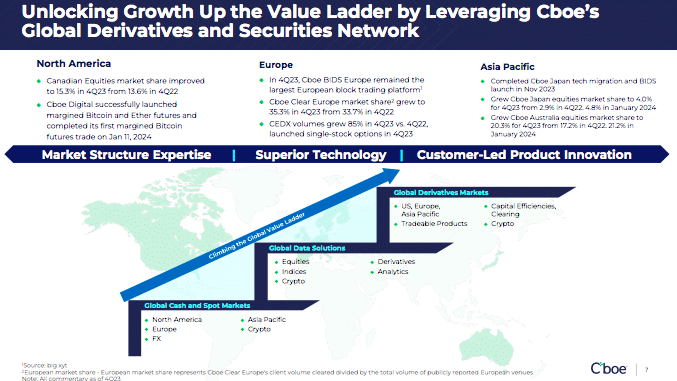

Tomczyk continued that over the last few years, Cboe has built a unique global derivatives and securities network through acquisitions, which are nearly all integrated. After acquisitions in Australia and Japan, both countries completed their migration to Cboe’s technology platform last year, which also allowed Cboe to launch BIDS for equity block trading in Japan. The remaining technology integration in Canada is planned for early 2025.

“We are now turning our attention to unlocking the value of this network through strategic organic growth initiatives,” Tomczyk added. “We are working through our strategic review now.”

Cboe will focus on three priorities – sharpening strategic focus; effective allocation of capital and developing talent and management succession.

Tomczyk continued that when he was on the Cboe Board, prior to becoming chief executive last year, he thought the strategy of adding more asset classes and geographies was “pretty broad.”

“Now that I’m CEO I want to sharpen that focus, as I was always on my predecessor about making choices,” he said. “It’s now up to us to decide where we see the biggest opportunity to invest organically and drive growth across our global platform.”

As part of its strategic review, Cboe is analysing secular trends which are reshaping trading and capital markets. The first trend is the globalisation of markets and Cboe’s customer base, who want to access all of Cboe’s trading capabilities. Tomczyk said they are looking for efficiencies and a consistent trading experience across asset classes and geographies, which Cboe can deliver.

The second trend is the unprecedented rise of retail, which has transformed the US market in recent years. Cboe believes this will evolve to other jurisdictions as global markets typically follow a similar evolution to the US.

“We believe this new generation of retail investors is here to stay and becoming more sophisticated as they increase their use of options to help execute their trading and investing strategies,” he added. “We continue to see opportunities to service this key segment as the retail wave expands globally.”

The final trend is technology and data, including emerging areas such as cloud computing and artificial intelligence. As customers engage with markets around the world, high quality technology and easily accessible, relevant data is paramount according to Tomczyk.

David Howson, global president of Cboe, said on the results call that the technology migrations in Australia and Japan provided a uniform infrastructure to enhance performance and trading capabilities in Asia Pacific, but also unlocked opportunities to provide incremental data offerings and add adjacent asset classes over time.

“Australia provides the most recent example of this expansion strategy in action,” added Howson. “Since the migration completed nearly a year ago, Australia has seen a solid increase in its equities market share to 21.2% in December last year, up 3.5% compared to December 2022.”

Howson highlighted that the fourth quarter of last year represented the highest quarter for data sales to customers outside the US. Cboe Global Cloud, a real-time data streaming service, provides customers with efficient access to data products and nearly 80% of Global Cloud customers are located outside the US.

“The movement of the value ladder from cash to data to derivatives provides a framework for establishing a flywheel of revenue generation,” he said.

Derivatives volumes

Tomczyk said product innovation has driven an “incredible” evolution of the options market that makes CBOE even more confident about the durability of the business.

A diverse set of market participants is turning to shorter duration options across the SPX complex which is shown by the growth of contracts that expire on the same day they are traded, i.e zero days to expiry or 0DTE derivatives. In the spring of 2022 0DTE options trading as a percentage of total trading of SPX was in the low 20% range. In 2023 that share reached 45% and increased to 50% in January this year, which Howson said speaks to the burgeoning need to manage intra-day risk more precisely.

“The increased utilisation of options as a tool has been underway for decades, but we are still just scratching the surface on widespread adoption,” added Howson.

Tomczyk said that while some product innovations like 0DTE drive immediate volumes, other innovations such as standing up a new derivatives market in Europe will take time.

Howson said Cboe has remained steadfast in its efforts to bring a US market experience to global participants, especially as there is overseas demand for the SPX and VIX suites.

“Shifting markets takes time and we are still in the early stages of this journey,” added Howson. “ We are well aligned with the global ambitions of our broker-dealer partners.”

Cboe sees Europe as a market that is ripe for this evolution as the value of equity and index options trading is just 6% of the value traded in the US, despite the regions having comparable GDPs. The group launched CEDX, a derivatives exchange in Europe, in September 2021 and Howson said CEDX had record volumes in the fourth quarter, which were up 85% year-over-year.

In November last year CEDX launched single stock options and it currently has contracts on 127 pan-European companies, with plans to add over 300 names later this quarter, subject to regulatory approvals. CEDX also expects to offer a liquidity provider programme in the months ahead.

Iouri Saroukhanov, head of European derivatives, said in a blog that CEDX has been closely monitoring the successful adoption of 0DTE products on Cboe’s US options exchanges.

“CEDX’s product development is driven by client demand primarily, but weekly and daily-expiring contracts are under consideration for 2024 on a select group of underlyings for our index derivatives,” he added.

Saroukhanov said CEDX’s strategy is strategy is to grow volume by building a pan-European ecosystem for trading, clearing, and market data that simplifies access and dramatically reduces costs. He said: “We are also promoting a US-style on-screen market to attract participants accustomed to this type of market in the US.”

In addition, single stock options traded on CEDX are cleared by Cboe Clear Europe, which offers margin offsets between index and single stock products. Saroukhanov said Cboe Clear will permit the use of underlying stocks as collateral to provide offsets against matched equity option positions, delivering a potential initial margin reduction for a covered call position of around 70%, according to initial estimates.

The European venue also introduced a new volume incentive programme in August for index futures which helped to boost activity, and this was recently extended to at least 31 March 2024.

“While our current efforts are aimed at providing a single access point to trade pan-European products, over time we expect to leverage our access to other regions like Asia Pacific,” added Howson.

Cboe is focussed on adding the new retail brokers and brokers internationally. There are several brokers in the pipeline according to Howson, including Robinhood.

Cboe Digital

Howson described digital assets as a product that touches each segment of Cboe’s ecosystem and where there is increasing demand for trusted and transparent markets.

“We were honored to have been chosen as the listing venue for six of the 11 Bitcoin ETFs made available for trading in January,” he added. “Beyond the ETF listings, cash trading and data benefits from a more vibrant crypto ecosystem and it is advantageous to our recently launched margin futures product.”

In January Cboe Digital became the only US regulated exchange to offer spot crypto trading, leveraged crypto derivatives and clearing on a single platform.

“We recognize it’s going to take time to build an ecosystem for a new and emerging asset class, so we are trying to be patient but continuing to focus on it right now,” added Howson. “We’re very much focused on building the derivatives side of the crypto market, which is our bread and butter.”

Financials

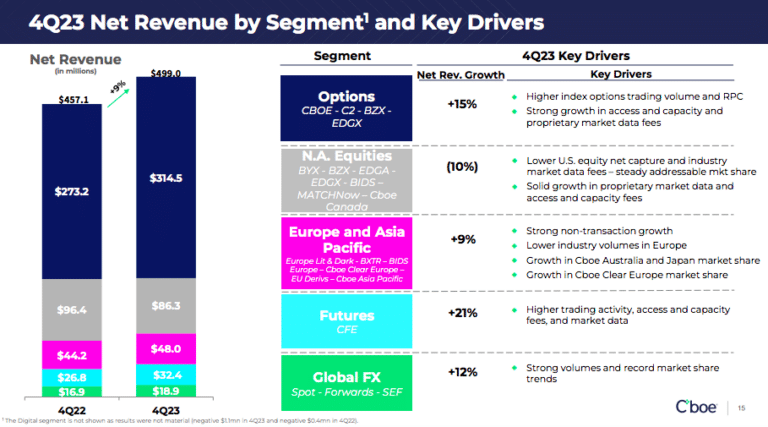

Cboe reported record net revenue for the 2023 full year of $1.9bn, up 10% from the previous year. The total was boosted by record net revenue for the fourth quarter of $499m, a 9% increase from the prior year period.

Jill Griebenow, chief financial officer and chief accounting officer at Cboe Global Markets, said on the call: “Derivative trends were strong throughout 2023 with net revenues growing 21% for the full year. Data and access solutions delivered solid growth with net revenue up 9% in 2023, while cash and spot markets declined given a challenging volume backdrop for global cash equity markets. “

Options net revenue in the fourth quarter of last year was $314.5m, up 15% from the fourth quarter of 2022. Cboe’s options exchanges had a total market share of 33.5%, compared to 34.1% in the fourth quarter of 2022. Futures net revenue of $32.4 m increased 21% compared to the fourth quarter of 202.

Equities net revenue of $86.3m fell 10% from the fourth quarter of 2022, reflecting lower net transaction and clearing fees and industry market data.

Europe and APAC net revenue of $48m increased by 9% compared to the fourth quarter of 2022, reflecting double-digit non-transaction revenue growth led by higher market data fees, access and capacity fees, and other revenue.

For 2024 Cboe has established an organic total net revenue growth target of 5% to 7%, with data and access solutions having an organic net revenue growth target of 7% to 10%.