On September 8, CoinShares International, a European digital asset investment firm with approximately US$10 billion in assets under management, announced its intention to become publicly listed in the United States through a definitive business combination agreement with Vine Hill Capital Investment Corp., a NASDAQ-listed special purpose acquisition company.

Upon completion of the transaction, CoinShares will be listed on the Nasdaq Stock Market via a newly formed parent company, Odysseus Holdings, in a move designed to support its global growth ambitions and give U.S. investors enhanced access to its expanding business—particularly within the U.S. market.

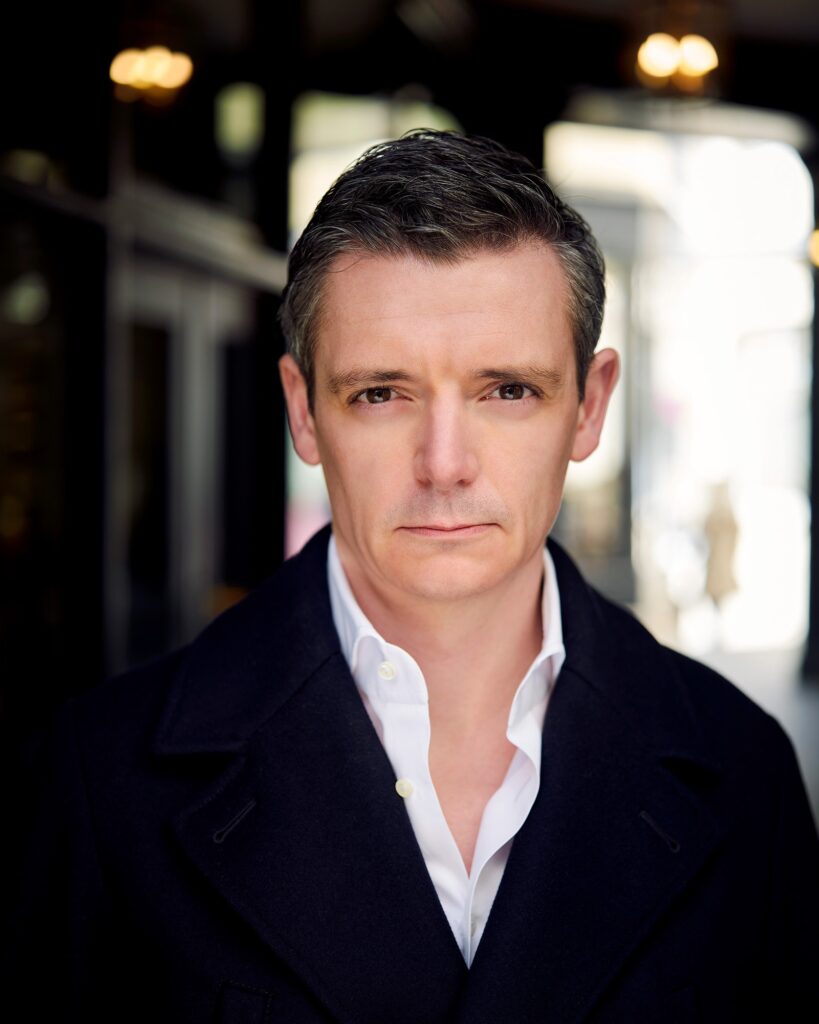

The deal implies a pre-money valuation of US$1.2 billion on a pro-forma basis, positioning CoinShares among the largest publicly traded pure-play digital asset managers in the world. Traders Magazine caught up with Jean-Marie Mognetti, CEO & Co-Founder of CoinShares, to learn more.

Beyond access to U.S. capital, what strategic advantages does the U.S. market offer for CoinShares that the European market does not?

We believe that the U.S. represents the epicenter of global digital asset innovation and institutional adoption. What we’re accessing isn’t just capital — it’s the most sophisticated ecosystem for digital asset investment in the world.

There are at least five reasons to view the U.S. as the epicenter. First, the scale is fundamentally different. The U.S. market manages 50% of the assets under management globally. We’re talking about pension funds, endowments, and RIAs managing trillions of dollars in assets that are increasingly allocating to digital assets through regulated vehicles.

Second, our view is that the investor sophistication in the U.S. runs deeper. U.S. institutional investors have been pioneers in alternative asset allocation for decades. They understand complex investment structures, they’re comfortable with innovative products, and they have the risk management frameworks to engage meaningfully with digital assets at scale.

Third, the U.S. offers something Europe simply cannot, a unified market with consistent regulatory frameworks and investment approaches. The European Union, while sophisticated, is inherently fragmented across 27 different jurisdictions, each with distinct regulations, investment vehicles, cultural preferences, and market practices. In contrast, the U.S. presents a single, massive market with harmonized standards and consistent investor behavior patterns. This unified approach dramatically simplifies product development, distribution, and client engagement at scale.

Fourth, being active in the U.S. positions us at the center of regulatory and market standard development. When new frameworks emerge, when industry standards are set, when the future of institutional digital asset management is being shaped — that’s happening in the U.S. first. Our presence here enhances our ability to influence those developments across all jurisdictions where we operate.

Finally, there’s a network effect that’s unique to the U.S. market. The concentration of institutional players, service providers, regulatory bodies, and industry infrastructure creates opportunities for partnerships and product development that simply don’t exist at the same scale anywhere else.

Our opinion is that this move positions CoinShares to lead in the most strategically important market for digital assets while we continue serving our European investor base, which remains a core part of our global strategy. We’re not replacing our European operations, we’re expanding from a position of strength to capture the largest opportunity in our industry.

CoinShares is entering the U.S. market with a strong foundation — 34% market share in EMEA and ~70% adjusted EBITDA margins. How do you plan to translate this European playbook to a very different and competitive U.S. regulatory and investor landscape?

We’re not approaching the U.S. as a copy-and-paste exercise from Europe. In fact, our strategy is fundamentally different as we are deliberately trying not to replicate what has been done in Europe because the intention here is to play an entirely different game.

In Europe, we succeeded by building the infrastructure for institutional digital asset access in a fragmented market. In the U.S., that basic infrastructure already exists through large asset management firms. They’ve done the heavy lifting on simple spot Bitcoin and Ethereum products.

Our advantage isn’t in competing with them on their terms, it’s in leveraging our decade of specialized digital asset expertise to deliver sophisticated products that we don’t believe they can build. We’re talking about advanced risk-managed indices, actively managed strategies, structured products, and yield solutions that require deep crypto-native knowledge.

The regulatory environment and investor expectations are indeed different, but that actually works in our favor in our view. U.S. institutional investors are more sophisticated in their appetite for complex alternative investment structures. They understand and demand the kind of innovative products that traditional asset managers will likely struggle to develop because crypto isn’t their core competency, as it is ours.

While big ETF firms have scale, they don’t have eleven years of crypto-specific research capabilities, operational infrastructure, or product innovation expertise that we have. We’re not trying to beat them at asset gathering, we’re creating products they cannot easily replicate because they lack our specialization.

Our European success provides the operational foundation and financial discipline, but our U.S. strategy is about being the digital asset specialists in a market dominated by generalists. We’re responding to market demand, building local partnerships, and ensuring full regulatory compliance, but we’re doing it to deliver sophistication that only a niche, purpose-built digital asset manager can provide.

The SPAC deal values CoinShares at a notable discount compared to peers like BlackRock and Grayscale, at 7.3x EV/EBITDA vs. 20.9x. Was this pricing a strategic decision to attract U.S. investors, or a reflection of macro uncertainty around digital assets?

This valuation represents a significant improvement from where we were trading in Sweden, which we believe to be substantially undervalued. The 7.3x multiple you’re citing actually reflects our strategic positioning rather than any discount to our intrinsic value.

In our view, ther undervaluation in Sweden is largely a function of the venue itself. The Swedish market relative to the US is a small, local market that isn’t particularly digital asset-friendly and, frankly, isn’t very suspportive of non-Swedish companies. The Swedish market simply doesn’t have a deep investor base or the institutional understanding of digital assets necessary to properly value a specialized firm like ours. The digital asset management industry is still in its early innings, and we are excited by the opportunity to introduce our capabilities and differentiated offerings to a broader base of investors in the U.S.

You’re targeting the U.S. market at a time when sentiment toward crypto is recovering and regulatory clarity is improving. What specific product launches or growth initiatives are planned post-listing to capitalize on this momentum?

We’re entering at an inflection point where the infrastructure work is largely done, and now it’s about sophistication and specialization. Our post-listing strategy focuses on three key areas where our digital asset expertise creates genuine competitive advantages.

First, we’re launching U.S.-domiciled products that go well beyond basic spot exposure. Think advanced risk-managed indices, actively managed strategies that can navigate crypto market cycles, and structured products that provide different risk-return profiles. These aren’t products you can build overnight, they require years of crypto-specific research and operational expertise that traditional asset managers simply don’t possess.

Second, we’re expanding into areas where we already have proven European capabilities but can tailor them specifically for U.S. regulatory and investor requirements: staking solutions, yield-generating strategies, and derivative products that provide leverage or hedging capabilities.

The key difference is that we’re not launching these products to compete with generalist asset managers’ spot Bitcoin ETF. Rather, we’re creating solutions for institutional investors who’ve already made their basic crypto allocation and now want more sophisticated exposure. When a pension fund wants to understand liquid staking derivatives or implement a systematic crypto rebalancing strategy, they need specialists who’ve been doing this for a decade.

The improving regulatory environment and market sentiment create the perfect backdrop for institutional investors to move beyond basic exposure into the more nuanced products where our specialization really matters.

Given your substantial recurring revenue and strong free cash flow, do you envision future M&A to accelerate your U.S. expansion, or will the focus remain on organic growth and product development?

Our approach will be both pragmatic and opportunistic. The SPAC transaction provides us with a committed institutional equity investment that supports our organic U.S. scale-up while maintaining significant firepower for strategic acquisitions that can accelerate our market penetration.

We’re not looking at M&A as a substitute for organic growth, it’s a complement to it. Our primary focus remains building our own U.S. operations, launching sophisticated products, and establishing direct relationships with institutional clients. That’s where our core competencies lie, and that’s what will drive sustainable value creation.

However, the digital asset management industry remains highly fragmented, particularly in the U.S. There are numerous smaller players with specialized capabilities, regulatory licenses, or distribution relationships that could significantly accelerate our market access. We’re specifically interested in targets that bring three things: expanded regulated distribution channels, complementary institutional infrastructure like custody capabilities, or specialized product development expertise that enhances our offering.

The key criterion is clear value creation for shareholders. We’re not interested in acquisitions for the sake of scale — we want deals that either compress our time to market, add capabilities that are difficult to efficiently build ourselves, or strengthen our regulatory positioning in ways that create lasting competitive advantages.

Our strong balance sheet and cash generation give us the luxury of being selective. We can pursue organic growth while remaining prepared to move quickly on attractive strategic opportunities. The U.S. market is large enough to support multiple approaches simultaneously — organic product launches, partnership development, and targeted acquisitions where they make strategic sense.

This balanced approach reflects our decade of experience building market-leading positions through disciplined capital allocation.