TECH TUESDAY is a weekly content series covering all aspects of capital markets technology. TECH TUESDAY is produced in collaboration with Nasdaq.

The introduction of a number of new tariffs have significantly affected confidence in U.S. stocks.

Markets have corrected, economic uncertainty has spiked, consumer confidence has dropped and inflation expectations have risen – all very quickly.

Some worry that, after seeing these losses in their portfolios, retail investors might shy away from the market.

However, the data suggests retail might actually be bargain hunting.

U.S. markets, in particular, have sold off

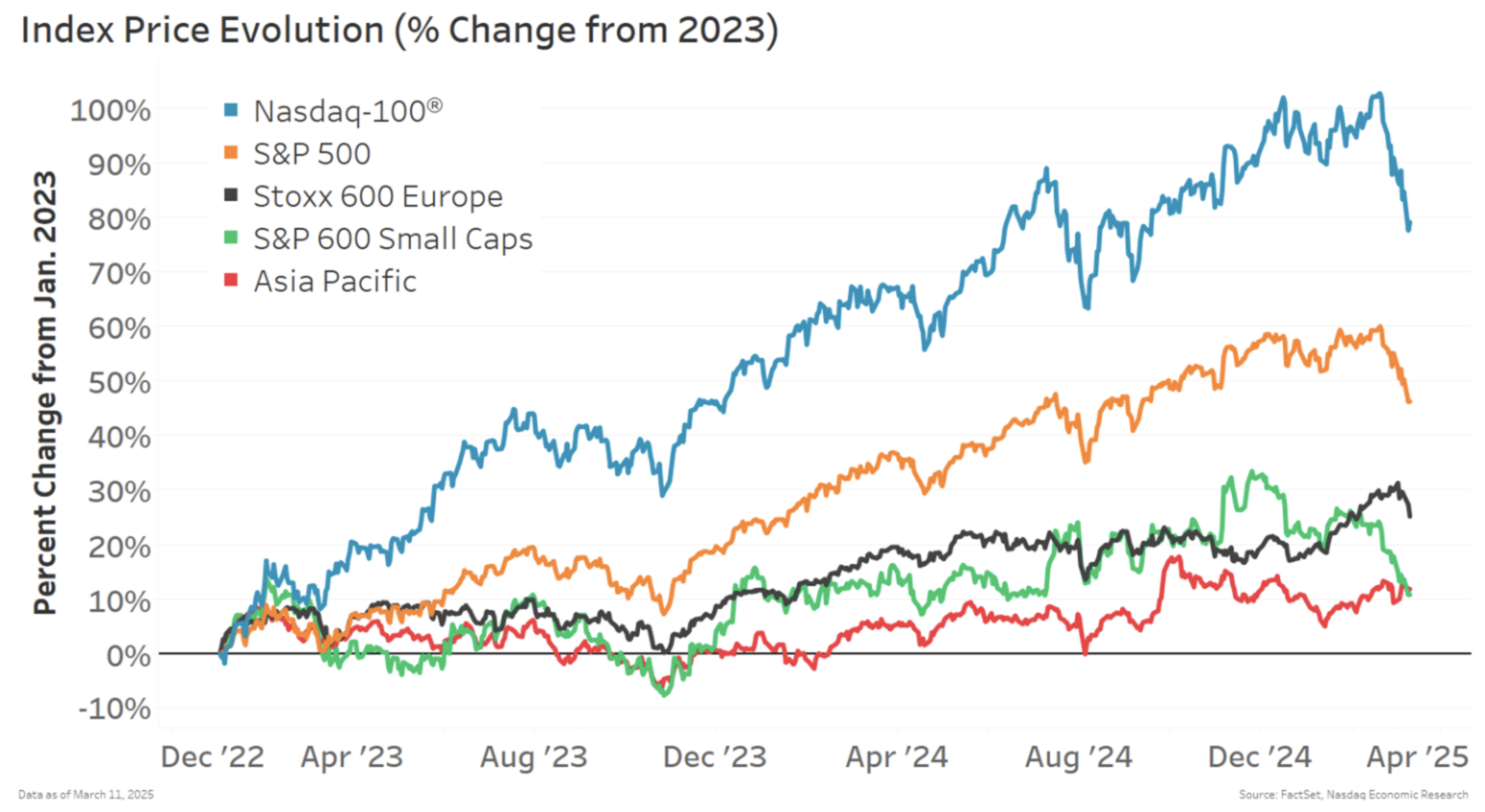

With all the news around tariffs, economic uncertainty measures have spiked to levels last seen during Covid and the Great Recession. That has contributed to a sell-off in stocks – at least in the U.S. – with large- and small-cap U.S. stocks underperforming other countries.

Chart 1: U.S. stocks are underperforming other countries so far in 2025

Retail shows no sign of slowing down

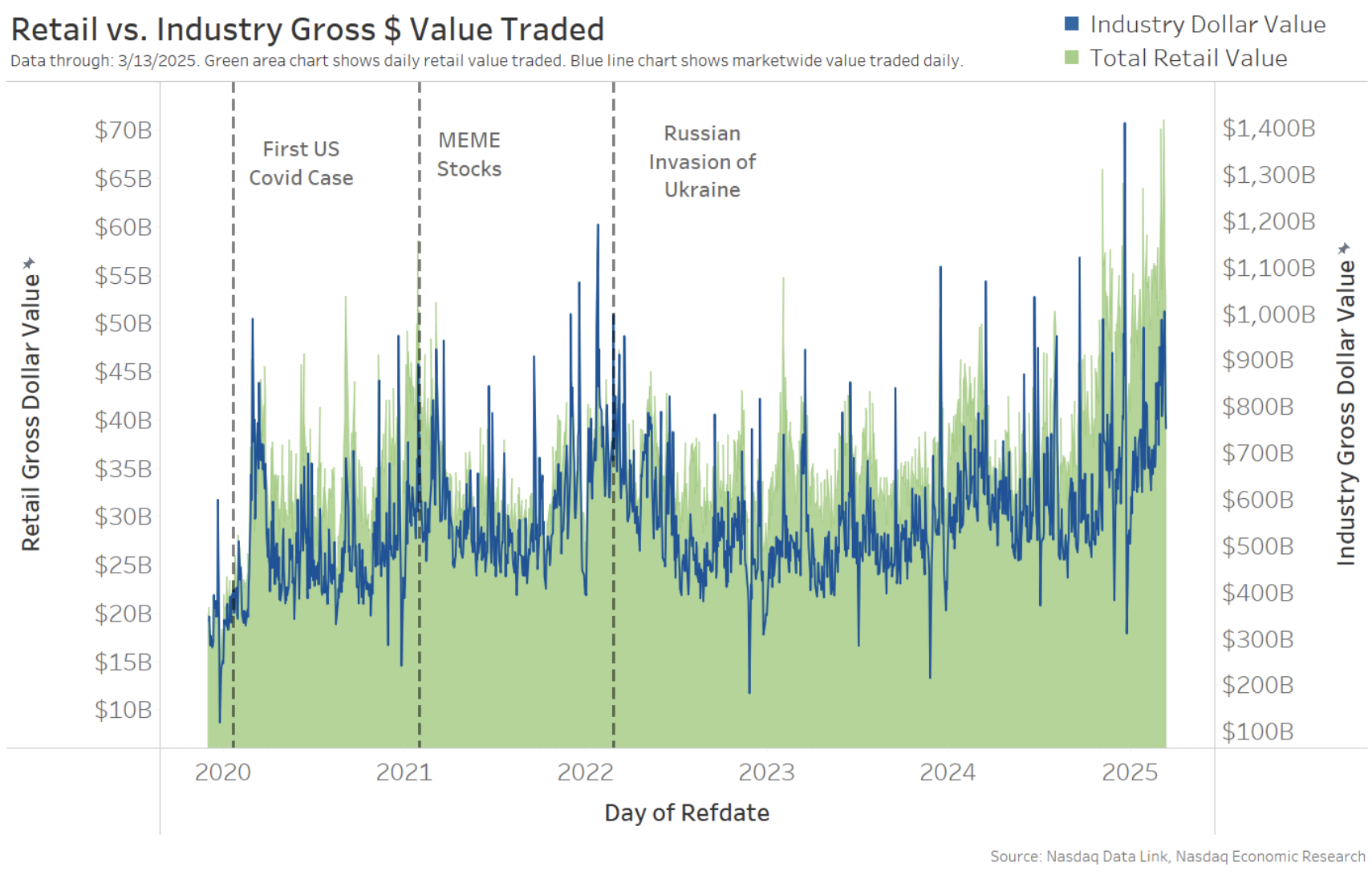

Yet our retail trading data shows no signs of slowing down or withdrawing from the market.

It’s quite the opposite in fact. Data shows that retail trading has increased, almost 49%, to averaging $62 billion daily so far in 2025.

The data also shows that retail activity started increasing right after the election – well before tariff fears led to the current sell-off and spike in market-wide trading (blue line).

Chart 2: Retail activity picked up before the start of 2025; market-wide activity spiked more recently

In fact, they’re mostly buying

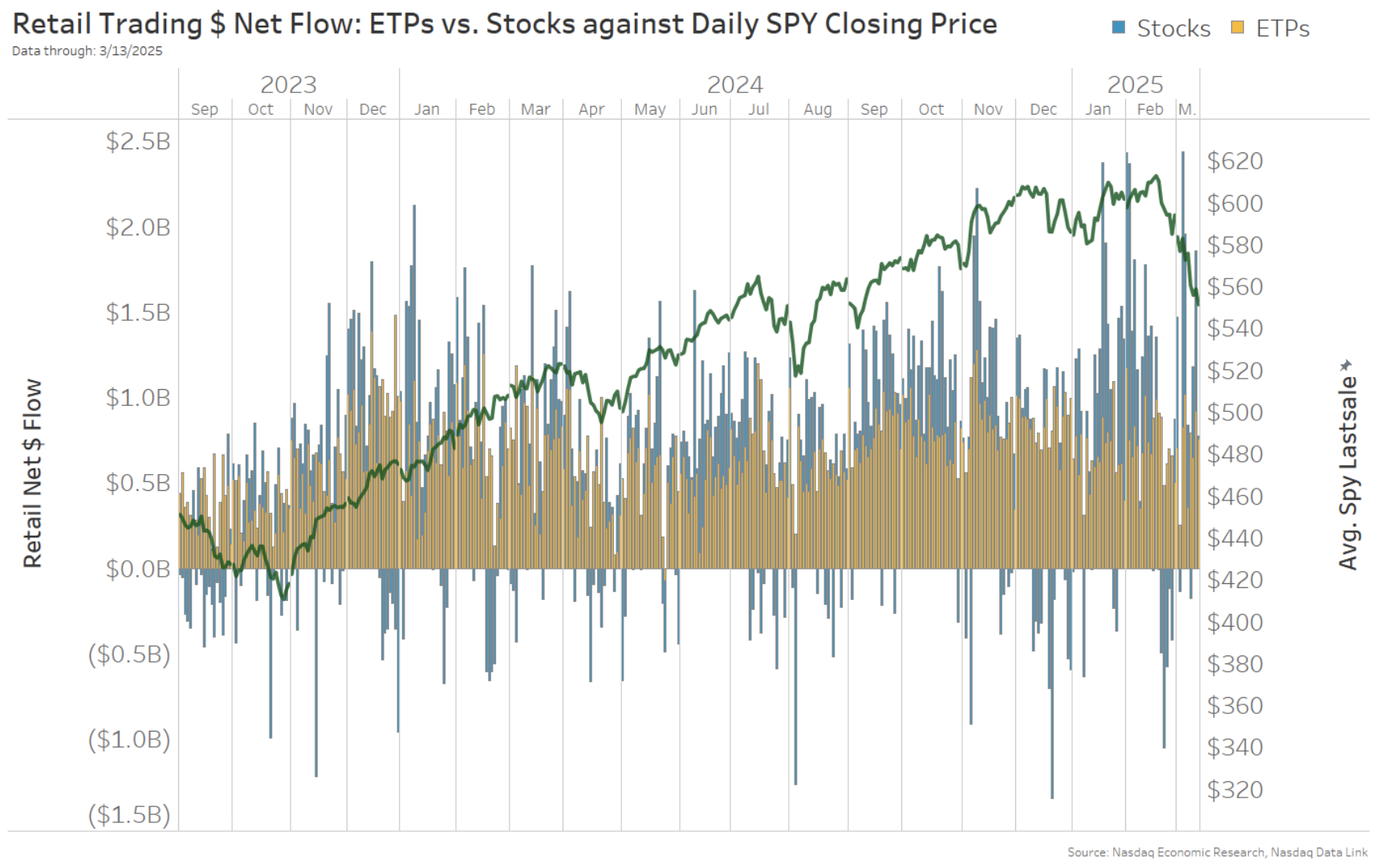

Interestingly, retail trading in company stocks was flat to a net sell immediately after the election.

But, in 2025, a lot of things changed. Looking at trading in stocks and ETFs, we see two different trends:

- ETFs still net to buy. Interestingly, the level of buying isn’t that different from normal.

- Stocks mostly strong buying, although there was net selling of stocks late in February. Overall, corporate stocks have been strongly net to buy most days in 2025.

Chart 3: Stocks have seen strong net buying much of 2025

Retail buying trends

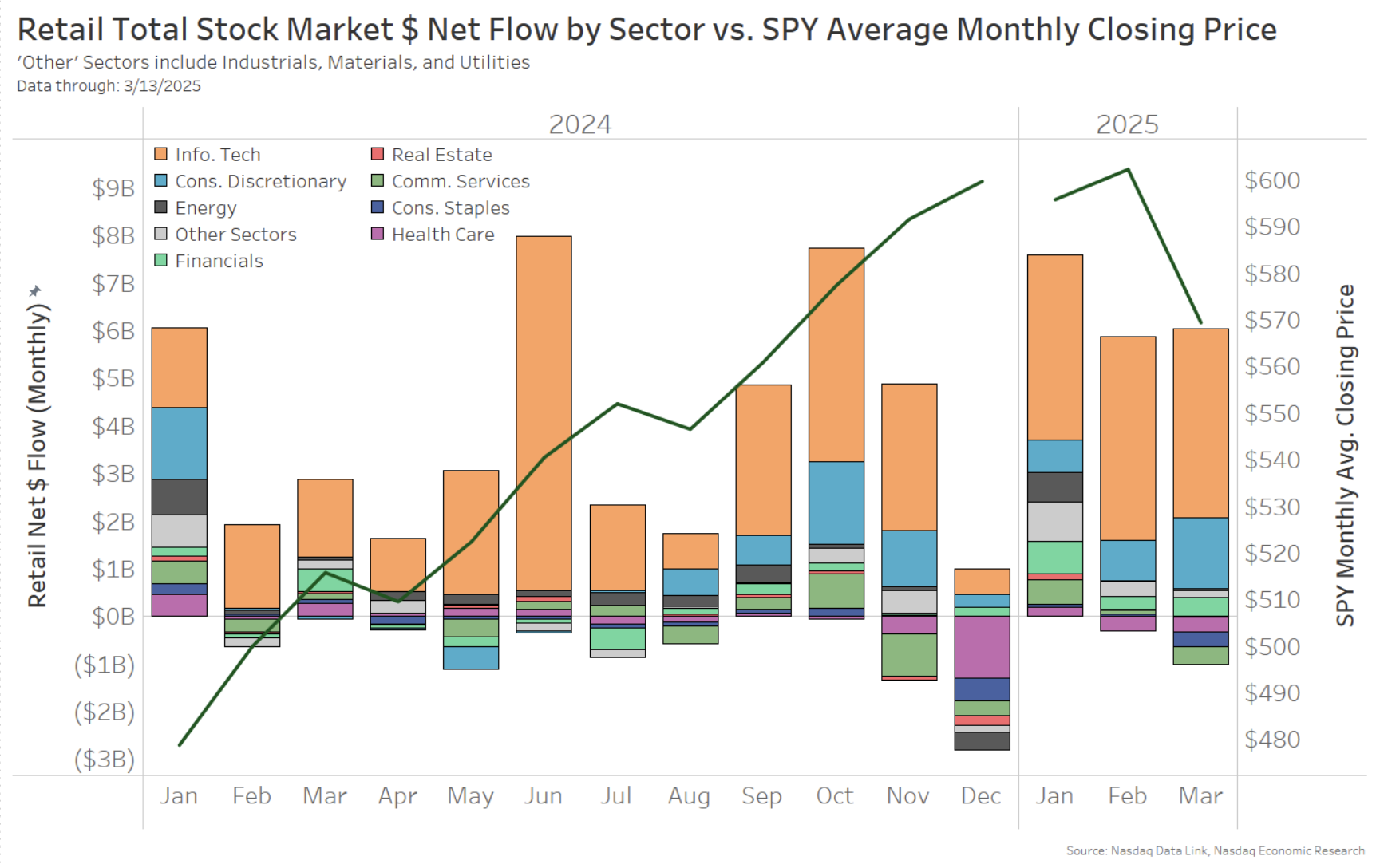

Looking at company stock trading by sector each month, the period of selling in February isn’t visible. Instead, we see three months of net buying, especially in Information Technology.

A deeper dive shows that, since the start of February, the majority of Tech buying has been in NVDA, while over half of the net buying in Consumer Discretionary has been in TSLA.

Having said that, the breadth of buying has fallen as the year has progressed, with net selling across Communications, Healthcare and Staples so far in March.

Chart 4: Majority of buying in Technology, despite the sell-off in that sector in March

Retail seems to be actively buying in 2025

Far from being scared away from the market by recent volatility, retail trading seems to have instead increased. In fact, recent trading has retail buying the dip across many stocks and sectors.

Creating tomorrow’s markets today. Find out more about Nasdaq’s offerings to drive your business forward here.