By John Smollen, Head of Exchange Traded Products and Strategic Relations, MIAX, and Jesse Stein, Managing Principal, Advanced Fundamentals LLC

Consider the value of a 15-story Class B office building with four elevators in the central part of any American city.

While its value may have always fluctuated, based on some tangible, measurable factors you could estimate closely its value in February 2020. Then came the pandemic.

All the tenants are now working successfully from home. You don’t know how many will renew their leases or what office space in general will be worth post-pandemic.

Now multiply that scenario tens of thousands of times across every class of commercial real estate and you begin to see the scope of the commercial real estate valuation problem.

While it is certainly true that the pandemic has ravaged many classes of assets, those investment sectors often have something previously unavailable in the commercial real estate asset class — a liquid derivatives market allowing investors to buy into or hedge against changes in commercial real estate values.

Most asset classes have derivatives markets that dwarf their underlying markets, while such investment opportunities in commercial real estate are virtually unheard of. As a result, there are few opportunities for speculation, risk protection and hedging commercial real estate.

During times of market stress like we are witnessing today and saw during the great recession of 2008-2009, transaction volume in real estate private markets declines precipitously as a gap develops between buyer and seller expectations, resulting in investors’ inability to buy and sell during a downturn.

The idea that a Real Estate Investment Trust (REIT) meets such a need is clearly limited. REIT and REIT exchange traded funds (ETF) equities and options do not track the underlying prices of real estate assets; rather, they track the equity value of the corporations that own and manage commercial real estate. Each REIT has a distinct leverage structure creating higher volatility and more uncertainty in comparable performance; and in the case of ETFs, a market-cap based sector allocation that does not allow for a customized unlevered investment strategy.

What has been lacking is a fully functioning derivatives market allowing investors to separate property-level acquisition decisions from portfolio-level allocation choices. This need was apparent before the pandemic and will remain long after we are all vaccinated and back in our offices, as COVID-19 may result in long-term structural changes in each commercial property sector. A derivatives market would enable investors to respond to these changes and position their portfolios accordingly.

Such a derivatives market opportunity is, indeed, a large one. As an asset class, commercial real estate in the U.S. alone is worth approximately $16 trillion, compared to $35 trillion in U.S. corporate equity and $33 trillion in household owned residential real estate. It is an asset class virtually equivalent to the U.S. Treasury bond market or with the publicly traded U.S. bond market.

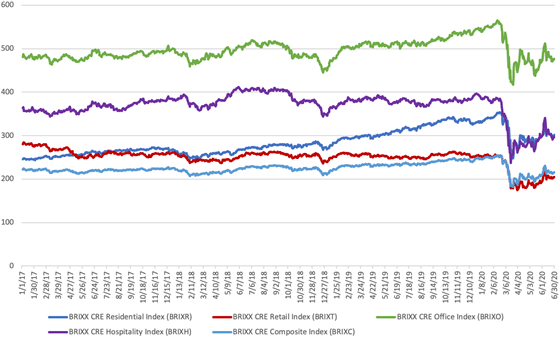

Our own solutions are BRIXX™ Commercial Real Estate Futures and Options. Our derivative opportunities in commercial real estate include residential, retail, office, hospitality and a composite of all four. It is an index family offering derivatives that include futures, swaps and options under a common regulatory structure. It uses real-time, unlevered property data and does not require regression restraints, capped weighting, alternative market identifiers or self-reporting.

It is both our belief and our intent that with the introduction of a derivatives product, commercial real estate can become a more technologically proficient, democratic market, allowing for a wide range of innovative investment strategies and opportunities. The redistribution of risk through the listed derivative markets will offer an option to investors wanting to manage investment exposure. Creating products that can offer both up- and down-side exposure will open these markets to a wider investor base, a benefit to any marketplace.

John Smollen is Head of Exchange Traded Products and Strategic Relations at MIAX. Smollen is responsible for business development, new products and joint ventures, as well as maintaining and growing all client relationships at MIAX. Smollen concentrates on identifying, developing and cultivating business opportunities and partnerships that are aligned with the long-term goals and vision of the company. He has over 30 years of experience in the exchange and trading community.

Jesse Stein is the Managing Principal of Advanced Fundamentals LLC, a data analytics and real estate indexing firm which he founded in July 2016. He also has served as the Co-head of Republic Real Estate since its inception in May 2020. Previously, Mr. Stein was a co-founder and Chief Operating Officer of Compound, a real-estate investment platform, and was a founding member and the Chief Operating Officer of ETRE Financial, LLC, a real estate financial services and information technology company. Mr. Stein has a background in equities trading and real estate investment banking. He graduated from Cornell University and received a Master’s Degree in Real Estate Investment from New York University.